A resolution on building a regional financial center in Da Nang City and a comprehensive international financial center in Ho Chi Minh City will be submitted by the Government to the National Assembly for promulgation at the May 2025 session.

Da Nang plans prime land plots on Vo Van Kiet Street (facing the sea) to become a financial center - Photo: DOAN CUONG

Accordingly, these centers will be developed in Ho Chi Minh City and Da Nang with a series of unprecedented incentives on investment, taxes, land, salaries, and immigration.

In addition to attracting foreign financial institutions, creating new investment resources, providing high-quality financial services, meeting the needs of domestic and foreign enterprises, these centers are also considered new growth poles of Ho Chi Minh City, Da Nang and the whole country in the coming years.

Many advantages

According to the Ministry of Planning and Investment, Vietnam possesses many advantages to develop an international financial center such as:

* Having a different time zone from 21 of the world's largest financial centers, located in the heart of Southeast Asia, conveniently connected to Asia's dynamic economies . This is a unique, special advantage.

* Vietnam is among the leading markets in terms of future financial technology adoption rate, and is one of the top 3 innovative economies among low-middle income countries.

* There are currently 121 financial centers in the world , Ho Chi Minh City is ranked in the group of global financial centers, ranking 105/121 financial centers in the world.

Experimenting with disruptive fiscal policy

To build financial centers, a series of outstanding policy mechanisms to encourage and facilitate the attraction of capital, technology, modern management methods, promote infrastructure development, and create a civilized living environment will be tested.

The Ministry of Planning and Investment said that from the development experience of emerging financial centers such as Dubai, Abu Dhabi and Astana, the ministry has proposed a financial center membership registration policy instead of the usual business registration policy.

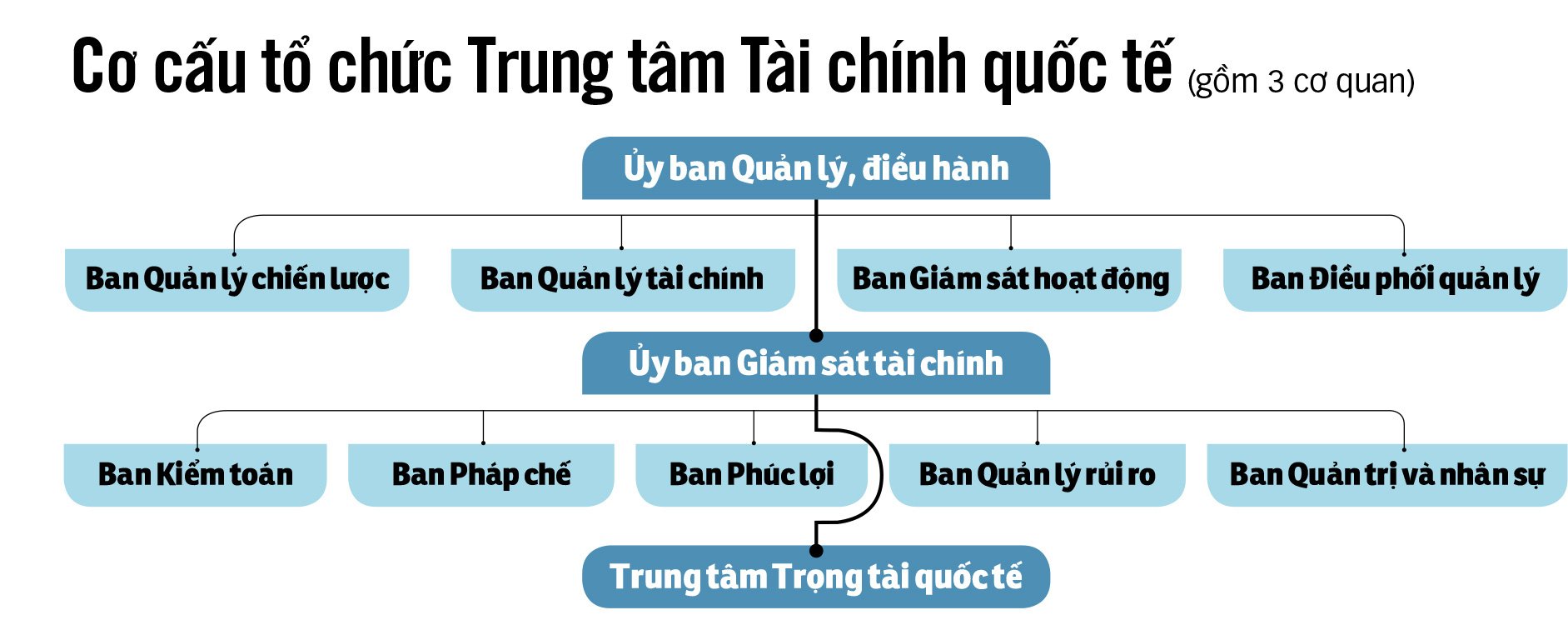

Members of the two financial centers of Ho Chi Minh City and Da Nang will be credit institutions, financial companies, stock exchanges, gold, foreign currency, financial investment funds, investment funds, insurance companies... The management agencies of the financial centers will directly grant operating licenses to members.

