Update gold price today April 22, 2025 latest in domestic market

At the time of survey at 3:30 p.m. on April 22, 2025, the domestic gold price today, April 22, 2025, increased sharply, bringing SJC gold bars, gold rings and gold jewelry to a new record level. At the end of the gold price session on April 22, 2025, major brands such as PNJ, DOJI, SJC, Bao Tin Minh Chau, Phu Quy and Mi Hong recorded significant price increases, reflecting the heat from the international market, where the gold price reached 3,500 USD/ounce.

PNJ Company listed the gold price today, April 22, 2025, for SJC gold bars in Ho Chi Minh City, Hanoi, Da Nang, the West and the Southeast at 122.0-124.0 million VND/tael, an increase of 6.0 million VND/tael in both directions. PNJ gold price reached 117.0-120.0 million VND/tael, an increase of 3.5 million VND/tael (buy) and 3.1 million VND/tael (sell). 999.9 jewelry gold, plain rings of PNJ, Kim Bao, Phuc Loc Tai recorded 117.0-120.0 million VND/tael, an increase of 3.5 million and 3.1 million VND/tael. 750 gold (18K) reached 82.28-89.78 million VND/tael, an increase of 2.63 million VND/tael; 585 gold (14K) at 62.56-70.06 million VND/tael, up 2.05 million VND/tael.

DOJI Group announced SJC gold bars at 122.0-124.0 million VND/tael, up 6.0 million VND/tael in both directions. 9999 gold material reached 117.0-118.1 million VND/tael, up 3.7 million and 2.0 million VND/tael. SJC Company listed SJC gold bars at 122.0-124.0 million VND/tael, up 6.0 million VND/tael. SJC 99.99% gold rings reached 116.5-119.5 million VND/tael, up 3.5 million VND/tael. Bao Tin Minh Chau announced SJC gold bars at 120.5-122.5 million VND/tael, up 4.5 million VND/tael. Phu Quy listed 120.0-123.0 million VND/tael, up 4.5 million and 5.0 million VND/tael. Mi Hong remained unchanged at 111.0-113.5 million VND/tael.

At the end of the gold price session on April 22, 2025, the domestic gold market made a strong breakthrough, reflecting the positive sentiment of investors in the face of international fluctuations. Today's gold price on April 22, 2025 increased simultaneously, encouraging investors to closely monitor to seize opportunities.

The latest gold price update table today, April 22, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 122.0 | ▲6000 | 124.0 | ▲6000 |

| DOJI Group | 122.0 | ▲6000 | 124.0 | ▲6000 |

| Red Eyelashes | 111.0 | - | 113.5 | - |

| PNJ | 117.0 | ▲3500 | 120.0 | ▲3100 |

| Vietinbank Gold | 124.0 | ▲6000 | ||

| Bao Tin Minh Chau | 120.5 | ▲4500 | 122.5 | ▲4500 |

| Phu Quy | 120.0 | ▲4500 | 123.0 | ▲5000 |

| 1. DOJI - Updated: April 22, 2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 122,000 ▲6000 | 124,000 ▲6000 |

| AVPL/SJC HCM | 122,000 ▲6000 | 124,000 ▲6000 |

| AVPL/SJC DN | 122,000 ▲6000 | 124,000 ▲6000 |

| Raw material 9999 - HN | 117,000 ▲3700 | 118,100 ▲2000 |

| Raw material 999 - HN | 116,900 ▲3700 | 118,090 ▲2090 |

| 2. PNJ - Updated: April 22, 2025 15:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| HCMC - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Hanoi - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Hanoi - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Da Nang - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Da Nang - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Western Region - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Western Region - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - Southeast PNJ | 117,000 ▲3500K | |

| Jewelry gold price - Southeast SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - PNJ 999.9 Plain Ring | 117,000 ▲3500K | |

| Jewelry gold price - Kim Bao Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Jewelry gold 999.9 | 117,000 ▲3500K | 119,500 ▲3500K |

