From January 1, 2025, according to the provisions of the 2023 Law on Identification; Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NHNN, banks will suspend/restrict transactions for cardholders who have not updated biometrics or whose identification documents have expired.

As the deadline of December 31, 2024 approaches, banks are using every means to notify customers that they must update their biometrics and chip-embedded ID card numbers. If they do not do so, customers will not be able to make certain transactions from January 1, 2025.

Banks also help customers "sprint" to update biometrics and update personal identification numbers according to chip-embedded CCCD before the deadline of December 31, 2024.

According to Decision 2345/QD-NHNN of the Governor of the State Bank of Vietnam, from July 1, 2024, bank accounts are required to have biometric authentication if they want to transfer money online over 10 million/time or the total amount transferred over 20 million VND/day.

After 3 months of implementing Decision 2345, over 38 million accounts have been biometrically authenticated.

In addition, Circular 17/2024/TT-NHNN (Circular 17) and Circular 18/2024/TT-NHNN (Circular 18) issued on June 28, 2024 also require financial institutions to check the validity of identification documents, authenticate biometric information and update customers' residence information.

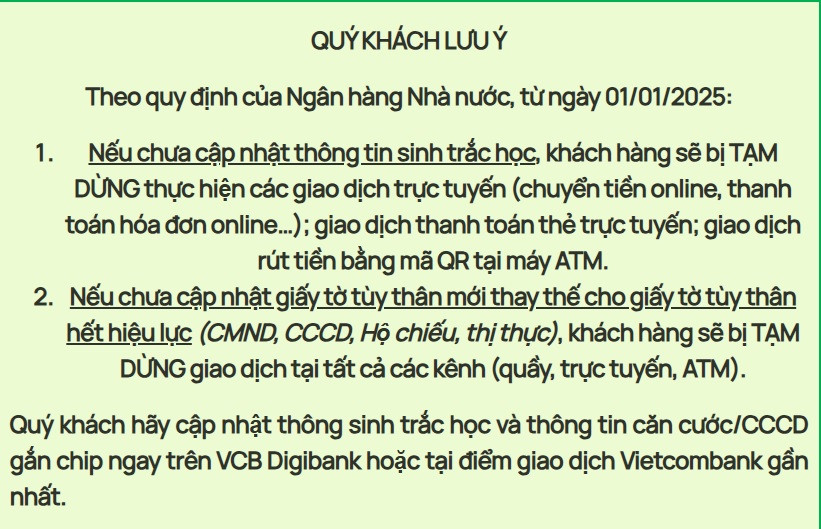

Accordingly, from January 1, 2025, payment account holders/bank card holders will not be able to make online transactions and transfer/withdraw money using QR codes at ATMs if they: have not completed the change of the declaration number and correct biometric information; have not updated the new information supplement to replace expired identification documents.

In addition, the 2023 Law on Identification stipulates that all 9-digit and 12-digit identity cards (ID cards) will expire from December 31, 2024, requiring people to switch to chip-embedded citizen identification cards (CCCD). This requires customers to update new CCCD information in their records to avoid transaction interruptions.

These regulations ensure the safety and security of online payments, thereby creating a healthy cyberspace, promoting sustainable development of cashless payments and protecting customers' rights.

Individual customers can update their biometrics themselves through the app following the instructions. However, for devices that do not support NFC (wireless connection technology), customers need to go to any bank transaction point to request support from staff.

Realizing the increasing demand for biometric updates from people, some banks have had to work overtime and on weekends to serve customers.

At Vietcombank, from November 23, 2024 to January 15, 2025, Vietcombank transaction points serve customers from 8:00 a.m. to 6:30 p.m. from Monday to Friday and from 8:00 a.m. to 5:30 p.m. on weekends to support customers in registering information.

Vietcombank said that after implementing overtime, the number of customers successfully updating biometrics doubled compared to before. In some industrial zones, the number of customers who are factory and company employees coming to update biometrics increased dramatically, especially on weekends. These Vietcombank branches mobilized all staff to work overtime to serve customers.

Which transactions are interrupted? Which transactions are still going through?

According to the 2023 Identity Law and Circular 17, Circular 18, customers who have not updated their biometric information will have their online payment transactions SUSPENDED . However, customers can still make cash withdrawals at ATMs using physical cards. Card transactions can still be made at card acceptance devices at points of sale (POS...).

For customers whose identification documents have expired, the bank will TEMPORARILY STOP card transactions on all transaction channels.

To avoid transaction interruptions, the bank recommends that customers who have not updated their biometric information and/or have not updated their ID information to replace their expired ID documents:

Method 1: Update biometric information on the e-banking application.

Method 2: Update biometric information and identification documents at all bank transaction points nationwide.

Customers only need to update their biometric information and valid identification documents once at the bank. When the biometric information changes or the identification documents expire, customers need to update them.

According to the latest official dispatch No. 9913/NHNN/TT dated December 3, 2024, the State Bank has provided guidance on electronic card transactions as follows: "Online payment transactions and cash withdrawals at ATMs are considered electronic card transactions (excluding the use of physical cards to withdraw money at ATMs) and transactions at card acceptance devices at points of sale are not considered electronic transactions." Thus, from January 1, 2025, if customers have not updated their biometric information, they can still use their physical cards to withdraw money at ATMs and make transactions at POS machines. In addition, other card transactions of customers will be SUSPENDED, including: online payment transactions by card; cash withdrawal transactions by QR code at ATMs; other electronic card transactions. |

Source: https://vietnamnet.vn/tu-1-1-2025-giao-dich-ngan-hang-nao-bi-tam-dung-neu-tai-khoan-chua-dinh-danh-2353399.html

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] People choose places to watch the parade from noon on April 29](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/3f7525d7a7154d839ff9154db2ecbb1b)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

Comment (0)