Vinasun sets profit target to decrease sharply, reaching only 80.51 billion VND

Vinasun predicts that this year the taxi business will face fierce competition pressure, plus the company will adjust its driver support policy and revenue sharing ratio, so its profit target will decrease sharply, reaching only 80.51 billion VND.

Vietnam Sun Joint Stock Company (Vinasun, stock code: VNS) has just announced documents for the 2024 annual general meeting of shareholders.

Accordingly, the company targets total revenue and income this year at VND 1,137.45 billion, down 10% compared to 2023 business results. Pre-tax profit target is VND 80.51 billion, down 46.7%.

According to Mr. Dang Thanh Duy, General Director of Vinasun, the company's business plan and profits are affected by many factors such as fierce competition in the taxi business, inflation and consumer purchasing power, the recovery of the tourism and passenger transport industry. In addition, profits are also affected by policies to support drivers and adjust fares, revenue sharing ratios of self-employed vehicles, vehicles in cooperation with individuals and commercial vehicles.

Vinasun's management board plans to invest in about 700 new cars this year, mainly focusing on Toyota's high-end hybrid cars. The number of cars liquidated and sold on credit to drivers for business under the franchise form is about 500. It is expected that by the end of 2024, the company will have a total of 2,790 cars, including 1,081 4-seat cars and 1,709 7-seat cars.

“The company will proactively adjust the increase or decrease in the number and types of invested and liquidated vehicles as well as harmoniously coordinate the number of vehicles in business models and methods on the basis of ensuring the highest level of efficiency,” said Vinasun's board of directors.

The company added that its key task this year to achieve the revenue target of VND1,137 billion and pre-tax profit of more than VND80 billion is to focus on large markets such as Ho Chi Minh City, Binh Duong, Dong Nai, and Da Nang. In addition, the company will re-attract employees through cooperation policies and reasonable income distribution. The company also seeks opportunities to cooperate with potential units in the transportation, technology, consumer, and payment businesses at home and abroad to take advantage of each other's available advantages.

Last year, Vinasun recorded revenue of VND1,218 billion, up nearly 12% over the same period. Revenue from providing passenger transport services by taxi contributed VND1,021 billion, the rest was from contracted transport and other services.

The sharp increase in cost of goods sold caused Vinasun's gross profit to decrease by 14%, reaching only approximately VND256 billion. Financial expenses increased 2.5 times compared to the same period, plus a jump in sales expenses also significantly affected the business results for the whole year. Accordingly, the company reported a profit after tax of VND150 billion, down 18% compared to the previous year. This result did not complete the target of VND1,345 billion in revenue and more than VND209 billion in profit after tax set by the board of directors.

By the end of 2023, the company had total assets of VND 1,653 billion, down VND 183 billion compared to the beginning of the year. Long-term assets accounted for more than VND 1,100 billion. The company's liabilities were more than VND 485 billion, up about VND 30 billion compared to the beginning of the year. The company currently has nearly VND 290 billion in outstanding short- and long-term loans.

Source

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

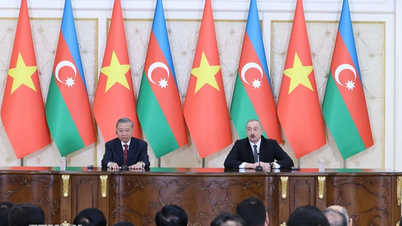

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

Comment (0)