| Jewelry gold price - Jewelry gold 999 | 116,880 ▲3500K | 119,380 ▲3500K |

| Jewelry gold price - Jewelry gold 9920 | 116,140 ▲3470K | 118,640 ▲3470K |

| Jewelry gold price - Jewelry gold 99 | 115,910 ▲3470K | 118,410 ▲3470K |

| Jewelry gold price - 750 gold (18K) | 82,280 ▲2630K | 89,780 ▲2630K |

| Jewelry gold price - 585 gold (14K) | 62,560 ▲2050K | 70,060 ▲2050K |

| Jewelry gold price - 416 gold (10K) | 42,360 ▲1450K | 49,860 ▲1450K |

| Jewelry gold price - 916 gold (22K) | 107,060 ▲3200K | 109,560 ▲3200K |

| Jewelry gold price - 610 gold (14.6K) | 65,550 ▲2140K | 73,050 ▲2140K |

| Jewelry gold price - 650 gold (15.6K) | 70,330 ▲2280K | 77,830 ▲2280K |

| Jewelry gold price - 680 gold (16.3K) | 73,910 ▲2380K | 81,410 ▲2380K |

| Jewelry gold price - 375 gold (9K) | 37,460 ▲1310K | 44,960 ▲1310K |

| Jewelry gold price - 333 gold (8K) | 32,090 ▲1160K | 39,590 ▲1160K |

| 3. SJC - Updated: 04/22/2025 15:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,000 ▲6000K | 124,000 ▲6000K |

| SJC gold 5 chi | 122,000 ▲6000K | 124,020 ▲6000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,000 ▲6000K | 124,030 ▲6000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500 ▲3500K | 119,500 ▲3500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500 ▲3500K | 119,600 ▲3500K |

| Jewelry 99.99% | 116,500 ▲3500K | 118,900 ▲3500K |

| Jewelry 99% | 112,227 ▲3965K | 117,227 ▲3465K |

| Jewelry 68% | 75,010 ▲2380K | 81,010 ▲2380K |

| Jewelry 41.7% | 43,736 ▲1459K | 49,736 ▲1459K |

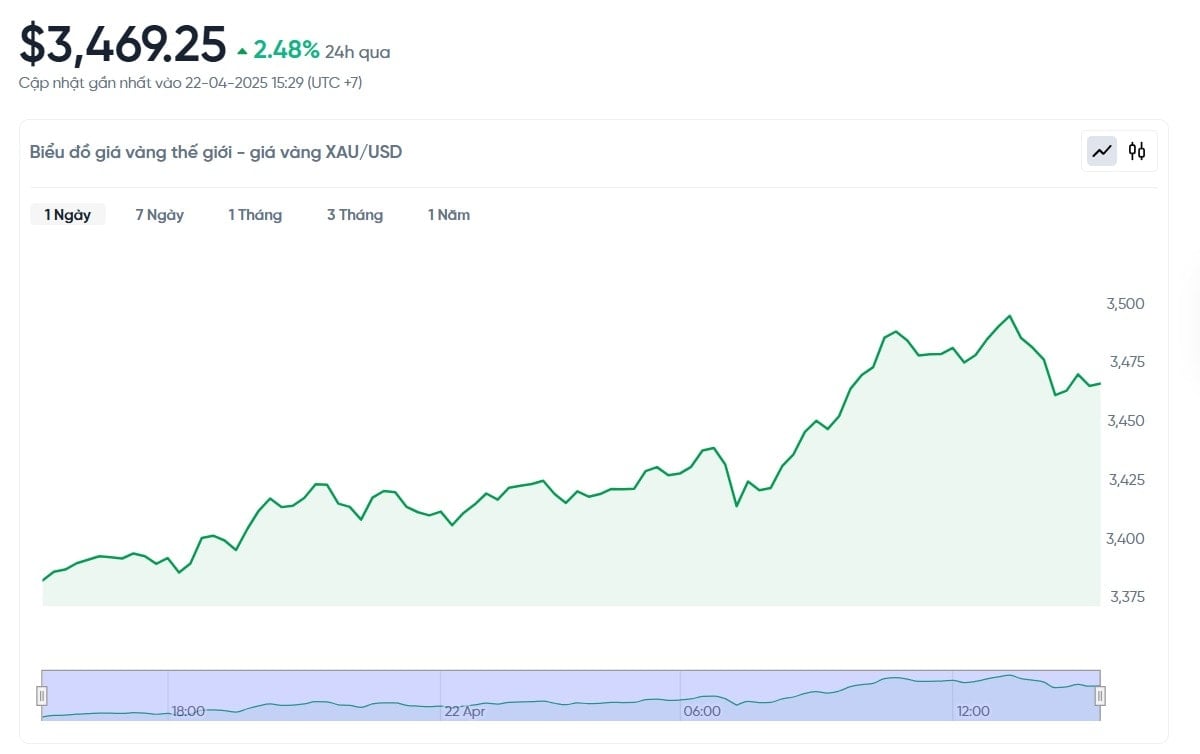

Update gold price today April 22, 2025 latest on the world market

At the time of trading at 10:00 a.m. on April 22, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,472.83 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 109.88 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (120.5-122.5 million VND/tael), the SJC gold price is currently about 12.62 million higher than the international gold price.

