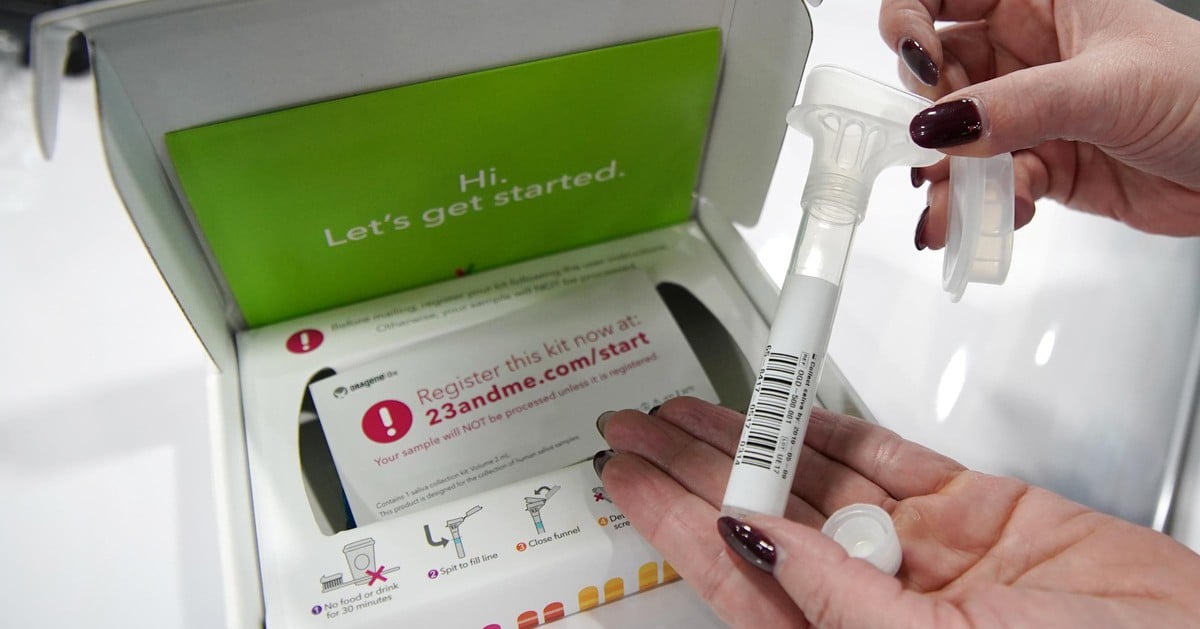

Founded in 2006, biotechnology and genetics company 23andMe aims to revolutionize the once monopolistic genetic testing industry with its direct-to-consumer model. With funding from high-profile investors and celebrity endorsements, the company sells its testing kits to customers at affordable prices.

Unlike competitors like Ancestry.com, 23andMe is looking to leverage its database for drug development. The company went public in 2021 and is valued at about $3.5 billion. That funding has allowed 23andMe to grow its drug research team and forge partnerships with pharmaceutical companies.

23nadMe is on the brink of bankruptcy despite its market capitalization once being valued at $6 billion.

“We’re at a tipping point. There are huge opportunities in therapeutics and opportunities in our consumer business,” 23andMe CEO Anne Wojcicki told CNBC in 2021.

Soon after its Nasdaq debut, rising interest rates made it harder to raise money and sales began to decline. The company introduced a subscription product in 2020 in hopes of making up for the lack of recurring revenue from its testing kits, but that strategy failed. 23andMe reported a net loss of $312 million in fiscal 2023, and by September 2023, 23andMe’s stock price had fallen below $1 a share.

Along with financial concerns surrounding 23andMe, privacy issues surrounding the genetic database have also been on the rise. In October 2023, hackers accessed information on nearly 7 million customers.

23andMe Holding Co. is an American biotechnology and genetics company headquartered in South San Francisco, California. The company is best known for its direct-to-consumer genetic testing service, in which customers provide saliva samples that are analyzed in a laboratory, using single-nucleotide polymorphism genotyping to generate reports regarding the customer's ancestry and genetic predisposition to health-related topics. The company's name comes from the 23 pairs of chromosomes in diploid human cells.

When asked by CNBC what would happen to 23andMe's database if the company were sold or taken private, a company spokesperson said Wojcicki has publicly shared that she intends to take the company private and is not open to third-party acquisition offers.

“Anne also expressed a strong commitment to customer privacy and is committed to maintaining the company’s current privacy policies, including following through on the anticipated completion of the acquisition she is pursuing,” a 23andMe spokesperson said in an email.

Ms. Wojcicki submitted a proposal to take the company private in July, but the proposal was rejected by a special committee formed by the company's directors because it did not offer a price higher than the closing price of 40 cents ($1) a share at the time.

When 23andMe's independent directors resigned in September, they cited frustration over "strategic differences" in Ms. Wojcicki's vision for the company.

23andMe now faces a November 4 deadline to get its stock price above $1 and find new board members to maintain its Nasdaq listing.

(According to CNBC)

Source: https://www.baogiaothong.vn/tung-co-gia-6-ty-do-la-vi-sao-cong-ty-sinh-hoc-23andme-tren-bo-vuc-pha-san-192241023205021884.htm

![[Photo] Magnificent rehearsal of the parade to celebrate the 50th anniversary of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/9d03de12cfee4bd6850582f1393a2a0f)

![[Photo] Foreign tourists impressed by the way history is conveyed through interactive exhibitions at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/6bc84323f2984379957a974c99c11dd0)

![[Photo] Special journey of a helicopter flying the flag, flying over the sky of Ho Chi Minh City, celebrating National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b6304a7ed5eb4e7e960d57de239e8ef9)

Comment (0)