Strong selling pressure in pillar stocks such as VPB, VIC, HPG... caused VN-Index to continue to decline. More than 1.13 billion shares were traded during the session, of which more than 84 million ABB shares were "changed hands".

Green has returned after the previous volatile session. However, the market's upward momentum continues to face challenges as the VN-Index approaches its old peak. However, demand remains relatively strong and helps the index maintain its green color for most of the morning session.

After about 2 hours of trading, selling pressure increased somewhat and demand remained weak, causing the VN-Index to reverse. The pressure became greater in the afternoon session when a series of large-cap stocks fell sharply.

The focus of attention in today's session belongs to the large-cap group, especially banking stocks. In the VN30 group, there were 24 stocks that decreased in price while only 5 stocks increased. VJC was the stock that decreased the most with more than 3%, but VJC was not in the top 8 stocks that had the most negative impact on the VN-Index. Instead, VPB took away 1.02 points from the index when it decreased by nearly 2.7%. Similarly, VIC also decreased by more than 2% and took away 0.95 points. It is worth noting that at one point in the session, VIC climbed to 46,900 VND/share but closed at the lowest level of the session with 45,500 VND/share. Banking stocks such as CTG, TCB or VCB were also in red.

The “national” stock HPG had a negative trading session when it fell 1.7% and was net sold by foreign investors for VND81 billion. HPG shares were sold heavily right before the ex-rights trading session tomorrow (May 23). HPG will issue an additional 581.4 million shares to existing shareholders at a rate of 10%, meaning that shareholders who own 10 shares will receive 1 new share.

On the other hand, FPT is the name that contributed the most to help slow down the decline of VN-Index. FPT closed the session up 1.47% to 138,000 VND/share. Recently, FPT announced its preliminary business results for the first 4 months of 2024 with pre-tax profit of 3,447 billion VND, up nearly 20% over the same period and achieving 31% of the yearly plan. Accumulated in the first 4 months of the year, FPT's revenue is estimated at 18,989 billion VND, up nearly 21% over the same period in 2023. Pre-tax and after-tax profits both increased by about 20%, reaching 3,447 billion VND and 2,932 billion VND, respectively. Net profit is estimated at 2,455 billion VND, up nearly 22%. EPS is equivalent to 1,933 VND/share.

|

| Photo caption |

In addition, HVN, LPB, PDR and MWG are names that have contributed well to the VN-Index in today's session. PDR increased well by nearly 4% and helped the cash flow well into real estate stocks despite the strong fluctuations of the general market. Other real estate codes such as HDC, IDJ, LDG, HPX, HDG... also increased sharply in price. Notably, HDC was also pulled up to the ceiling price.

The securities group in general also had a positive trading session although some prominent names such as VCI, SHS, SSI, VND or MBS ended the session in red. On the contrary, a series of other securities stocks such as APS, DSC, HCM, VDS, BVS or BSI maintained good price increases.

At the end of the trading session, VN-Index decreased by 10.23 points (-0.8%) to 1,266.91 points. The entire floor had 173 stocks increasing, 291 stocks decreasing and 50 stocks remaining unchanged. HNX-Index maintained its green color when it increased by 1.86 points (0.76%) to 245.15 points. The entire floor had 88 stocks increasing, 80 stocks decreasing and 64 stocks remaining unchanged. HNX-Index maintained its green color thanks to the support of stocks such as HUT, NTP or NVB... UPCoM-Index increased by 0.25 points (0.27%) to 94.7 points.

|

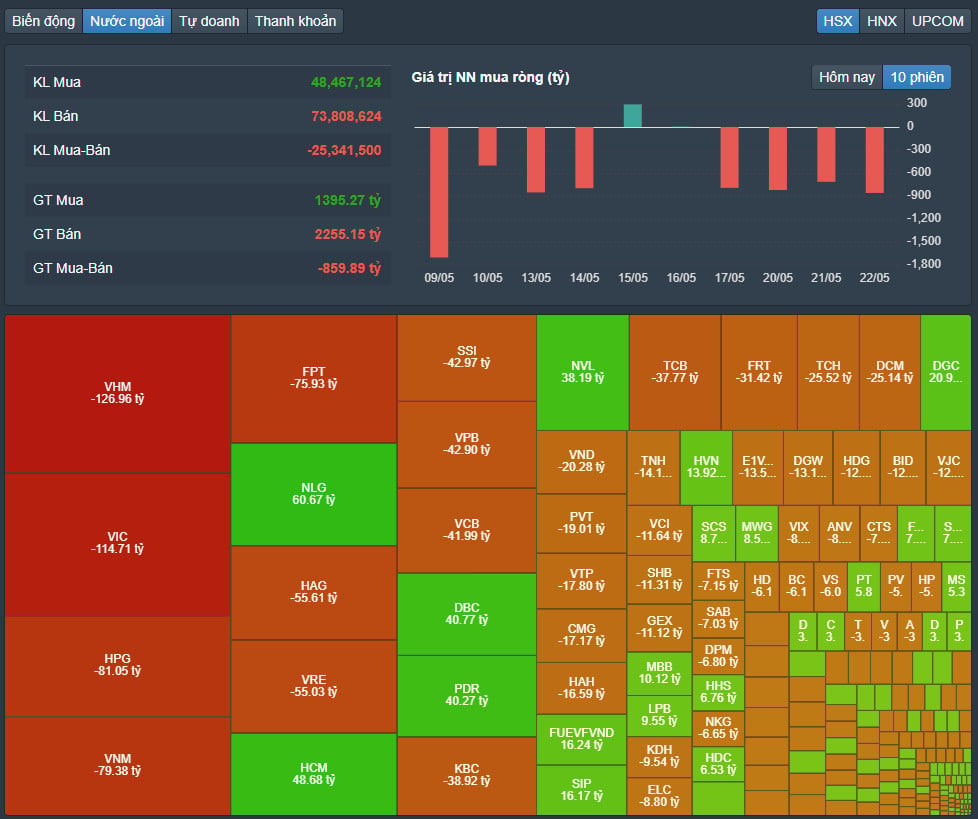

| Foreign block transactions. |

The total trading volume on HoSE reached more than 1.13 billion shares, worth VND28,930 billion, up 16% compared to yesterday's session. Negotiated transactions contributed VND3,630 billion. Of which, more than 84 million ABB shares, equivalent to 8.2% of the ownership ratio at An Binh Commercial Joint Stock Bank, were negotiated. The seller was the International Finance Corporation (IFC). After completing the transaction, ABBank only has a major foreign shareholder, Maybank - the largest bank in Malaysia with an ownership ratio of 16.4%.

Trading value on HNX and UPCoM reached VND2,760 billion and VND2,650 billion, respectively.

HPG topped the market's order matching list with nearly 39.8 million units. Next, SHB and HAG matched orders with 38.6 million units and 36.5 million units, respectively.

Foreign investors continued to net sell VND860 billion on HoSE alone, in which, this capital flow net sold the most VHM code with VND127 billion. VIC and HPG followed with net selling values of VND115 billion and VND81 billion respectively. In the opposite direction, foreign investors net bought the most NLG code with VND61 billion. HCM, DBC and PDR were all net bought over VND40 billion.

Source: https://baodautu.vn/vn-index-mat-hon-10-diem-dot-bien-giao-dich-co-phieu-abbank-d215833.html

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)