Reduce social insurance payment period from 20 to 15 years, minimum pension rate for male workers is 33.75%, female workers 45%.

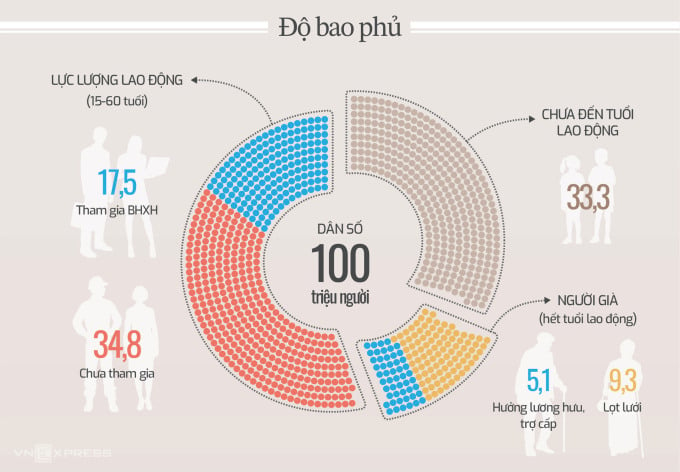

In the Draft of the revised Law on Social Insurance submitted to the National Assembly on October 10, the Government proposed reducing the number of years of social insurance contributions from 20 to 15 years, moving towards a 10-year roadmap to expand coverage in the new context of 38% of the working-age workforce participating in the social security net.

Elderly people work in a garment factory at Dong Ba market (Thua Thien Hue ). Photo: Vo Thanh

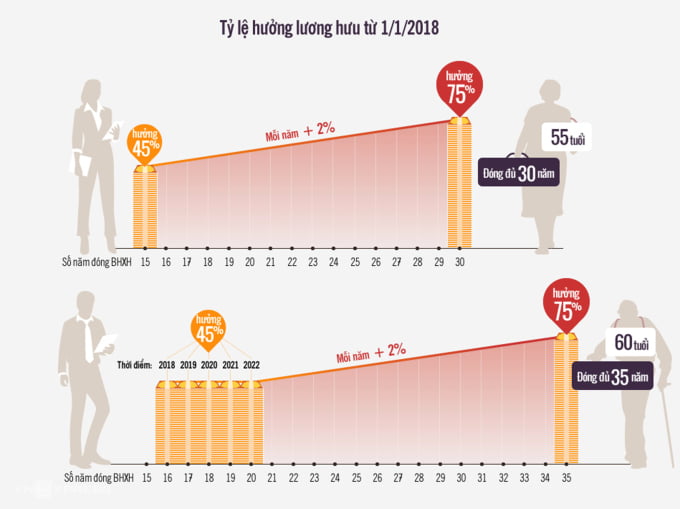

According to the draft law, the pension for workers retiring under normal conditions is equal to 45% of the average salary used to calculate social insurance contributions, corresponding to 20 years of insurance contributions for male workers and 15 years for female workers. After that, for each additional year of contributions, the pension will be increased by 2%.

Male workers who pay social insurance for 15 years receive a minimum rate of 33.75% and need to pay for 35 years to receive a maximum pension of 75%. Men who pay for 15 years but less than 20 years will receive an additional 2.25% each year. Female workers who pay for 15 years receive a minimum pension of 45% and need to pay for 30 years to reach the maximum of 75%.

Although the minimum social insurance contribution period is 15 years, the pension accumulation rate for men is 11.25% lower than that of women. Explaining this, the representative of the drafting agency said that the calculation method and social insurance benefit rate inherit all current regulations, without placing much emphasis on changing the benefit formula.

The 2006 Social Insurance Law stipulated a minimum contribution period of 15 years for both men and women to receive 45%. The 2014 amendment gradually increased the minimum contribution period for men to 20 years and for women to maintain 15 years to receive the above rate.

Former Deputy Minister of Labor, War Invalids and Social Affairs Pham Minh Huan, who participated in drafting the Social Insurance Law in 2006 and 2014, explained that the minimum contribution period is 5 years different to match the old retirement age of 55 for women and 60 for men.

Because female workers retire 5 years earlier than men, and have a shorter participation period in the system, the minimum number of years of social insurance contributions is also adjusted lower accordingly, so that women retiring at age 55 will receive a maximum of 75% with 30 years of participation, while male workers retiring at age 60 will pay for 35 years.

"Therefore, if the number of years of contribution is reduced but the old calculation method is kept, there will be a difference in the pension rates for men and women," he said.

The pension rates of male and female workers are based on the number of years of social insurance contributions according to current law. Graphics: Tien Thanh

The pension rate of Vietnamese people is high, but pensions are very low due to low social insurance contribution. With the current average social insurance contribution salary of 5.7 million VND, the pension for men participating in social insurance for 15 years is about 2 million VND and for women about 2.6 million VND. However, this is the basic level, pensions are adjusted based on CPI and the annual socio-economic situation.

According to the revised Social Insurance Bill, the regulation of reducing the social insurance contribution period to 15 years only applies to workers who retire under normal working conditions. Workers who do heavy, hazardous work and have reduced working capacity can retire earlier than the prescribed age, but must still contribute for 20 years. After that, for each year of early retirement, 2% will be deducted. In case of early retirement with odd periods before 6 months, the benefit rate will not be deducted, over 6 months the reduction rate is calculated as 1%.

The Ministry of Labor, War Invalids and Social Affairs explained that the pension rate for this group is already low, and if the number of years of contribution is reduced, the pension rate will be even lower. For example, a male worker who has paid social insurance for 15 years will receive a pension of 33.75%, but if he retires 5 years earlier and is deducted 10%, it will only be 23.75%.

Vietnam's social security coverage is low, with only over 35% of the elderly after working age receiving pensions and monthly allowances (See details). Graphics: Gia Linh

The proposal to reduce the previous year of social insurance contributions received two opposing opinions, according to the review report of the Social Committee. The first group agreed because they believed that the policy would attract workers and help expand coverage, especially for low-income and irregular earners. The other group suggested keeping the current 20 years of contributions so that pensions would not be too low, as well as ensuring fairness and sharing between men and women in the social security system.

In addition to reducing the number of years of pension payment, the Government submitted to the National Assembly two options for one-time social insurance payment; proposed to put about 3 million people in 5 labor groups into compulsory payment; supplemented maternity allowance of 2 million VND for voluntary social insurance participants; lowered the age of receiving social pension benefits to 75 instead of 80 as currently; and provided monthly allowances for workers who are old enough to retire before 75 years old but have not paid social insurance for enough time.

The revised Social Insurance Law Project is expected to be discussed by the National Assembly at the session at the end of October, approved at the session in May 2024 and take effect from July 1, 2025.

Hong Chieu

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)