The tug-of-war continued into the afternoon session, with VN-Index suddenly turning around and soaring to 1,281 points. However, the market still has the potential to fluctuate around the resistance zone.

The tug-of-war from the previous two sessions continued until today's session (May 23), but the index suddenly reversed at the end of this afternoon's session, increasing by more than 14 points (+1.11%), VN-Index reached 1,281.03 points.

Thus, after today's session, VN-Index recovered points after a sharp drop of 10.23 points yesterday (May 22), surpassing the resistance zone of 1,280 points.

Green color spreads in the market but the tug-of-war trend still appears

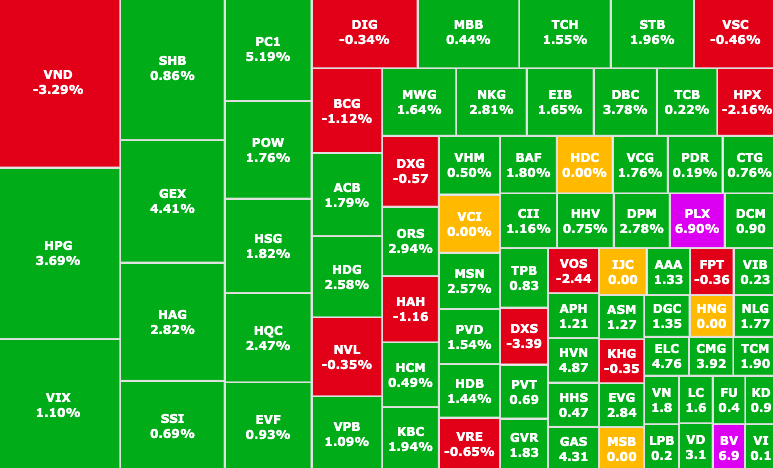

Market breadth was on the upside, with 278 stocks rising, 152 stocks falling and 65 stocks moving sideways. Trading liquidity was stable, around VND23,000 billion on the HOSE floor alone, although this figure still decreased slightly compared to the previous session.

The three industries that attract the highest cash flow in the market are real estate, banking and securities.

Retail and banking stocks led the index with HPG (Hoa Phat Steel, HOSE) increasing sharply by 3.67%, contributing 2 points. Next were ACB (ACB, HOSE), MSN (Masan, HOSE), MWG (Mobile World, HOSE), STB (Sacombank, HOSE),…

The group of stocks that increased dominated, VN-Index reversed quickly at the end of the session (Photo: SSI iBoard)

Notably, many stocks not in the VN30 group appeared in the group of stocks that positively affected the market, such as: REE (REE Refrigeration Electrical Engineering, HOSE), DGC (Duc Giang Chemicals, HOSE).

The VN30 group had 25/30 stocks increasing, in which the focus came from PLX stock (Petrolimex, HOSE), increasing by 6.9%, with a purchase volume of nearly 3 million shares, reaching a market price of VND 40,300/share, a record high since June 2022 to present.

In addition, BVH shares (Bao Viet Insurance, HOSE) also increased by the ceiling of 6.95%, reaching a market price of VND 44,600/share.

VND continues to plummet after foreign investors net sold 67.6 billion VND (Photo: SSI iBoard)

Foreign investors net bought 66.4 billion VND on HOSE with the following stocks: DBC, MWG (Mobile World, HOSE), HPG (Hoa Phat Steel, HOSE) and DBC (Dabaco Group, HOSE).

On the contrary, net selling pressure was concentrated in VHM (Vinhomes, HOSE), FPT (FPT, HOSE) and VND (VNDirect, HOSE). Of which, FPT decreased slightly by 0.36%, VND decreased sharply by 3.29%,

Since the beginning of the year, foreign investors have continuously recorded strong net selling of many stocks in the VN30 group. According to experts, this development is actually due to the trend of profit-taking after collecting tens of thousands of billions of VND in the period of 2022 - Q1/2023 by foreign investors.

Thus, VN-Index has returned to the 1,280 point area. According to experts, the market will often fluctuate around the resistance zone, in fact, the tug-of-war trend still appears in the market, typically in today's session: this development lasted until near the end of the session before reversing. This shows that selling pressure is still high, market sentiment is not stable. Investors still need to be cautious when trading.

Source: https://phunuvietnam.vn/vn-index-dao-chieu-phut-chot-vuot-1280-diem-sau-phien-giam-manh-20240523180303611.htm

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/5/351b51d72a67458dbd73485caefb7dfb)

Comment (0)