World oil prices recovered more than 1% as the Middle East continued to "heat up" and China's new moves toward loosening monetary policy.

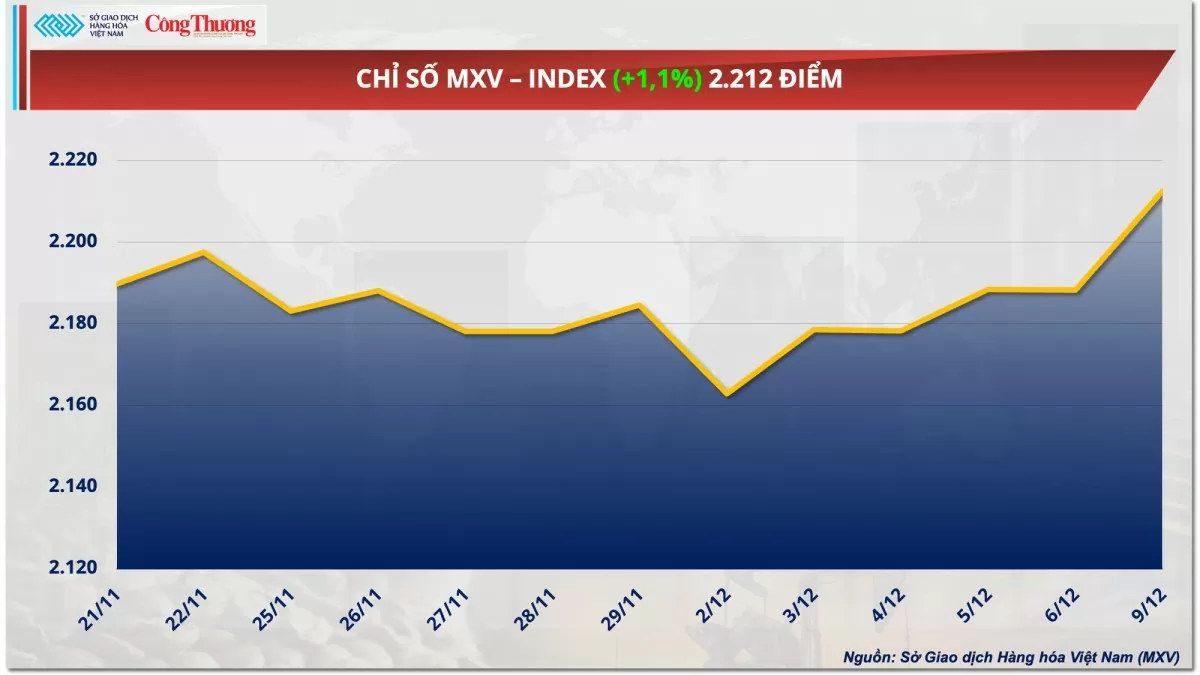

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material price list in yesterday's trading session (December 9). At the close, the MXV-Index increased by 1.1% to 2,212 points. Notably, the energy group led the market's increase when all 5 commodities increased in price in the context of escalating geopolitical tensions and China's recent move to loosen monetary policy. In addition, buying power also dominated the metal market.

