ANTD.VN - The first days of July 2023 marked a milestone in the nearly half-century journey of the world's 36th largest dairy company in terms of revenue - Vinamilk, changing its brand identity after nearly 50 years of formation and development.

Considered a “national stock”, in recent years, VNM stock of Vietnam Dairy Products Joint Stock Company – Vinamilk has made many investors wonder about the problem of finding new growth drivers. In that situation, VNM has entered a strong restructuring process with the first step of launching a new brand identity after nearly 5 decades, demonstrating a bold, determined spirit, always being itself.

|

| Vinamilk's new logo created a "fever" on social networks right after its launch. Source: Vinamilk |

Changing brand identity – The first step in a complete restructuring strategy

Ms. Mai Kieu Lien - General Director of Vinamilk said that changing the brand identity is an effort to reposition, marking the first step in the process of modernizing the user experience and creating momentum for a breakthrough in the future.

Rebranding is just the first step in the company's 5-year strategy, along with a series of changes in digital transformation, personnel recruitment, management processes, etc. with the goal of reaching consumers faster and more effectively.

"A brand that wants to last 100 or 200 years must always change with real conditions. During the 47 years of formation and development, Vinamilk has also changed many times and this change is no exception," Ms. Mai Kieu Lien shared. "More importantly, Vinamilk will always maintain its value - that is, bringing the best services and products to consumers," the CEO continued.

The new identity is being deployed throughout the Vinamilk system including the website, online sales channels, retail points, store systems and brand publications and product packaging...

SSI Securities Company assessed that this is Vinamilk's largest product portfolio restructuring in the past decade, which is expected to contribute to improving revenue and help the company regain market share in the coming time.

VietCap Securities Joint Stock Company (VCSC) believes that the new eye-catching images of VNM products will be effective in creating a strong first impression from customers. These designs will help VNM attract consumers' attention to the company's products.

In addition, VCSC believes that VNM's extensive distribution network including 200 exclusive distributors and 210,000 points of sale in traditional channels as well as 8,000 points of sale in modern channels is an advantage because these sales channels can help promote the company's new brand identity.

To attract and retain customers in the future, VCSC believes that VNM needs to carry out effective advertising and promotion activities as well as maintain product quality. However, the securities company believes that it is also necessary to consider and evaluate the results achieved after changing the brand identity before determining whether this strategy is successful or not. In its latest update report, VCSC expects VNM to gradually regain market share from 2024 and forecasts that the company's revenue will increase at a compound annual growth rate (CAGR) of 6% in the period of 2023-2027.

First growth numbers of the second quarter

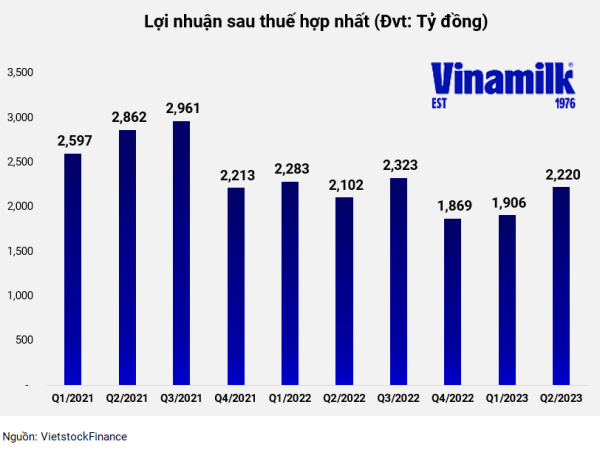

According to the preliminary business report for the first half of this year, the dairy giant recorded total revenue in the second quarter of VND15,200 billion and after-tax profit of VND2,220 billion.

This result increased by 1.6% and 5.6% respectively compared to the same period last year and increased by 8.9% and 16.5% compared to the first quarter. Thus, Vinamilk's profit has increased for 2 consecutive quarters after 2 years of being affected by the Covid-19 pandemic as well as the world macroeconomic situation.

Accumulated for 6 months, VNM's estimated revenue reached nearly VND 29,200 billion and after-tax profit was over VND 4,100 billion. Compared to the target set at the 2023 Annual General Meeting of Shareholders, Vinamilk achieved 46% of the revenue plan and nearly 48% of the after-tax profit target.

|

| Source: VietstockFinance |

Outlook for the second half of the year

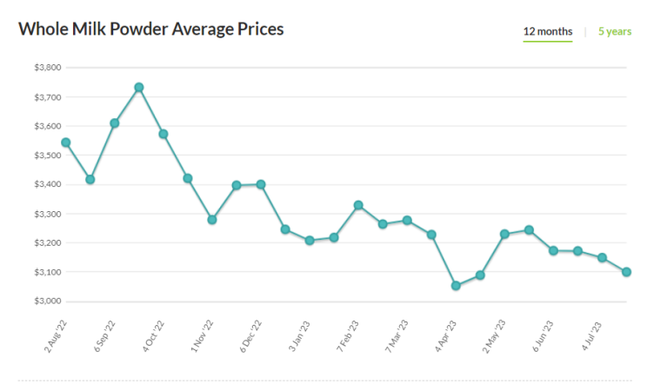

The mid-year outlook report for 2023 released by Bao Viet Securities (BVS) on June 20 stated that the second half of this year will be a time for large-cap industry groups to shine. With a healthy financial structure and abundant cash, BVS expects that the cooling price of raw milk powder will contribute to gradually improving VNM's profit margin from the third quarter.

BVS also believes that VNM will still hold the largest market share in Vietnam. This securities company emphasizes the trend of differentiation, product diversification and boldly attacking VNM's niche segments.

SSI analysts also found that lower input costs (imported milk powder) will begin to positively impact Vinamilk's gross profit margin from the second quarter, thereby raising the gross profit margin to nearly 40%, up from 38.8% in the first quarter.

|

| Whole milk powder prices over the past year. Source: Global Dairy Trade |

VNDirect experts forecast that VNM's net profit could grow by 6.6% in 2023 and 8.1% in 2024. Of which, net profit is estimated by the securities company to increase by 15.8% in the second and fourth quarters of 2023.

With prospects for raw material prices and profit margin growth in the second half of the year, VNM shares continue to be considered a balanced choice between opportunities and risks, and portfolio diversification for investors.

At the close of trading on July 24, VNM shares closed at VND75,000/share, up 14.5% from the lowest level since the beginning of the year. VNM's liquidity has also improved since mid-June, with an average trading volume of more than 6.1 million units per session.

In terms of valuation, VNM's P/E is currently hovering around 19 times, lower than the industry average of 21.63 times. Thus, VNM is still trading below the industry average valuation and has room for growth in the future.

VNM stock performance in recent months

|

| Source: VietstockFinance |

Assessing the milk market, the company's leaders affirmed that the Vietnamese milk market is not yet saturated. "The average milk consumption per capita in Vietnam is still low, so the Vietnamese milk market is not yet saturated. Vinamilk will focus on meeting consumer needs in three aspects: quality, price and service to increase sales and market share," Ms. Lien shared.

In addition, in international markets, this enterprise has signed many contracts with a total value of 100 million USD for the first 6 months of the year and is currently actively participating in trade promotion activities abroad, most recently the international fair in Guangzhou, China , to expand growth opportunities towards the revenue target for the last 6 months of the year.

(Source: FILI )

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)