| General Department of Customs improves efficiency in providing online public services General Department of Customs strengthens risk control for enterprises temporarily suspending chemical imports |

Accordingly, the General Department of Customs issued Document No. 4625/TCHQ-GSQL dated September 26, 2024 to the Ministry of Industry and Trade to discuss the content related to the management policy of petroleum products, specifically HFO oil products.

|

| HFO oil is declared by businesses under many names (Illustration: Can Dung) |

The document states: When importing goods, businesses declared them under many different names, specifically:

Refined Oil HFO350 contains over 70% of mineral oil by weight from petroleum origin, belongs to the heavy oil segment, not used as engine fuel (packed in flixibags, imported for sale), 100% new.

Mineral oil is distilled from coal tar, at high temperature (Base oil HFO350). Packed in containers used to store oil, each container contains 19 to 22 tons, 100% new goods.

Base oil preparation (Base oil - 3.0) has a larger aromatic magnetic sphere mass than non-aromatic magnetic sphere mass, has a distillation content of less than 65% at 250 degrees C, used for rubber plasticization and industrial combustion, 100% new product.

High temperature coal tar mineral oil (HFO350-Heavy Fuel Oil), mineral oil content over 70%. Belongs to the heavy oil segment not used as engine fuel, 100% new.

All businesses declare HS code 2710.19.90.

However, in Clause 2, Article 1 of Decree No. 95/2021/ND-CP dated November 1, 2021 amending and supplementing Decree No. 83/2014/ND-CP dated September 3, 2014: "Petroleum is the general name for products of the technological process of distilling and processing crude oil, waste and other raw materials to create products used as fuel. including: gasoline, diesel fuel, kerosene, fuel oil, aviation fuel, biofuel and other products used as fuel, excluding liquefied petroleum gases and compressed natural gas". The detailed list according to HS codes for petroleum is specified in Appendix IV issued with Circular No. 41/2019/TT-BCT dated December 16, 2019 of the Ministry of Industry and Trade.

In comparison with the above provisions, in order to have a basis for handling customs procedures for the above HFO350 oil item to ensure compliance with regulations, the General Department of Customs requests the Ministry of Industry and Trade to comment on whether the HFO oil item as declared by the enterprise at Point 1 above is subject to the regulation of Decree No. 95/2021/ND-CP amending and supplementing Decree No. 83/2014/ND-CP or not? In case the HFO oil item as declared by the enterprise at Point 1 above is subject to the regulation of Decree No. 95/2021/ND-CP, the Ministry of Industry and Trade is requested to amend and supplement the detailed List according to HS codes for gasoline and oil specified in Appendix IV issued with Circular No. 41/2019/TT-BCT in the direction of adding HFO leather goods to the List.

See text details here!

Source: https://congthuong.vn/tong-cuc-hai-quan-de-nghi-bo-cong-thuong-dac-dinh-doi-tuong-dieu-chinh-mat-hang-dau-hfo-348964.html

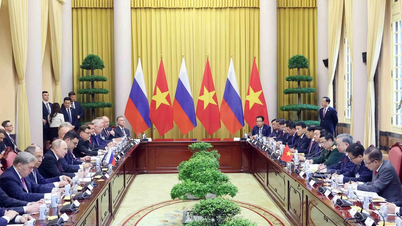

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

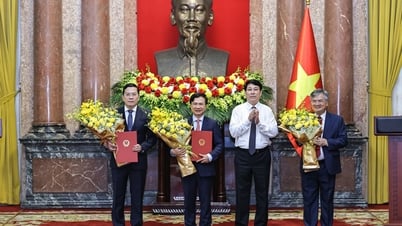

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)