|

| MXV-Index |

Oil prices recover

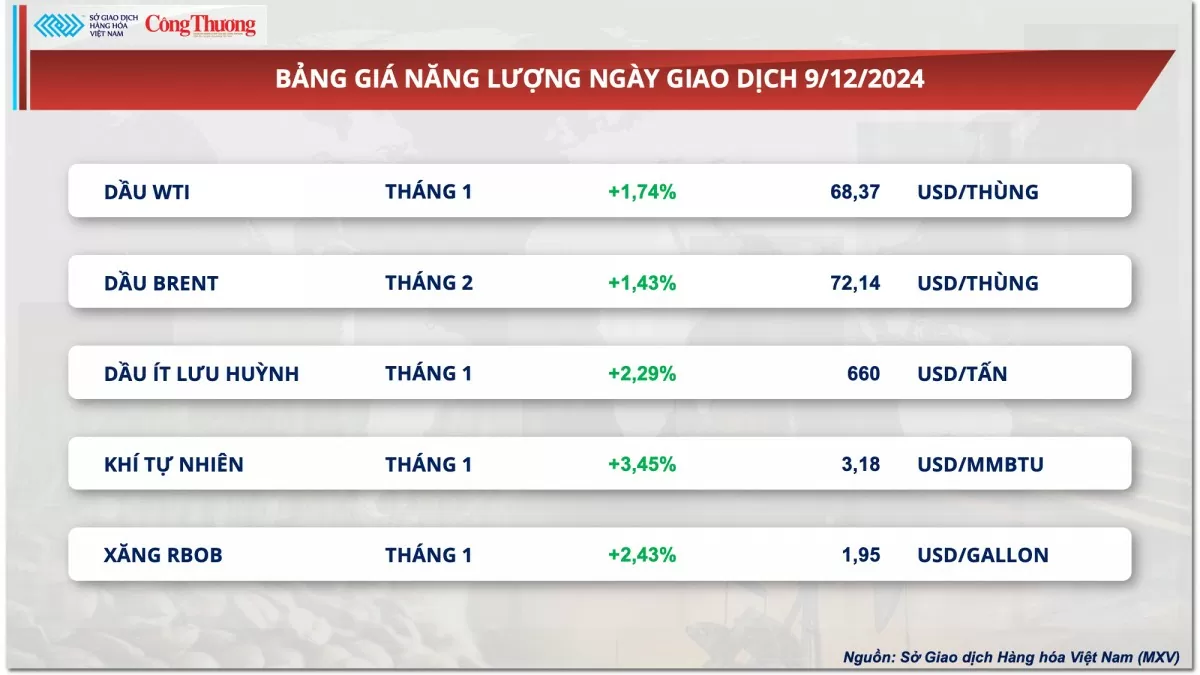

At the end of yesterday's trading session, world oil prices recovered more than 1% in the context of the Middle East continuing to "heat up" and China's new move towards loosening monetary policy.

At the end of the trading session, WTI crude oil price increased by 1.74% to over 68 USD/barrel. Meanwhile, Brent oil price also increased by 1.43% to 72 USD/barrel.

|

| Energy price list |

In the Middle East, Syrian rebels seized the capital Damascus on December 8, marking the end of the regime of President Bashar al-Assad, which was backed by Iran and Russia. Although not a major oil producer, Syria is strategically important, making its instability a major influence on the regional balance of power and the stability of oil flows in the Middle East. Ship tracking data showed early signs of disruption in the oil market, when an Iranian tanker bound for Syria turned around in the Red Sea.

On the demand side, China's Xinhua news agency, citing a summary of a meeting of top officials, reported that the country will adopt a "reasonably loose" monetary policy for the first time in 14 years in 2025. The news has raised market expectations for improved oil demand. China's economic stimulus could also support a surge in commodity prices in the near term, said a senior analyst at Price Futures Group.

Meanwhile, a Reuters survey found that credit demand in China is gradually improving. New loans in November were estimated to have doubled from October to 990 billion yuan ($136 billion), suggesting that the previous $1.4 trillion economic stimulus package is starting to take effect.

