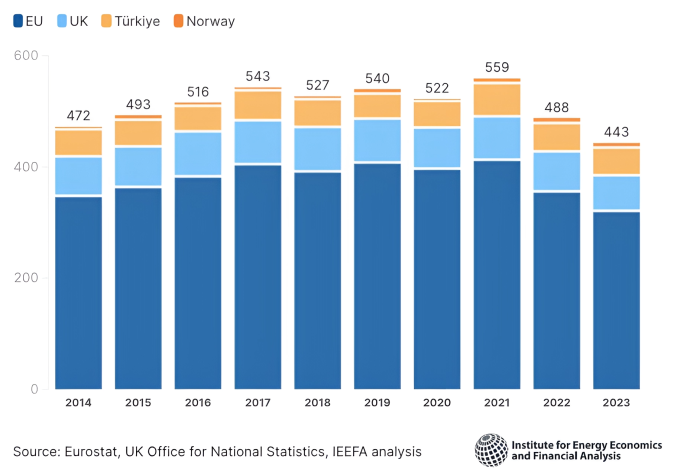

Europe's gas consumption in 2023 fell to a 10-year low of 433 billion cubic metres.

A report by the Institute for Energy Economics and Financial Analysis (IEEFA) based in New York (USA) also said that since the conflict in Ukraine broke out, gas demand in Europe has decreased by 20%. Consumption decreased mainly in Germany, Italy and the UK.

Ana Maria Jaller-Makarewicz, European energy analyst at IEEFA, said the region's energy system was more diverse and resilient after two years of conflict.

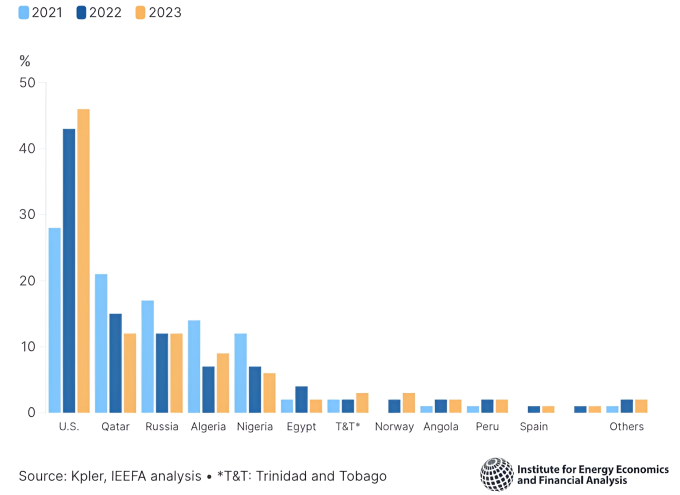

Specifically, in 2021, 41% of the European Union's (EU) gas imports came from Russian pipelines, 40% from other pipelines and 19% from liquefied natural gas (LNG). But last year, 41% of gas imports were from LNG sources.

European gas consumption (billion m3). Including European Union (dark blue), UK (light blue), Turkey (yellow), Norway (orange). Source: IEEFA

"The energy crisis is somewhat under control. Increased efficiency measures and rapid deployment of renewables and heat pumps are enabling the continent to reduce its gas demand," Ana explained. IEEFA forecasts that if current policies and programs are maintained, Europe's gas demand will fall below 400 billion cubic metres by 2030.

Over the past two years, in order to quickly reduce dependence on Russian gas, Europe has accelerated the construction of LNG terminals. Eight LNG import terminals have been operational since February 2022, adding 53.5 billion m3 of new regasification capacity. Another 13 projects will be operational by 2030, tripling current LNG import capacity, exceeding the bloc's demand by the end of this decade.

Structure of LNG supplies to Europe. Source: IEEFA

After increasing its LNG import capacity, Europe buys from three main sources: the US, Qatar and Russia. The US supplied more than 45% of the continent's LNG imports last year. "After risking its energy security by relying too much on one source, Europe must learn from past mistakes and avoid becoming overly dependent on the US, which supplied nearly half of its LNG imports last year," said Ana.

In addition, Europe’s success in cutting imports of Russian pipeline gas contrasts with growing exports of Russian LNG. Russian LNG exports to Europe increased by 11% in 2021-2023, with volumes to Spain doubling and Belgium more than tripling. Turkey and Greece began importing Russian LNG in 2022. By 2023, Spain, France and Belgium accounted for 80% of Europe’s total LNG imports from Russia.

Phien An

Source link

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)