Step 1: Determine your financial freedom goal

This could include paying off debt, accumulating a fixed amount of money, or even being able to retire early. Different people may need different amounts of assets to achieve financial freedom.

Step 2: Focus on professional work to increase income

Contrary to the view of many people that you have to do a lot of work to achieve financial freedom soon. According to Mr. Huy, "one job for nine is better than nine jobs". When we put all our efforts into our current salaried job, we will have more opportunities for promotion, thereby improving our income. This is the most important resource in the first step to building a financial freedom plan.

Step 3: Manage spending and save for investment

The 50/30/20 3-jar spending management method will help you manage your spending and save a certain amount of money every month without having to write it down. First, depending on your income, you must set aside a fixed amount of money every month. This amount must be invested in a disciplined and consistent manner in a portfolio of stocks or suitable fund certificates or in installments, paying interest on loans to buy real estate.

Then you transfer a sufficient amount of money into an account for essential expenses such as groceries, electricity, water, children's school fees... The rest, you transfer to another account to spend on favorite items such as watching movies, traveling , buying perfume...

Step 4: Clearly determine the appropriate level of return and investment cycle suitable for each type of asset.

You should invest the majority of your assets in traditional investment vehicles such as real estate and a portfolio of leading, fundamentally sound stocks or mutual funds. Investments must ensure diversification and a minimum investment period to achieve the expected return.

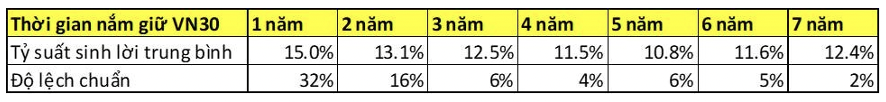

For example, the table below shows the expected return, standard deviation and investment cycle of the VN30 stock basket.

This statistic shows that investing in a stock portfolio like VN30 should have a minimum investment period of 4 years to achieve an expected return of 12%/year (including dividends) with an acceptable standard deviation of 4%. Similarly, residential land has an investment cycle of 5 years with a return of 9-11%/year.

Step 5: Build Passive Cash Flow Step by Step

For young people who are still far from the goal of financial freedom, priority should be given to allocating to capital gain portfolios such as residential real estate and growth stocks. At this time, your assets will increase rapidly but will not actually generate cash flow.

As we get closer to retirement or our financial freedom goal, we should switch to cash-flowing real estate such as apartments and high-dividend stock portfolios. Passive cash flow from these assets will help you no longer rely too much on salary and bonus income, thereby achieving financial freedom.

"Financial freedom is just a state. To maintain this state of financial freedom, you need to control your spending so that your spending cash flow is smaller than your income. If you lose control of your spending, no amount of assets is large enough to ensure maintaining a state of financial freedom," the expert advised.

Source: https://laodong.vn/kinh-doanh/tu-do-tai-chinh-khong-phai-la-giac-mo-xa-voi-voi-nguoi-lam-thue-1366097.ldo

![[Photo] Standing member of the Secretariat Tran Cam Tu chaired a meeting with Party committees, offices, Party committees, agencies and Central organizations.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/1/b8922706fa384bbdadd4513b68879951)

Comment (0)