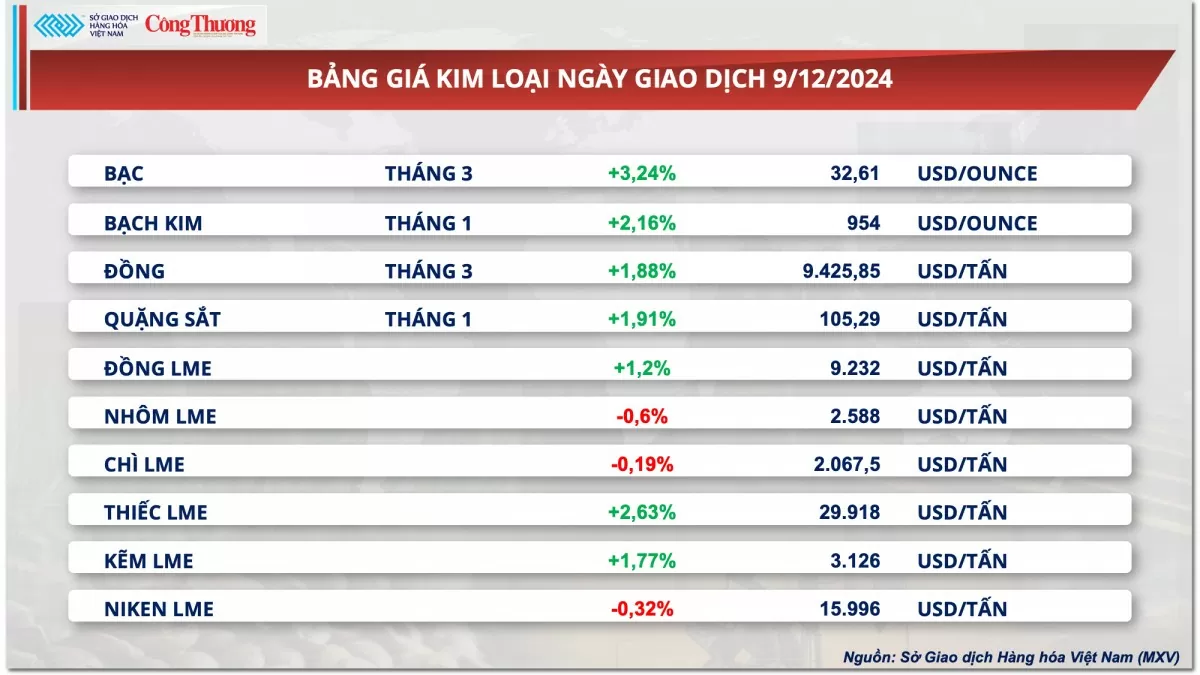

Copper prices hit one-month high

According to MXV, the metal market started the new week with overwhelming green on the price board. For precious metals, silver prices jumped more than 3% to over 32 USD/ounce, the highest level in more than a month. Platinum prices also recovered after three consecutive previous declines, closing at 954 USD/ounce, up 2.16%.

|

| Metal price list |

Precious metals continued to benefit from signs of escalating geopolitical tensions in the Middle East. Silver and platinum, which act as hedges against risk, saw strong buying interest yesterday.

In addition, improved market sentiment after the People’s Bank of China (PBOC) resumed gold purchases after a six-month hiatus also supported the precious metal. Last year, China was the world’s largest official buyer of gold.

For base metals, COMEX copper prices rose nearly 2% to $9,425 a tonne, the highest in about a month. Copper prices fluctuated in the morning session after China announced negative economic data. According to the National Bureau of Statistics of China (NBS), in October, the country's consumer price index (CPI) increased by 0.2% compared to the same period last year, marking the slowest increase in the past 5 months. Notably, compared to the previous month, the CPI decreased by 0.6%, down 0.2 percentage points more than expected and the sharpest decline since March this year.

However, in the early afternoon session, copper prices reversed and increased sharply again, completely erasing the previous decline thanks to China's signal that it would continue to support economic growth.

