TikTok - the global short video platform owned by ByteDance, aims to increase the size of its e-commerce business Tiktok Shop by 10 times with an estimated value of up to 17.5 billion USD in 2024. This poses a greater threat to the e-commerce platform Amazon.com.

The 2024 volume target for the U.S. version of TikTok Shop has been discussed in internal meetings in recent weeks and could still change depending on how the business performs, according to sources.

TikTok’s ambitious goal puts it on a collision course not just with Amazon but also with Chinese-owned discount retailers Temu and Shein, which are making big inroads with young shoppers in the U.S. Unlike its two rivals, TikTok is relying on its social media reach and the appeal of viral videos to attract shoppers.

|

| TikTok Shop aims for $17.5 billion e-commerce platform |

Additionally, TikTok is on track to generate around $20 billion in global gross merchandise value by 2023, with Southeast Asia contributing the bulk of revenue through the platform. The company is now looking to expand sales across the U.S. and Latin America, where it plans to launch e-commerce in the coming months, experts said.

Meanwhile, parent company ByteDance, founded more than a decade ago by Zhang Yiming and Liang Rubo, has grown into a $200 billion-plus internet leader thanks to the virality of its short-video platform TikTok and its Chinese version Douyin. TikTok Shop is one of the fastest-growing features for the Beijing-based company, which is looking for new growth drivers beyond social media advertising. ByteDance’s revenue is set to rise about 30% in 2023 to more than $110 billion, outpacing the projected growth of its long-time media rivals Meta Platforms and Tencent Holdings.

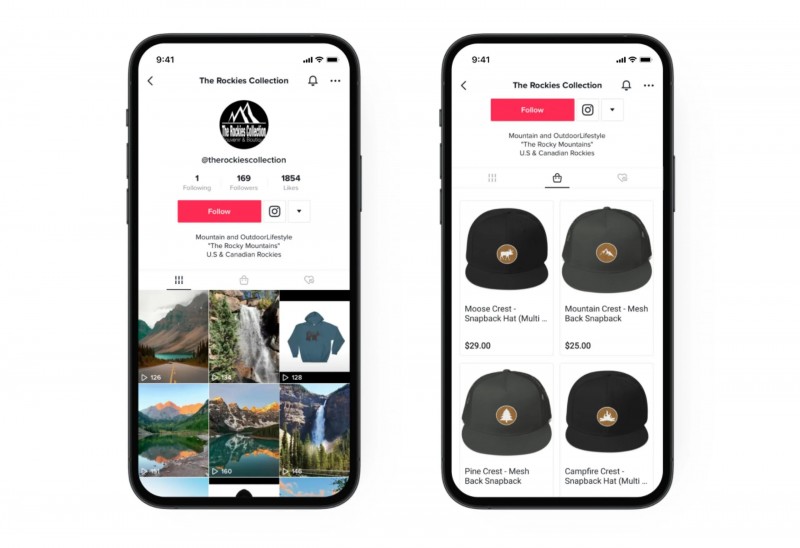

More specifically, TikTok Shop lets users buy items while scrolling through a permanent feed of short videos and live streams within its main social media app. The hope is that consumers will use it as an alternative to Amazon or Sea's Shop. This entertainment-cum-ecommerce format combines shopping on Amazon with the product discovery capabilities offered by apps like Meta's Instagram. This approach has helped Douyin capture a significant portion of Chinese consumer spending from Alibaba Group Holding and JD.com, especially after lockdowns during this time. The pandemic has also caused people to spend more time online.

ByteDance intends to take its e-commerce model global. In the United States, TikTok is offering free shipping to influencers who sell gadgets, clothing, and makeup in videos or livestreams. The company also said that in November, more than 5 million new customers in the U.S. spent on TikTok Shop, boosted by Black Friday and Cyber Monday deals. The platform now has about 150 million users in the country.

|

| TikTok Shop Interface |

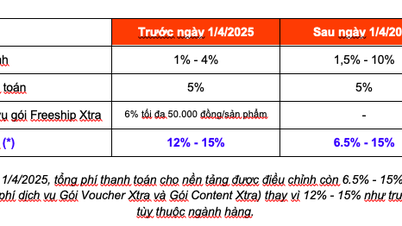

On January 3, TikTok announced that it would increase its seller fees to 6% on products sold starting in April and to 8% in July for most product categories, marking the end of promotions that used to entice sellers. That commission is still significantly lower than the fees sellers face on Amazon, which typically hover around 15%, but the boost signals that TikTok is rapidly shifting to generating revenue from its e-commerce platform.

Meanwhile, Americans are increasingly shopping on Chinese e-commerce apps, including popular fashion site Shein and PDD Holdings' Temu, which has grown in popularity since airing a Super Bowl ad in February 2023.

Separately, in Indonesia, TikTok took control of GoTo Group’s e-commerce unit Tokopedia in a $1.5 billion deal, allowing the company to relaunch its online retail service after months of scrutiny from local authorities.

It is not yet clear what sales targets TikTok Shop is aiming for globally or for other markets.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference to promote public investment growth momentum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/7d1fac1aef9d4002a09ee8fa7e0fc5c5)

Comment (0)