VNM shares increased sharply after a long period of sideways trading, helping Vietnam's leading dairy company ( Vinamilk ) return to the top 10 largest capitalized companies on the stock exchange. Although the prospects for VNM shares are still there, experts also gave risk recommendations to investors.

Vinamilk's market capitalization surpasses the "giant" Vingroup

Since the "explosive" session at the end of last week, VN-Index has increased sharply in the past 3 consecutive sessions with a total increase of 49 points, helping the index surpass the 1,270 point threshold after nearly 2 months of continuous "shaking" and gloomy liquidity.

Thanks to that, the general trend of stock codes in most industry groups tends to increase positively.

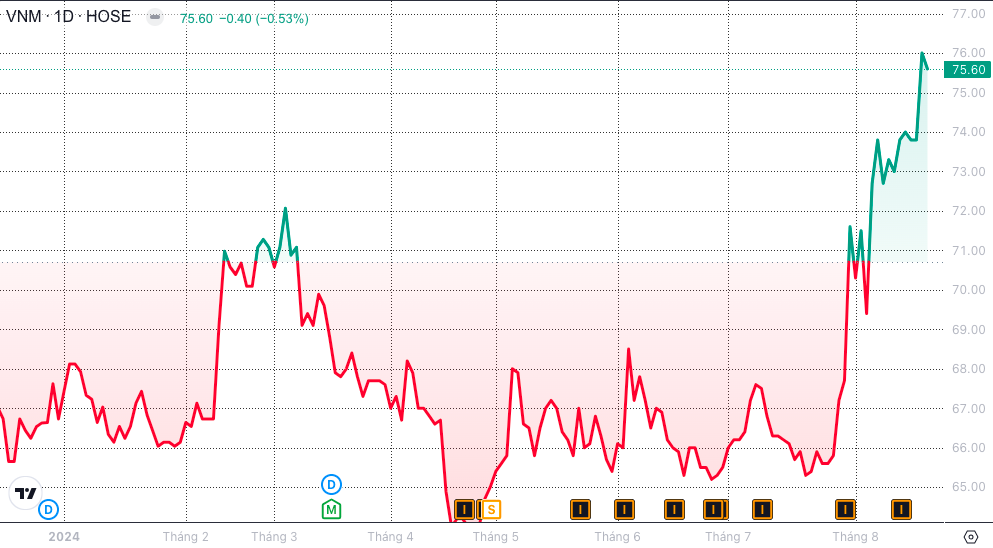

A typical example is the stock of Vietnam Dairy Products Joint Stock Company - Vinamilk (VNM, HOSE) when it broke out to increase its market price sharply, surpassing the threshold of 76,000 VND/share. Thus, after nearly 1 month, VNM stock has increased by more than 16%, trading at the highest level in nearly 1 year, since September 2023 to present.

Thanks to that, Vinamilk's capitalization has increased to approximately VND160,000 billion (equivalent to USD6.4 billion). This value has surpassed the "big guy" Vingroup (stock code VIC), returning to the top 10 most valuable enterprises on the Vietnamese stock market. However, the current capitalization is still limited compared to the golden period at the end of 2017, when Vinamilk was the most valuable name on the market.

VNM stock continues to recover, trading at its highest peak in nearly a year (Photo: SSI iBoard)

Factors that help VNM stock increase continuously

The increase in VNM shares comes from the strong support of foreign investors. Since the beginning of July, foreign investors have net bought about 33 million VNM shares, equivalent to a value of nearly VND2,400 billion.

In terms of business performance, the second quarter of 2024 is Vinamilk's highest revenue quarter with VND 16,655 billion, surpassing the peak of VND 16,194 billion (quarter 3 of 2021), and is also the quarter with the highest revenue growth since the beginning of 2022 to date with 9.5% over the same period. As a result, profit after tax is VND 2,696 billion, up 21% over the same period.

