The Governor of the State Bank said that recently, gold prices have fluctuated strongly in line with world gold prices. The State Bank has intervened in the gold market through bidding and direct sales of gold bars to supplement supply.

Intervene in the gold market through bidding

Governor State Bank (NHNN) Nguyen Thi Hong has reported to National Assembly delegates on a number of contents related to the group of questions at the 8th session.

Governor of the State Bank Nguyen Thi Hong.

According to the Governor, in the coming time, the State Bank will continue to implement many solutions. In particular, to continue implementing the Prime Minister 's instructions, on the basis of the intervention situation in the past time, based on the regulations law Currently, the State Bank will consider intervening in the gold market if necessary with appropriate volume and frequency to stabilize the market and monetary policy goals.

Along with that, coordinate with ministries and branches to inspect and examine the activities of gold trading enterprises, stores, distribution agents and gold bar trading...

Conduct a full review of the implementation of Decree 24/2012, propose amendments and supplements in accordance with the practical situation, contribute to preventing the gold-ization of the economy, and avoid fluctuations. gold price affecting exchange rates, inflation and macroeconomic stability.

According to the Governor, recently, gold prices have fluctuated strongly in the same direction as gold prices. world. At the morning of November 5, the price of SJC gold bars was traded at 87/89 million VND/tael, an increase of 13.5 million VND/tael (about 18%) compared to the beginning of 2024.

From the beginning of 2024 to June, the gap between domestic and world gold prices widened, especially for SJC gold bars. The price difference between SJC gold bars and world gold prices at times reached up to 18 million VND/tael (May).

Fluctuations in domestic gold prices basically depend on developments in world gold prices and supply-demand relations in the market. Specifically, on the supply side, from 2014 to 2023, the State Bank will not increase the supply of SJC gold bars to the market.

From April 2024 to present, facing the strong increase in world gold prices and public concern, the Government and the Prime Minister have directed drastic measures to reduce the difference in domestic and international gold prices.

The State Bank intervenes in the gold market through bidding and direct sales of gold bars to supplement the supply of SJC gold bars to the market, limiting the impact on the macro economy, currency, and foreign exchange.

On the demand side, the world gold price has continuously increased, along with the difficulties of other investment channels (frozen real estate, gloomy corporate bond market, low bank deposit interest rates...) making gold more attractive.

From the beginning of 2024 to June, the gap between domestic and world gold prices widened.

However, according to the Governor, through monitoring by units in the system, the demand for gold buying is mainly concentrated in two major areas, Hanoi and Ho Chi Minh City, and has psychological and expectation factors.

In addition, it is not possible to rule out the existence of market manipulation, violations of relevant regulations of the law on tax, competition... leading to a high difference between domestic gold prices (especially SJC gold) and world prices.

Difficult to further reduce interest rates

Reporting on interest rates, the Governor also said that the decrease in inflation is not sustainable and there is a risk of upward pressure in the context of the large openness of the Vietnamese economy. Therefore, the State Bank believes that implementing the policy of continuing to reduce interest rates in the coming time will be very difficult.

According to the report, the interest rate level will decrease by about 2.5% in 2023 and continue to decrease in the first 10 months of 2024.

The reason is that lending interest rates have been on a downward trend recently. In addition, the demand for credit capital is continuing to increase, which will put pressure on interest rates in the coming time.

In addition, exchange rate pressure from the international market causes the reduction of domestic VND interest rates to increase pressure on the domestic exchange rate and foreign exchange market.

According to the State Bank, the pressure on capital supply from the credit institution system to the economy is still large, including medium and long-term capital in the context of capital mobilization from the corporate bond and securities markets facing many difficulties.

"This poses a large term and liquidity risk for the banking system mobilizing short-term deposits for medium and long-term loans," the report stated.

Besides, this agency assessed that the credit absorption capacity of businesses and people is still low.

Source: https://www.baogiaothong.vn/thong-doc-ngan-hang-nha-nuoc-noi-ve-gia-vang-tang-manh-thoi-gian-qua-192241107173916033.htm

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

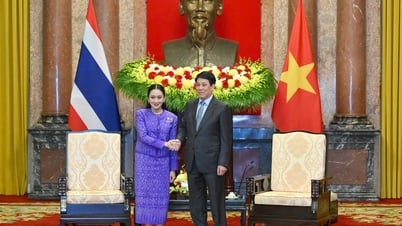

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)