| USD and rising inventories push export coffee prices down Positive signals on supply, export coffee prices recover |

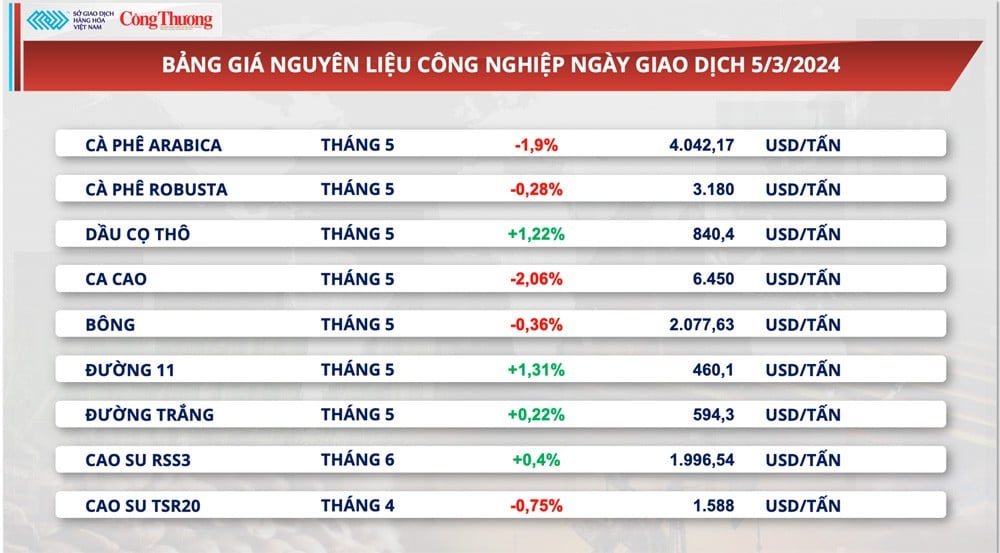

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on March 5, Arabica prices lost 1.9% and Robusta prices decreased 0.28%, ending a three-session streak of consecutive increases. Positive signals on inventory data, combined with the strengthening of the Brazilian Real, created double pressure on Arabica prices.

The stock of certified Arabica on the ICE-US Exchange continues to recover, contributing to strengthening the supply situation in the market. As of the end of the session on March 4, the amount of certified coffee on the ICE Exchange increased by 10,560 60kg bags, bringing the total number of certified bags to nearly 371,110 bags. Along with that, yesterday, the USD/BRL exchange rate recovered 0.25%, stimulating the demand for coffee sales of Brazilian farmers.

|

| Arabica prices lost 1.9% and Robusta prices fell 0.28%, ending a three-session winning streak. |

In addition, coffee supplies from some major exporting countries are also increasing. According to preliminary estimates from the Brazilian Coffee Exporters Association (CECAFE), Brazil's exports of Arabica coffee beans in February 2024 increased by 44% compared to the same period in 2023, reaching 2.97 million bags.

Robusta prices weakened under technical pressure, despite the supply risks still lurking in the market. At the end of the session on March 4, Robusta inventories on the ICE-EU continued to decrease by 120 tons, down to 23,470 tons. Moreover, prolonged hot weather in Vietnam's key coffee growing areas has increased concerns about a poor supply outlook.

Coffee’s rally remains buoyed by supply concerns, a falling dollar, falling inventories and weather in Brazil that saw only 50% of average rainfall last week, threatening 2024/25 coffee production.

In Vietnam, the coffee harvest for the 2023-2024 crop year has almost ended. The output is forecast by the Coffee-Cocoa Association to decrease by 10% compared to the previous crop year to 1.6 million tons. The reason is that the coffee growing area has been narrowed as farmers have shifted to other crops.

Assessing the global coffee supply and demand situation, experts say that the world will not lack or face difficulties with Arabica supply but will have difficulties with Robusta.

Meanwhile, Vietnam has been the world's number 1 producer and supplier of Robusta for many years. The whole world is used to buying Robusta coffee from Vietnam. Roasters around the world have changed their roasting formulas to include a large proportion of Vietnamese Robusta.

Coffee is an integral part of Italian culture. The Italian coffee market is forecast to grow at an average rate of 3.35% per year from 2024 to 2029.

Market research shows that Robusta coffee dominates the coffee market in Italy, with a 56% market share by 2023. Robusta coffee beans have a high caffeine content, making them less acidic and more flavorful. This is considered a great opportunity for Vietnamese coffee exporters.

|

| In February, the average export price of Vietnamese coffee was estimated at 3,276 USD/ton, up 7.4%. |

According to statistics from the European Statistical Office (Eurostat), in 2023, Italy imported 624.61 thousand tons of coffee from non-EU markets, worth nearly 2.1 billion USD, down 4.2% in volume and 8.2% in value compared to 2022.

Of which, coffee imports from Vietnam reached 150.13 thousand tons, worth 345.38 million USD, down 0.5% in volume and 1.2% in value compared to 2022. However, Vietnam's coffee market share in Italy's total imports from the non-EU market increased from 23.13% in 2022 to 24.04% in 2023.

In 2023, Italy imported 198.37 thousand tons of coffee from Brazil, worth 727.31 million USD, down 0.8% in volume and 10.1% in value compared to 2022. The market share of Brazilian coffee in Italy's total imports from the non-EU market increased from 30.65% in 2022 to 31.76% in 2023.

In the future, Brazil and Vietnam are expected to remain the two main sources of coffee for Italy.

Source

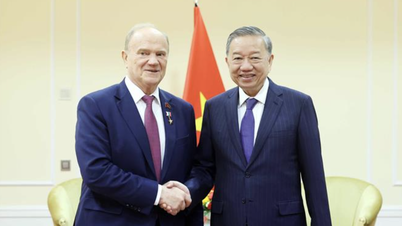

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

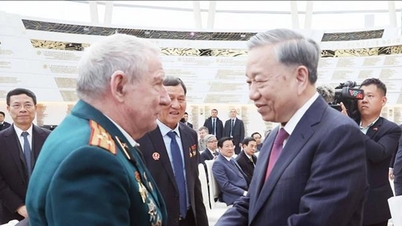

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)