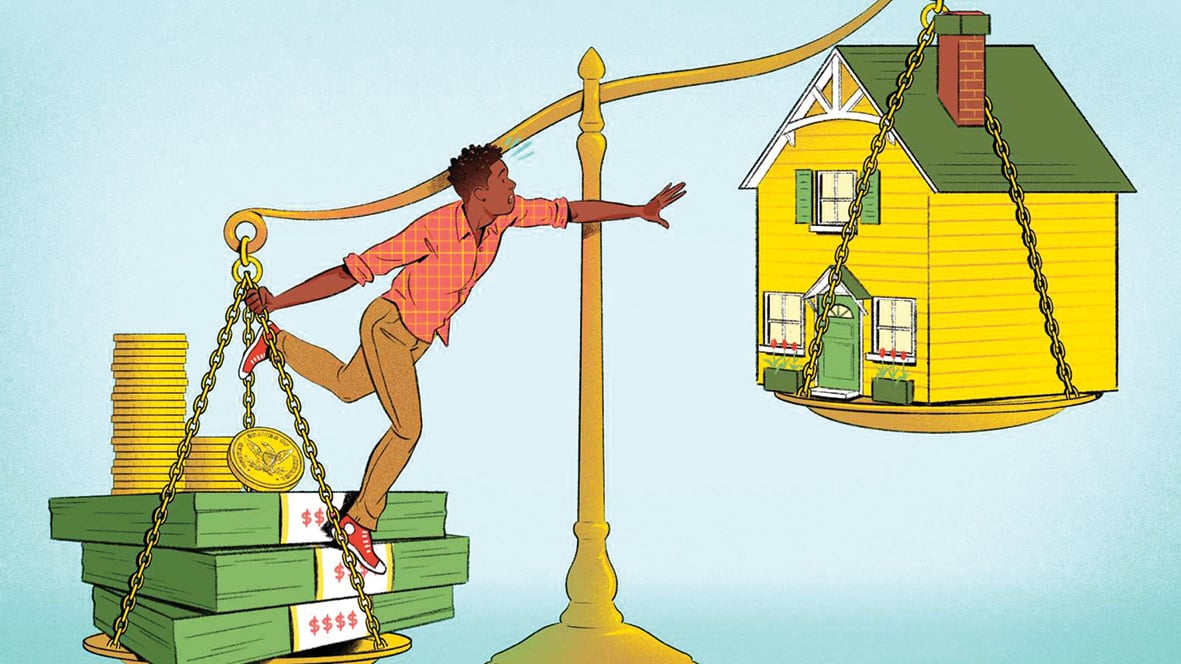

The figure of 26 years of savings needed to buy a 60m² apartment, as calculated by a real estate website, is only theoretical.

Photo: Money.com

Owning a house in Hanoi , Ho Chi Minh City or other big cities is not simple nowadays, for many different reasons.

According to the survey results of batdongsan.com.vn recently published, young people nowadays face many difficulties in buying a house on their own.

In 2024, with an average GDP per capita of about 9.5 million VND/month, a young person born in the 90s needs to work and save for 25.8 years to buy an apartment of about 60 square meters , priced at about 3 billion VND, under the condition of a mobilization interest rate of 4.5%.

The Big Challenge for Every Generation: Buying a Home

First of all, the rate of increase in real estate prices has always far exceeded the increase in average income, which has become a trend for many years. In the 20 years from 2004 to 2024, housing prices in Vietnam increased more than five times, while income increased only about three times.

In Ho Chi Minh City, apartment prices currently range from 40 to 60 million VND/m2, even 100 million VND/m2. This means that an apartment with a minimum area of about 60m2 costs 2.5 billion VND or more.

But in reality, apartments priced at 40 million VND/m² are becoming rare.

With an average salary of 9.5 million VND/month as reported by the average GDP, owning a house is certainly unimaginable for many workers.

Buying a home has become a big challenge for all generations, especially in big cities where living expenses always take up a large part of people's income.

Fixed expenses such as rent, food, education and transportation consume 70-80% of many people's monthly income. At the same time, other expenses such as health care further reduce the ability to save.

Meanwhile, the home loan support policy is still not attractive enough. Current loan interest rates are still a big burden for workers.

Many people give up on their dream of buying a home because it is nearly impossible to save enough to buy a home or pay off the principal and interest on the bank loan.

Real estate speculation, pushing up housing prices, is also the reason why it is difficult for workers to reach their dream of owning a house, especially in big cities, and is one of the reasons that distorts the market.

Furthermore, the structure of real estate supply is also seriously unbalanced when affordable apartments, low-cost apartments, and social housing almost disappear, giving way to the proliferation of high-end projects serving the high-income class or investors.

Gone are the days of "settling down and making a living"?

For many people, owning a house has long been a symbol of stability and success, with the thought of settling down. But is this concept no longer appropriate given the reality of housing prices being too high compared to income?

Long-term rental is becoming a more reasonable choice for some people, especially young people, when considering the pros and cons in the current context.

First, the monthly rental cost is much lower than the mortgage payment when buying a house.

This helps workers maintain a better standard of living by allowing them to spend money on more fundamental investments such as education and personal development.

Second, renting offers flexibility in an age where job or residence changes are becoming more frequent.

According to Euronews , Switzerland and Germany have a fairly high rental rate, accounting for more than half of the population, due to transparent and stable rental market support and management policies.

The German government provides a legal system to protect tenants, including strict regulations on rents, contract lengths and living conditions, giving tenants peace of mind about their long-term accommodation.

In addition to improving the rental system, specific policies are needed to help expand equitable access to housing.

First of all, everyone sees the need to strictly control speculation and increase transparency in real estate transactions.

Applying a scientific and reasonable real estate tax not only helps reduce speculation but also increases budget revenue to have a source of investment in social housing.

The development of the affordable apartment segment should be encouraged through preferential loan support packages for real estate developers. This will help increase the supply of housing that meets the needs and affordability of the majority of workers.

In addition, it is necessary to develop programs to support first-time homebuyers. The United States has the Federal Housing Administration (FHA) which allows first-time homebuyers to borrow at low interest rates and requires equity of only 3-5% of the home value.

A similar program in our country would certainly reduce financial pressure on young people and push them closer to their dream of home ownership.

And as mentioned, changing the concept of home ownership is an essential factor. In developed economies, renting is no longer considered a secondary option, but has become part of the modern lifestyle.

Can Vietnam build a balanced housing market where everyone can comfortably choose between renting and buying, depending on their needs, personal circumstances and financial capabilities?

Solve the housing problem for everyone to have the opportunity, so that everyone has the opportunity to access suitable housing....

Bold reforms to housing policy so that every generation can access the dream of homeownership, without compromising financial risk or quality of life.

Source: https://tuoitre.vn/tich-cop-26-nam-moi-du-tien-mua-nha-da-qua-roi-thoi-an-cu-lac-nghiep-20241209075929357.htm

Comment (0)