This result was supported by domestic and foreign business activities with growth rates of 5.8% and 29.9% respectively over the same period. Of which, the foreign market contributed 18.5% of consolidated revenue in the second quarter of 2024; net export revenue reached VND 1,740 billion, up 37% over the same period.

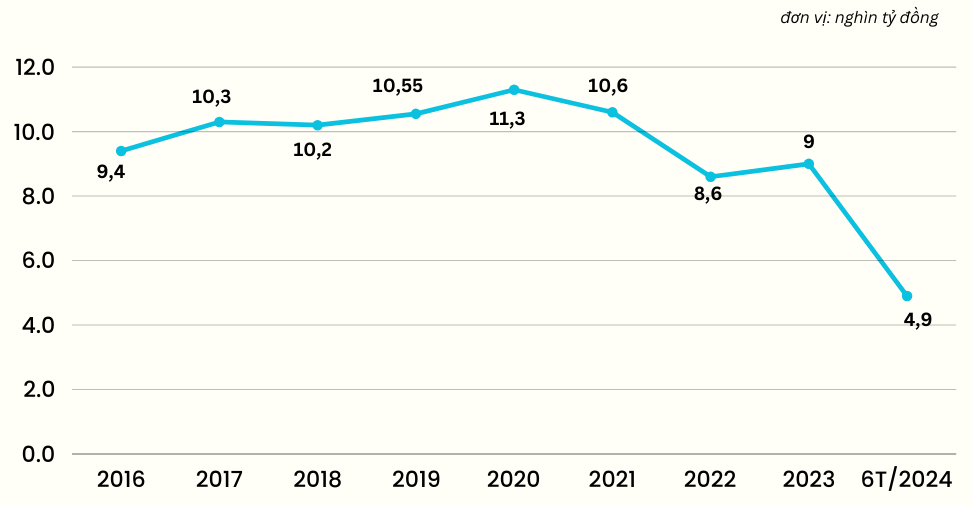

In the first 6 months of the year, Vinamilk earned VND 30,768 billion in net revenue and VND 4,903 billion in profit after tax, up 5.7% and 18.6% respectively over the same period last year. Thus, after the first half of 2024, Vinamilk has completed 51% of revenue with profit after tax reaching 47% of the plan set for 2024.

Developments in profit after tax at Vinamilk in recent years

Source: Financial Statements

The asset scale after the first 6 months of the year also had a positive improvement. In the past 6 months, Vinamilk has "resolved" nearly 2,000 billion VND of payable debt, reducing the debt level to 15,856 billion VND, while increasing the owner's equity by 9.5% compared to the beginning of the year, reaching 38,337 billion VND.

Total assets at Vinamilk as of the end of June reached VND54,194 billion, of which liabilities accounted for 29.3% and equity accounted for 70.7%.

What risk factors should investors be aware of?

Vinamilk benefits from strong export growth in the second quarter of 2024 (Photo: Internet)

Vinamilk's positive growth comes amid a strong support from the domestic consumer sector: retail sales continued to grow strongly in July at nearly 10% compared to the previous month; the economy recovered; value-added tax remained at 8% until the end of 2024.

Exports also expanded their growth momentum in the first 7 months of this year, increasing by 15.7% over the same period, VNM benefited greatly from the outstanding export figures in the second quarter.

According to Mirae Asset Securities, thanks to the decrease in raw material prices and the promotion of product marketing, Vinamilk has achieved positive business results in the second quarter of this year. At the same time, it has helped the company to show many potentials and growth prospects in the coming time. Typically, the situation of powdered milk prices is expected to continue to decrease in the future, contributing to helping the company expand its profit margin in the long term; the potential comes from VNM's beef segment.

However, investors should note that this is also a risk for VNM shares, as world powdered milk prices can still increase when affected by geopolitical factors or weather risks; new competitors appear in the domestic market.

Source: https://phunuvietnam.vn/vnm-tro-lai-top-10-voi-von-hoa-64-ty-usd-nha-dau-can-luu-y-gi-20240820184931513.htm

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)