At financial centers, purchases, payments, transfers, and transactions between organizations and individuals are made in Vietnamese Dong or freely convertible foreign currencies.

Sandbox policies for business models applying technology in the financial sector (fintech) will also be applied from July 1, 2026.

The Financial Centers Regulatory Commission will license, regulate, assess the impact, and control fintech activities including crypto-asset and crypto-currency exchanges.

Regarding capital market development policy, foreign banks establishing branches or moving headquarters and offices to the two financial centers of Ho Chi Minh City and Da Nang are given incentives as in the fields in the investment incentive list.

Registration, custody, trading and clearing activities for listed securities are carried out according to the practices of major financial centers in the world.

The establishment of specialized trading floors for financial centers based on the application of technology in the financial sector will be carried out according to simple processes and procedures.

Tax exemption, multi-faceted support

Managers, scientists, and experts will be exempt from personal income tax when working in financial centers. Other subjects with taxable income will be exempt from tax until the end of 2035 and have their tax reduced by 50% in the following years.

Enterprises investing in priority industry projects in the financial center will enjoy corporate income tax exemption for the first 4 years, 50% tax reduction for the next 9 years and a tax rate of 10% throughout the project's life cycle.

In particular, businesses and corporations in the list of the 500 largest businesses in the world according to Forbes rankings, credit institutions and financial companies are exempt from corporate income tax for the first 2 years and have 50% of the tax payable reduced for the next 4 years.

Regarding incentives for strategic investors, the Ministry of Planning and Investment said that strategic investors investing in financial centers in Da Nang and Ho Chi Minh City will be provided with investment support services, support for site clearance, collection of service fees, participation in planning and adjustment, and development of policies applicable at the financial centers.

With the proposed immigration, travel and temporary residence policy, foreigners and Vietnamese people holding foreign passports working, investing and doing business in financial centers and their family members will be granted multiple entry and exit visas with a duration suitable for the working period at the financial center.

Long-term temporary residence in financial centers, if necessary, will be considered for extension upon expiration.

Members of the financial center are exempt from visas for entry for no more than 30 days. Foreigners investing in financial centers are allowed to recruit foreign workers and negotiate salaries based on the work.

The salary of civil servants, public employees, and salaried employees working in international financial center management agencies shall not exceed three times the basic salary issued by the State.

Managers, scientists, and experts working at financial centers are supported with housing. According to the proposed mechanism for developing financial centers, the Ho Chi Minh City and Da Nang governments are allowed to use tax, fee, and other legal revenue from financial centers left to the locality to pay salaries for management staff and support housing for experts.

Enterprises investing in priority investment fields and projects in financial centers are allowed to lease land for 70 years. When the term expires, if there is a need, it can be extended.

Furthermore, foreign-invested organizations and enterprises have the right to mortgage land use rights and assets on land attached to financial centers to borrow capital from domestic and foreign credit institutions. Foreigners are also entitled to receive land use rights in financial centers.

Presented by: N.KH.

New game opens up opportunities for Vietnam

According to Minister of Planning and Investment Nguyen Chi Dung, the global financial system is gradually reshaping. The world is in need of developing new financial centers, providing specialized financial products and services, serving niche markets, different from traditional financial centers.

Therefore, emerging financial centers like Vietnam have a golden opportunity to participate in this "game" by establishing an open legal corridor, issuing outstanding preferential policies and in accordance with international practices to become a "playground" for leading financial investors.

In particular, Ho Chi Minh City and Da Nang have converged many fundamental factors to develop a regional and international financial center, assessed by the Global Financial Center Index (under the London Financial Center) as one of the emerging financial centers, on the path of strong growth.

The successful construction of a regional and international financial center will play an important role in helping Vietnam achieve five opportunities: connecting with the global financial market; attracting foreign financial institutions, creating new investment resources, promoting existing investment resources;

Providing high-quality financial services, meeting the needs of domestic and foreign enterprises; creating a new qualitative shift, helping the financial market in Vietnam become healthy and effective, catching up with international standards; contributing to bringing Vietnam deeper into the global economic value chain.

According to Associate Professor Dr. Dinh Trong Thinh (Academy of Finance), when there are international financial centers, the amount of capital coming to Vietnam will be greater, international investors will put capital into financial centers to carry out international stock and bond trading activities.

The government and domestic enterprises can also easily carry out international bond issuance activities to raise capital right in Vietnam instead of having to go to Singapore or Hong Kong.

As more capital flows into and out of the country, domestic enterprises can also easily access international financial markets to raise capital.

