The special consumption tax (SCT) rate on beer is proposed to increase from the current 65% to 80% in 2026, then continuously increase by 5%/year, reaching 100% in 2030. Many opinions are concerned that this increase will cause consequences for the economy .

The draft revised Law on Special Consumption Tax (SCT) is being discussed at the 8th session of the 15th National Assembly , including a proposal to increase tax on beer.

There are 3 proposed options. Of which, two options of the Ministry of Finance :

Option 1 - increase from the current tax rate of 65% to 70% in 2026, increasing by 5% each subsequent year to reach 90% in 2030

Option 2 - increase to 80% by 2026, increase 5%/year continuously until 2030 reaching 100%.

An option of the Beer, Alcohol and Beverage Association: Option 3 - increase tax from 2027, increase by 5%, increase every 2 years, by 2031 reach tax rate of 80%.

“Few countries have such a continuous level of taxation”

At the workshop on the socio-economic impact of the special consumption tax policy on industries, organized by the European Chamber of Commerce in Vietnam (EuroCham) on the morning of November 18, Dr. Nguyen Minh Thao, Central Institute for Economic Management (CIEM), expressed his concern that the Ministry of Finance is leaning towards option 2.

“Few countries have such a continuous tax rate,” Ms. Thao commented.

Ms. Thao said that the current impact assessment report of the Ministry of Finance does not have a comprehensive impact assessment, mainly based on the perception of the drafting agency; there is no scientific evidence, data, or figures to clearly indicate that this is a commodity that needs to be controlled; there is no cross-sectoral impact assessment (21 other sectors related to beer).

A series of figures were presented by CIEM representatives for policymakers to consider the pros and cons before making a final decision.

Regarding the impact on the added value of the beer industry , with option 1, the added value of the beer industry will decrease by 8% in 2026; option 2 will decrease by 11% in 2026 and option 3 will decrease by 7.2% in 2027. Accumulated from 2026-2030, option 1 will reduce the added value of the beer industry by more than VND 44,000 billion, option 2 will reduce by more than VND 61,000 billion and option 3 will reduce by more than VND 38,000 billion from 2027 to 2031.

Regarding the impact on the total added value of the entire economy , option 1, accumulated from 2026 to 2030, will reduce the total added value of the economy by more than 10,000 billion VND; option 2 will reduce more than 13,500 billion VND; option 3 will reduce more than 6,500 billion VND, with little negative impact on the beer industry and other industries in the economy.

Regarding the impact on workers , option 1 causes workers' income to decrease by more than 3,400 billion VND, option 2 reduces 4,600 billion VND and option 3 reduces 2,200 billion VND.

Regarding the impact on the state budget : Option 1 increases indirect tax (product tax) cumulatively from 2026-2030 by 6,469 billion VND, but direct tax (corporate income tax) decreases by 1,230 billion VND, so total tax revenue is only 5,149 billion VND; Option 2 increases indirect tax by 8,559 billion VND, reduces direct tax by 1,752 billion VND, total revenue is 6,807 billion VND; Option 3 accumulates from 2027-2031, increases indirect tax by 4,186 billion VND, reduces direct tax by 856 billion VND, total revenue is 3,330 billion VND.

Budget revenue increase is only achieved in the short term, but in the medium and long term, budget revenue begins to decline because the beer industry and other industries in inter-industry relations also have reduced revenue.

Businesses hope for leniency

From the perspective of a foreign investor, Mr. Nguyen Thanh Phuc, Director of External Relations of Heineken Vietnam, shares the views of beer, alcohol and beverage businesses when he said that increasing special consumption tax to 100% is a very negative policy.

First of all, the tax increase not only affects large enterprises, this policy also has a strong and comprehensive impact on the chain of small and medium enterprises (SMEs) in Vietnam participating in the alcoholic beverage industry (enterprises with input from agriculture, transportation, distribution, tourism, trade, night-time economy...).

When investors consider reducing production in Vietnam, SMEs will lose the opportunity to participate in the market, create jobs, and generate GDP.

The tax increase will likely restrain the motivation of investors, especially foreign investors, in the context of increasing input material and transportation costs, and the strain of complying with new policies such as green economy, clean economy, etc., now with the additional tax burden.

Another major consequence is the issue of social security. The labor market is increasingly facing unemployment. Tax increases could cause a series of businesses to shrink or cease operations. Option 2 of the Ministry of Finance would reduce workers' income by up to twice as much as Option 3.

In particular, Ms. Nguyen Minh Thao emphasized the impact of the policy of increasing special consumption tax on beer on GDP. Specifically, option 1 reduces GDP value by more than VND14,000 billion, equivalent to a decrease of 0.035% of GDP; option 2 reduces VND32,300 billion, equivalent to 0.08% of GDP; option 3 reduces VND8,590 billion, equivalent to 0.017% of GDP.

“We need to be very careful when proposing tax increases because it will directly affect the economic growth target. If GDP is reduced by 0.08%, it will not ensure the National Assembly's target,” Ms. Thao said.

Ms. Dinh Thi Quynh Van, Chairwoman of PwC Vietnam, agrees with the trend of increasing taxes, but also recommends considering the level of tax increase to harmonize the interests of businesses, the industry, and the budget revenue.

Source: https://vietnamnet.vn/van-ban-khoan-de-xuat-danh-thue-tieu-thu-dac-biet-100-voi-bia-2343168.html

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

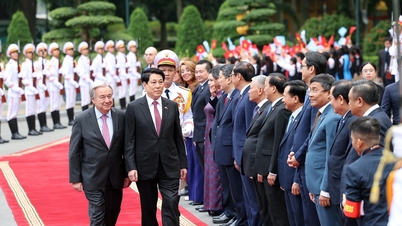

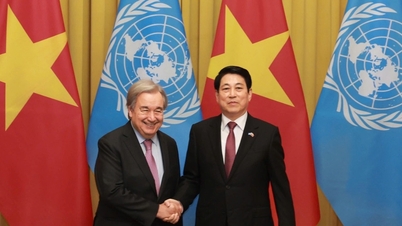

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

Comment (0)