Some businesses said they may need to increase rice imports from neighboring countries to serve export orders, especially for the Indonesian market.

ST rice price increases sharply, Vietnam needs to increase imports

In the Mekong Delta, farmers are currently harvesting late summer-autumn rice, but heavy rains have made harvesting difficult and the quality of the rice is not high. Therefore, the price of some types of rice has increased, while others have decreased.Vietnam may need to import rice for export in the last months of the year.

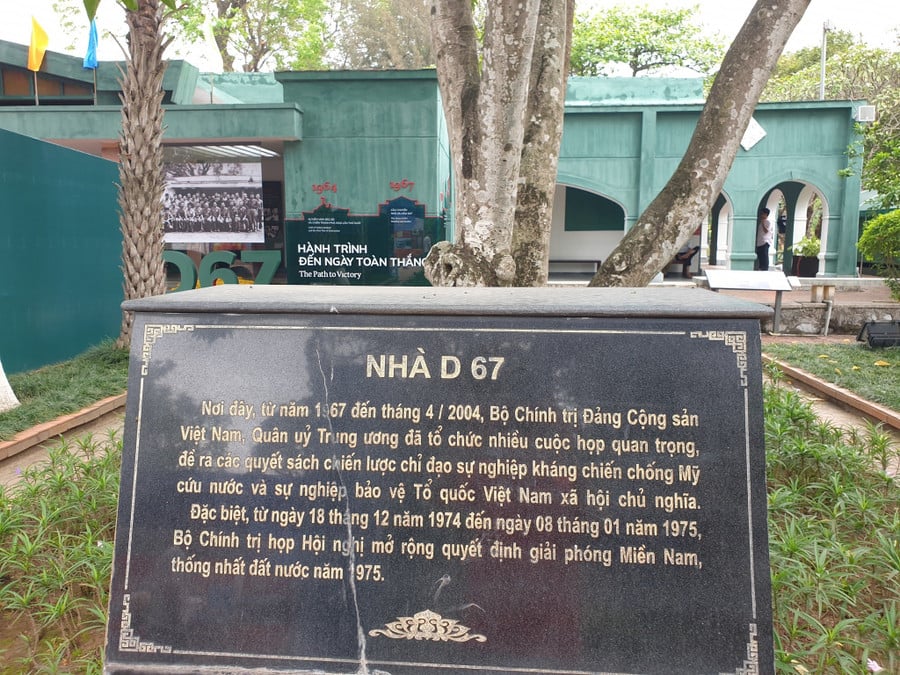

Photo: Cong Han

Why rice prices fall?

Regarding the world's largest supplier, India - which is said to be considering lifting the ban on exporting non-basmati white rice that has lasted for more than a year, Mr. Nguyen Van Thanh analyzed: These rumors have appeared many times but have not happened yet. In case it happens, it will not affect the Vietnamese market much, because the main market for Vietnamese rice is the Philippines. There are 3 main rice varieties of Vietnam that they really like: OM5451, OM18 and DT8; these 3 varieties account for 80 - 90% in the Philippine market; even Thai rice cannot compete. After harvesting, it only takes 15 - 20 days for Vietnamese rice to appear on the dining table of the Filipino people - they like that freshness. Vietnam has a geographical advantage, so short transportation time and low cost are advantages that no other country has. In the high-end segment such as the ST line, Vietnam is exporting very well to the Chinese, Middle Eastern and EU markets. Meanwhile, India's non-basmati white rice is in the Indonesian market segment (even in this segment, Vietnam's rice quality is higher). Currently, Vietnam's rice supply is not much, so the impact is there but not significant. Having just returned from two international rice conferences in Thailand and Indonesia, Ms. Pham Mai Huong, co-founder of the international rice market website SSRicenews, analyzed: The demand for rice in other countries is still high, especially in Indonesia and the Philippines. However, the recent downward trend in rice prices is due to the impact of the USD exchange rate on the domestic currencies of many rice exporting countries. Regarding the market, China continues its policy of restricting rice imports. This has caused Myanmar's rice reserves to increase rapidly as the country prepares to enter the next harvest in November. Myanmar has always depended on cross-border rice trade with China, while international trade, logistics are not well developed and costs are high. Therefore, when China restricted imports, Myanmar was under pressure and actively sought outlets by proactively reducing prices. This led to a decline in the general market. According to Ms. Huong, in mid-September, India abandoned its policy of applying a floor price for basmati rice exports. This was one of the moves to loosen the country's rice export restriction policy. Previously, India had allowed private ethanol producers to participate in bidding packages to purchase raw rice. In this segment, Pakistan is the country most directly and most affected, Vietnamese rice is not in this segment. As for non-basmati white rice, in fact, objective data shows that India has enough conditions to reopen and it will only be a matter of time. However, the issue India is considering is related to state agencies and enterprises implementing the policy of providing cheap rice to the poor. They are looking for solutions to avoid the situation where these policies overlap and negatively impact each other, causing subsidized rice to not reach the poor but be sold abroad.In 6 months, Vietnam imported 670 million USD of rice, up 27%

According to a report by the Ministry of Agriculture and Rural Development, in the first 6 months of 2024, Vietnam spent about 670 million USD to import rice, an increase of 27% over the same period last year. In 2023, Vietnam's rice imports were 860 million USD; the main supply was from Cambodia and India. Vietnam imports rice mainly for re-export and to serve the needs of processing rice-based products.Vietnam continues to win rice bids in the Indonesian market

In September, Indonesia invited bids for a record amount of 450,000 tons of rice, divided into 15 lots. A Vietnamese enterprise won 2 lots with a quantity of nearly 60,000 tons, the winning bid price was 548 USD/ton (C&F price - delivered at Indonesian ports). The lowest price in this bidding round belonged to a Myanmar enterprise with a price of 547 USD/ton. Thailand was the winning bidder with the highest rice price of 574 USD/ton, the quantity of 1 lot, equivalent to 31,800 tons. Pakistan was the winning bidder with the largest quantity of rice with 8 lots, a total of about 240,000 tons, the winning bid price ranged from 555 - 567.5 USD/ton. The Central Statistics Agency of Indonesia said that in the first 8 months of 2024, the country imported 3.05 million tons of rice, worth 1.9 billion USD. Rice imports increased by 121% percent over the same period last year.Thanhnien.vn

Source: https://thanhnien.vn/vn-co-kha-nang-tang-nhap-khau-gao-185240925210054467.htm

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[UPDATE] HCMC center before the April 30 parade: 'Only 9 hours left, will sleep sitting on the sidewalk'](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/0ff4e37fa63944889296bf9b9343939d)

![[Photo] People choose places to watch the parade from noon on April 29](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/3f7525d7a7154d839ff9154db2ecbb1b)

Comment (0)