For a long time, every time domestic enterprises issue international stocks and bonds, they have to go to foreign exchanges to trade at higher costs, more expensive, and the issuance conditions are also more complicated - Mr. Thinh added.

In addition, establishing an international financial center in Ho Chi Minh City and a regional financial center in Da Nang will increase tax and fee revenue for the locality, while creating many high-quality jobs, and improving the financial rankings of the country and businesses.

The legal environment must be transparent and stable.

Financial expert Huynh Trung Minh believes that when Ho Chi Minh City becomes a financial center, it will attract large financial institutions such as banks, investment funds, securities companies, insurance companies and fintech from all over the world.

This not only attracts capital but also brings knowledge, technology and modern management experience. In addition, when financial activities take place strongly, it will lead to the development of supporting industries such as legal consulting, information technology and human resource training.

At the same time, the construction of a financial center will create many job opportunities - from financial analysts, risk managers to positions in technology and management. In addition, international joint training programs will develop, improving the quality of local human resources.

To attract foreign investors, according to Mr. Huynh Trung Minh, it is important that the legal environment is transparent and stable.

A financial center that wants to succeed must have a clear legal system that protects property rights and ensures the rights of investors. Therefore, Ho Chi Minh City needs to improve its judicial system to handle disputes quickly and fairly, while protecting customer information and financial data.

District 1 (HCMC) with many banks, securities companies, and banking universities is considered to have many advantages to form an international financial center - Photo: TTD

Infrastructure must be good

Some financial experts recommend that in order to successfully build international financial centers in Ho Chi Minh City and Da Nang, the infrastructure for international financial centers must first be completed.

For example, it is necessary to build class A office buildings, international conference centers, digital banking systems, convenient transportation infrastructure connecting to airports and seaports. Invest heavily in technology to build digital platforms to support fast and safe financial transactions.

In addition, Ho Chi Minh City and Da Nang need to create a comprehensive financial ecosystem, build a developed capital market with diverse products such as stocks, derivative bonds and exchange-traded funds (ETFs). At the same time, they need to learn from successful models such as Singapore, Dubai (UAE), Shanghai and Hong Kong (China).

People must be good, if not have then hire

"To build international financial centers, tax, fee and land incentives are necessary, but the factor that ensures the successful construction of international financial centers is first and foremost good people.

"If there are no truly talented people, city governments must hire people with expertise and prestige to manage international financial centers after they are established," emphasized Professor Dr. Ha Ton Vinh, an international financial expert.

In addition, the team participating in the management and operation committees of international financial centers must be people who are good at finance.

Currently, there are very few Vietnamese people who are good at managing international financial funds, especially those who are good at managing funds and have certificates from international financial funds. When deciding to establish an international financial center, we will do it gradually with the hope that in the next 10-20 years, we will have good experts in managing international financial funds.

Sharing this view, many financial experts also believe that in order to have good people, the first thing the management and operation committees of international financial centers must do is invite international experts, especially experts of Vietnamese origin who are working at many large financial institutions in the world, to work. In parallel with this process, it is necessary to send people for professional training in finance to serve the long-term development of financial centers.

Other opinions suggest that it is necessary to strengthen cooperation with international universities to train human resources in the fields of finance, accounting, information technology and law. Encourage foreign experts to come to work through attractive visa and welfare policies.

Ho Chi Minh City financial center needs to be different to compete

Associate Professor Dr. Nguyen Huu Huan (Ho Chi Minh City University of Economics) said that in order to gain a competitive position with existing financial centers such as Singapore, Hong Kong or Dubai, Ho Chi Minh City needs to create a breakthrough difference instead of just copying the traditional model. One of the pioneering solutions is to build a decentralized stock market (Decentralized Stock Exchange - DSE) applying blockchain technology, helping to improve transparency, security, reduce transaction costs and increase processing speed, creating a superior advantage compared to current financial markets.

To realize this, Ho Chi Minh City needs to implement a roadmap consisting of three main phases:

Phase 1: Focus on completing the legal framework. Specifically, the Government and the State Securities Commission need to build a legal corridor for smart contracts, digital securities and CBDC digital currency (VNDT) and accept strong foreign currencies and popular cryptocurrencies such as Bitcoin to conduct transactions on the blockchain.

Phase 2: Develop a decentralized trading system on the blockchain 4.0 platform, allowing instant and highly secure transaction authentication as well as eliminating traditional intermediaries.

Phase 3: Test run with some stock codes before expanding to the entire market. Building a decentralized stock market not only helps Ho Chi Minh City differentiate itself from other financial centers in the world, but also lays the foundation for a more modern, transparent and efficient financial system.

Source: https://tuoitre.vn/trung-tam-tai-chinh-tp-hcm-da-nang-de-xuat-nhieu-chinh-sach-vuot-troi-20250210081053439.htm

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[Photo] Special flag-raising ceremony to celebrate the 135th birthday of President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/1c5ec80249cc4ef3a5226e366e7e58f1)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)