Building a financial multi-level business model, what tricks does GFDI Company use to circumvent the law and avoid authorities?

GFDI staff (in white shirt) gives investment advice to a customer at a coffee shop before the company went bankrupt - Photo: TRUONG TRUNG

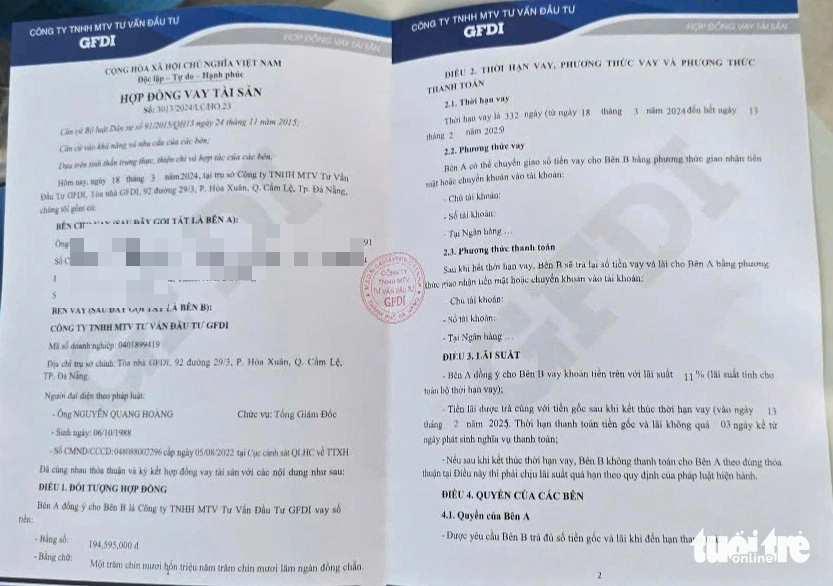

Avoid being charged high interest rates

Established in 2018 and building a business model of borrowing money from later people and paying interest to earlier people, GFDI Investment Consulting LLC has used many tricks to avoid detection.

During the "peak" phase of capital mobilization, there was a time when this company paid interest equivalent to 48% per year. After a while, when customers were attached to the company, the contracts were often extended in maturity and the interest rate was proactively reduced.

Mr. T. - a customer who deposited 200 million in this company before the company went bankrupt - said that in some contracts, the company did not provide an interest rate but instead stated the amount the customer would receive when the contract expired.

This way many customers wait patiently for the due date to receive a large sum of money.

In particular, when it was "thirsty for capital" to pay customers who had to pay before the collapse, this company continued to mobilize capital to pay sky-high interest rates, and at the same time gave gifts of new iPhone models to early investors.

Speaking with Tuoi Tre Online , lawyer Nguyen Anh Tuan, Da Nang City Bar Association, said that GFDI has very sophisticatedly legalized legal loopholes in the management and supervision of companies that raise capital with contracts in many forms of concealment.

According to Mr. Tuan, the current average interest rate on commercial bank deposits is from 3.5 - 7%/year, even in previous years it was as high as double digits, which is within the regulation that loan interest rates cannot exceed 20% according to Article 468 of the 2015 Civil Code.

To avoid raising capital at high interest rates, they also record interest in the principal, making lenders more confident.

"Although unusual, we must blame investors for being too greedy," said lawyer Anh Tuan.

GFDI loan contract signed with customers - Photo: TRUONG TRUNG

Need a control and early warning role?

From a legal perspective, lawyer Anh Tuan said that raising capital through similar asset loan contracts of GFDI has many potential risks.

The regulations on loan interest are specified in Article 468 of the 2015 Civil Code. Meanwhile, according to the provisions of the 2020 Enterprise Law, an enterprise can call for investment but must ensure information transparency and have a financially feasible plan.

In the case of GFDI mobilizing capital at interest rates exceeding the company's payment capacity, this model is not considered a safe investment but has many potential risks, especially when there are signs of abusing people's trust.

To circumvent the provisions of Article 468 of the 2015 Civil Code, some companies use "asset loan contracts" as a form of capital mobilization. This makes it difficult to control companies offering unusual interest rates.

Another gap is the lack of oversight over the legality of financial business models.

For example, companies can register their business as "investment consultants" but carry out capital mobilization activities with high interest rate commitments without control from authorities.

GFDI's magnificent headquarters in Hoa Xuan ward, Cam Le district, Da Nang - Photo: TRUONG TRUNG

With "asset loan contracts" and timely payments, GFDI successfully fooled customers and authorities until it defaulted on more than VND3,700 billion in debt, even though the company only had a charter capital of VND80 billion.

Beware of falling into traps when investing in high interest rate capital

Beware of falling into traps when investing in high interest rate capitalSource: https://tuoitre.vn/thu-thuat-vay-tai-san-va-bien-hinh-lai-suat-cua-da-cap-tai-chinh-gfdi-20241112122654221.htm

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)