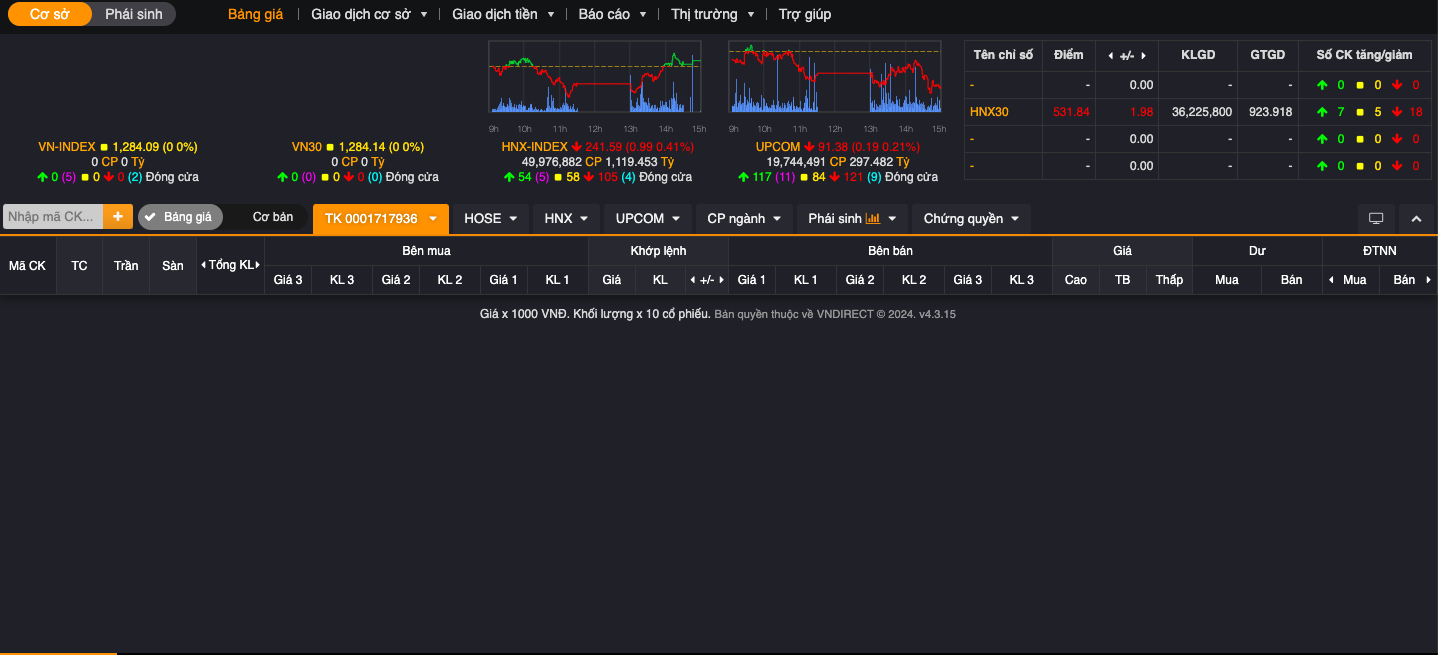

After the cyber attack, VNDirect resumed operations today. However, that did not make the market improve. At the end of the session, VN-Index decreased both points and trading volume.

Downward pressure comes from large stocks

At the opening of the first trading session of the second quarter of 2024, the VN-Index fluctuated around the support level of 1,280 points. Remember, at the end of the last session of the first quarter of 2024 (last Friday), the VN-Index witnessed a decrease of more than 6 points. Today, April 1, 2024, the VN-Index continued to decrease by 2.5 points compared to the session at the end of last week, down to 1,281.52 points.

Today's trading session also marks the return after the attack of VNDirect (VND, HOSE) - the group of 3 companies with the highest trading volume in the stock market (according to the financial statements of the fourth quarter of 2023). Thus, about 83.3 trillion VND of investors can be traded again from today's session.

However, this does not seem to help the market improve as liquidity stopped at more than VND 23,000 billion, trading volume was 960 million shares, lower than the average of the past month.

This result is believed to come from the cautious psychology of investors when fluctuations appeared right from the morning session.