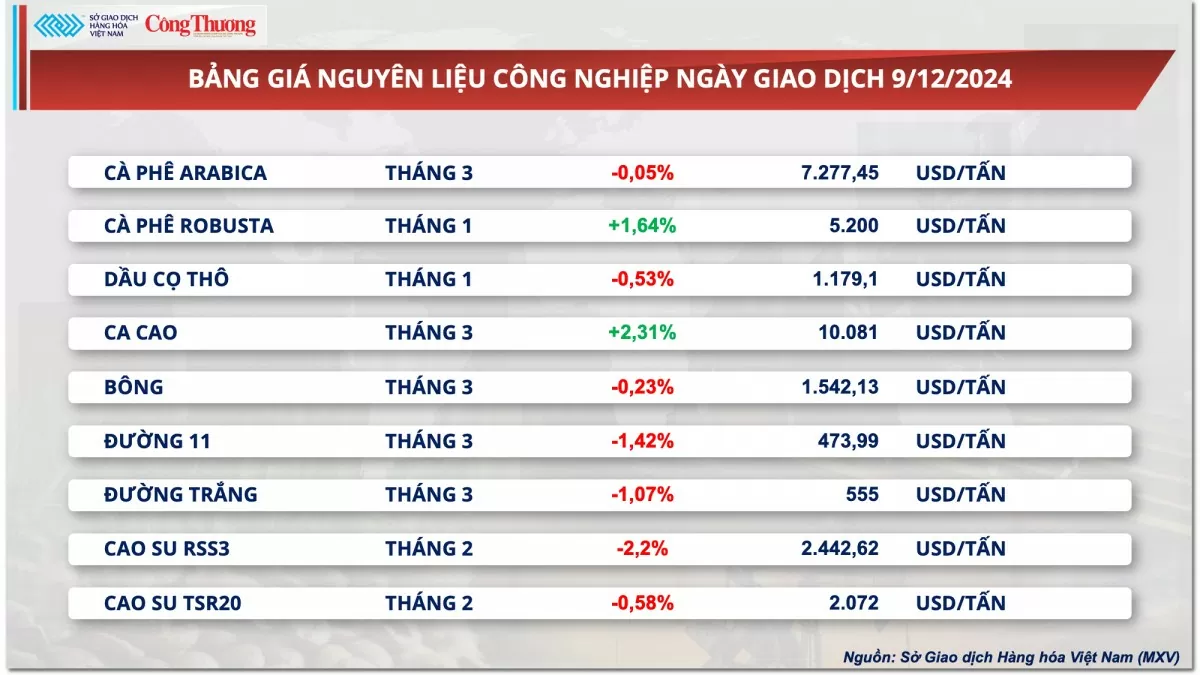

Prices of some other goods

|

| Industrial raw material price list |

|

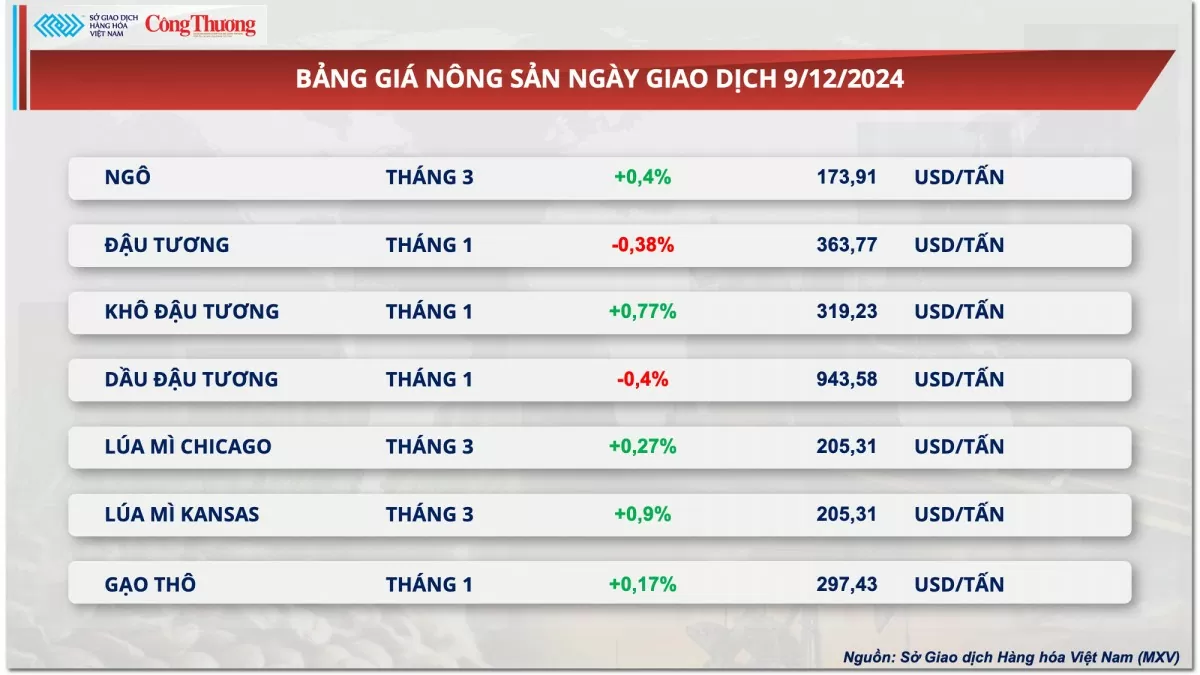

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-1012-trung-dong-tiep-tuc-nong-gia-dau-the-gioi-quay-dau-phuc-hoi-363468.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)