FIT's replacement at the giant project Cap Padaran Mui Dinh

FIT Group Corporation recently announced the divestment of its capital from Cap Padaran Mui Dinh Real Estate JSC - the investor of the Cap Padaran Mui Dinh project. The transfer transaction procedures were officially completed on September 9. Previously, on July 29, FIT's 2023 Annual General Meeting of Shareholders (AGM) approved this transfer plan.

Perspective of Cap Padaran Mui Dinh project. Source: TL

Cap Padaran Mui Dinh is one of the large-scale projects with an area of nearly 800 hectares. The goal is to develop it into an international-class resort, with many functional areas including 17,000 hotel rooms; coral resorts, mountain villas, hotel apartment complexes, entertainment and sports, dynamic sand dunes - one of the promoted features that no other resort tourism project has.

Phase 1 of Bai Trang resort construction covers an area of nearly 64 hectares, including a 5-star international hotel, resort villas and infrastructure, with a total investment of about 3,000 billion VND. Expected to be put into operation in 2024.

Cap Padaran Mui Dinh, formerly Mui Dinh Ecopark Company Limited, was established in June 2016 with the main business of short-term accommodation services. The company had an initial charter capital of 10 billion VND, with Mr. Nguyen Duc Chi and Mr. Le Minh Ha each contributing 50%.

By August 2016, the Company changed its name to Mui Dinh Ecopark JSC and increased its capital to VND368 billion, of which Crystal Bay JSC held 47.3%, KD Investment JSC held 50% and Mr. Chi only owned 2.7%. From July 2019, Mr. Nguyen Van Sang assumed the position of Chairman of the Board of Directors, Mr. Chi became Vice Chairman of the Board of Directors, Mr. Tuan became General Director and all three were legal representatives of the company.

By November 2022, the Company changed its name to Cap Padaran Mui Dinh Joint Stock Company, Ms. Nguyen Thi Nga sat in the General Director position and together with Mr. Chi and Mr. Tuan were the legal representatives. After FIT planned to divest, the company changed the Chairman of the Board of Directors and the legal representative of Mui Dinh to Mr. Thang Van Luong.

Continuous losses, negative equity

Mr. Thang Van Luong - the husband of actress Mai Thu Huyen, is one of the famous businessmen in the market. The ecosystem under Mr. Luong's leadership includes: Thang Long Investment and Trading Group Joint Stock Company (Tincom Group), Thang Long Brewery Joint Stock Company, VT Construction and Trading Joint Stock Company, TVL Vietnam Company Limited, Bahamas Financial Investment and Asset Management Joint Stock Company, Tincomcity Project Joint Stock Company, Tincom Real Estate Joint Stock Company...

The core of the ecosystem is Tincom Group, founded in 2003 with Mr. Luong as Chairman of the Board of Directors. The company is the investor of many large projects in Hanoi such as Tincom Phap Van, Tincom Point, Hanoi Paragon, Imperial Plaza 360 Giai Phong with a "not-so-small" asset size.

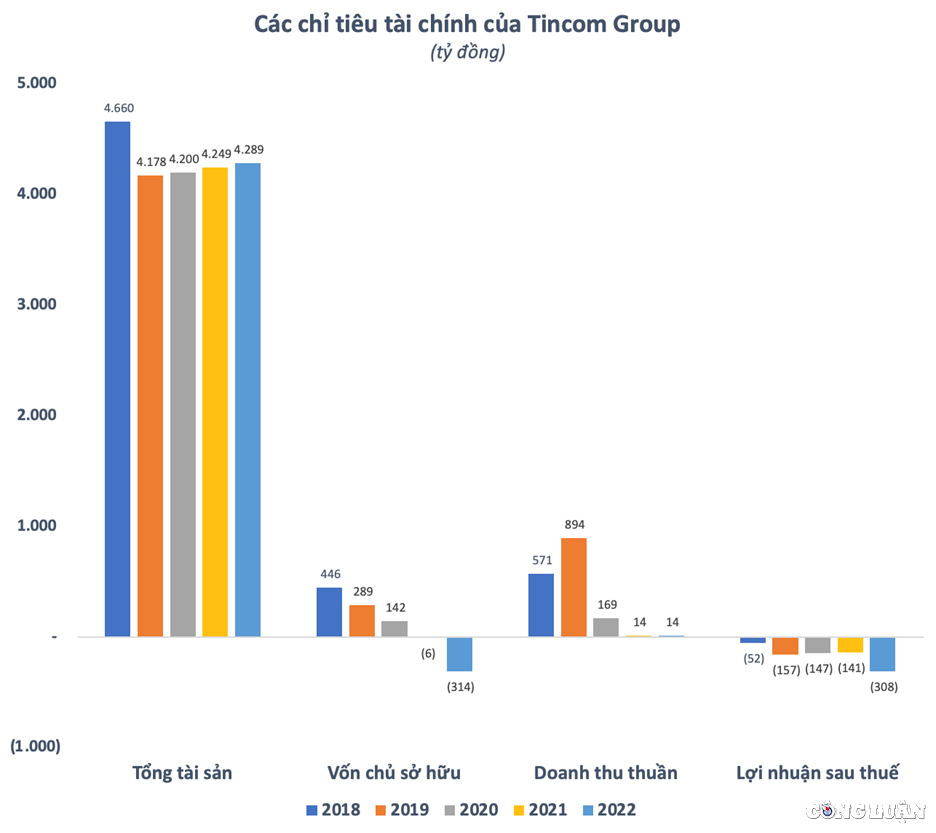

By the end of 2022, Tincom Group's total assets reached nearly VND4,300 billion, the highest level in 4 years but still lower than the end of 2018. However, it is worth noting that the company's equity was negative at VND314 billion. Total liabilities even exceeded assets, with the balance as of December 31, 2022 reaching more than VND4,600 billion. In fact, the situation of living on debt capital has lasted for many years for Tincom Group.

The “dismal” business situation with continuous losses has eroded Tincom Group’s equity. After peaking in 2019, the company’s revenue has plummeted and by 2022 it had only reached nearly 14 billion VND. The huge cost caused the company of tycoon Thang Van Luong to lose a heavy 308 billion VND.

Not only is the business going downhill, the Tincom group is also entangled in many bad debts at banks. In March this year, Ocean Commercial Limited Liability Bank (OceanBank) auctioned the bad debts of the Tincom group for the second time. The starting price was nearly 1,345 billion VND, the total bad debt is known to be 1,662 billion VND.

Previously in 2021, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) also auctioned Tincom Group's bad debt for the second time with a starting price of over VND 149 billion. The value of bad debt as of October 21, 2020 was VND 164 billion.

Source

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

Comment (0)