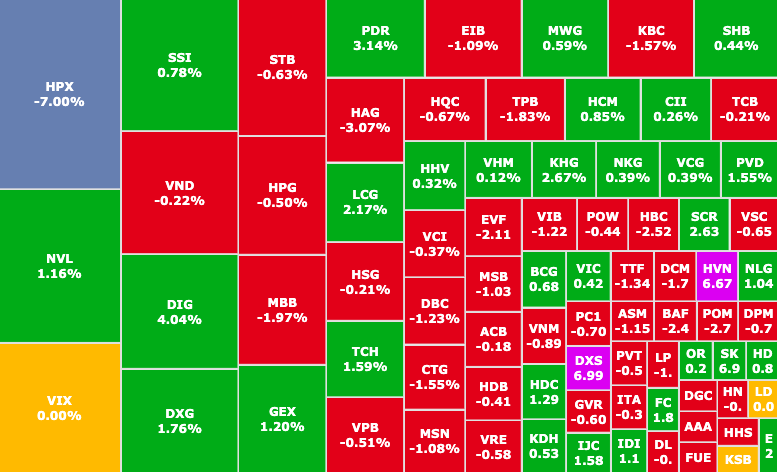

The market is clearly differentiated between industry groups, in which red still dominates.

Market is divided, red dominates

The pressure mainly comes from large stocks. Typically, many banking stocks are "sinking" in red, with a sharp decrease of 1-2%, including: CTG (VietinBank, HOSE) down 1.55%, MBB (MB Bank, HOSE) down 1.97%, MSB (MSB Bank, HOSE) down 1.03%, VIB (VIB Bank, HOSE) down 1.22%,...

This also makes the banking group the main factor pulling the market down.

Banking group sharply decreased, restraining the growth of VN-Index (Source: SSI iBoard)

HVN shares suddenly hit the ceiling

On the other hand, the focus was on HVN (Vietnam Airlines Corporation, HOSE) which unexpectedly increased by 6.67% to the ceiling price of VND14,400/share. HVN was in the group that contributed strongly to the market's increase.

In addition, the real estate group continued to catch the wave, maintaining green throughout today's session. In particular, DXS (Dat Xanh Real Estate, HOSE) increased steadily with purple, raising the stock value by 7% to VND 7,810/share.

Next is DIG (DIC Group, HOSE) up 4%, PDR (Phat Dat Real Estate, HOSE) up 3.1%,...

VND marks 6th consecutive session of decline after system-wide error (Source: SSI iBoard)

Marking the return of the VNDirect Securities trading system to the market, VND continued to "regress" by 0.22%, down to 22,900 VND/share. Since the incident last week, this is the 6th consecutive session of VND decline, causing the stock to lose 5.8% of its value.

According to the VNDirect price list, although investors can log in to their trading accounts on the website and trading application (App), many people still express complaints when some features such as portfolio management, securities trading, money withdrawal, price list section... are still not working properly and reporting errors.

Even though I have logged back in, many features on the VNDirect transaction page still cannot operate normally (Source: VNDirect Website)

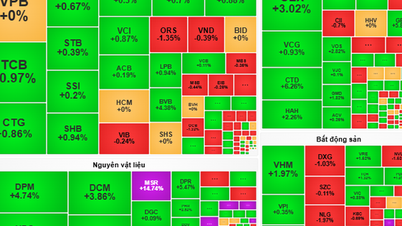

Meanwhile, the securities group recorded a slight increase of 0.5-1.5% with SSI (SSI Securities, HOSE), SHS (Saigon - Hanoi Securities, HNX), HCM (HCMC Securities, HOSE),...

The oil and gas group also recorded positive developments with many stocks approaching historical peaks: PVS (Vietnam Oil and Gas Technical Services Joint Stock Company, HOSE) increased by 3.8%, PVC (Petroleum Chemicals and Services Joint Stock Company, HOSE) increased by 1.5%,...

Notably, foreign investors continued to have a strong net selling session, marking the 14th consecutive session of net selling in the Vietnamese stock market. The entire market recorded 682 billion VND in net selling.

At HOSE, MSN (Masan Group, HOSE) suffered the strongest selling pressure with 248 billion VND, SSI (SSI Securities, HOSE) followed second with 171 billion VND.

VNDIRECT Securities Joint Stock Company (VND) was established with an initial charter capital of VND 50 billion in 2006. The company operates in the fields of securities brokerage, corporate finance consulting, proprietary trading, underwriting and portfolio management. VND has been listed and traded on the Ho Chi Minh City Stock Exchange (HOSE) since August 2017.

Source

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)