The price of gold on the world market today, April 22, 2025, is attracting attention as it approaches 3,500 USD/ounce, reaching a record high. Specifically, the spot gold price increased by 2.7%, to 3,472.83 USD/ounce, even reaching 3,480.0 USD/ounce at one point. The price of gold futures in the US also increased by nearly 3%, reaching 3,472.83 USD/ounce. This means that gold is becoming an attractive choice for many people in the context of many fluctuations in the global economy. So why is the price of gold increasing so strongly?

A key reason is the weakening US dollar, which has hit a three-year low. When the dollar weakens, gold becomes cheaper for holders of other currencies, increasing demand for the metal. In addition, concerns about the US economy, especially after President Donald Trump’s comments about the Federal Reserve Board, have dampened investor confidence. In times of uncertainty like these, gold is seen as a “safe haven” because its value tends to be more stable than other assets.

In addition, trade tensions between the US and China have also contributed to the rise in gold prices. China has criticized the US for abusing tariffs and warned other countries not to cooperate economically with the US if it causes damage to them. These conflicts have increased anxiety about the global economy, causing many people to seek gold as a way to protect their assets. According to David Meger, a metals expert, as trade tensions escalate, gold will become more popular.

However, gold prices will not always increase forever. Experts say that there may be times when prices drop slightly as investors take profits. However, the general trend is that gold prices will continue to stabilize or increase in the coming time. Since the beginning of 2025, gold prices have increased by more than $700, surpassing the $3,300 mark last week and increasing by another $100 in just a few days. This shows that gold is still very attractive.

Some experts, such as Kitco Metals’ Jim Wyckoff, believe that the sharp daily swings in gold prices could be a sign that the market is peaking in the short term. However, they stress that gold prices are likely to remain high due to its unique role as a hedge against economic uncertainty. For those who are not familiar with economics, gold is simply a “safe haven asset” that many people turn to when the world is in trouble.

Meanwhile, other precious metals such as silver, platinum and palladium did not see as strong a rise as gold. Silver prices were steady at $32.60 an ounce, while platinum and palladium even fell slightly. This further shows that gold is the focus of attention in the precious metals market today.

News, gold price trends today April 22, 2025 domestic and world gold prices

Gold prices today, April 22, 2025, are at a record high after rising nearly 25% since the beginning of the year. However, many experts warn that gold prices may be at a short-term peak. Investing in gold at this time is risky, especially when prices are very high. Mr. NS Ramaswamy, an expert from Ventura, advises not to buy gold now but to wait for prices to fall to around $3,150 or $3,080 per ounce. He predicts that in the medium term, gold prices may reach $3,450–$3,550, but each increase is often accompanied by the possibility of a correction.

However, gold prices still have a positive outlook thanks to many supportive factors. Prolonged trade tensions, rising inflation and gold demand from central banks are creating momentum for gold prices to rise. Mr. Navneet Damani of Motilal Oswal said that in the context of political, economic and inflationary uncertainties in the world, gold is still a popular safe asset. He recommends buying gold on corrections in the medium to long term, unless there is a major breakthrough in global trade.

Other experts are more optimistic about gold prices. Alex Kuptsikevich from FxPro said that gold has regained momentum after a correction period since late 2024. He predicted that gold prices could surpass $3,500/ounce in the short term, even reaching $3,540, a high similar to the peak in 2011. Similarly, Yeap Jun Rong from IG said that factors such as US-China tensions, geopolitical instability and Mr. Trump's criticism of the Federal Reserve Bank are pushing investors to seek gold as a safe haven.

In addition, Nicholas Frappell of ABC Refinery emphasized that the uncertainty of tariffs and tough US policies could disrupt global supply chains, further supporting the strong rise in gold prices. ANZ Bank even predicted that gold prices could reach $3,600/ounce by the end of 2025 and $3,500 in the next six months, as demand for gold as a hedge against risks has yet to peak. For those who are not familiar with economics, it is understandable that gold is being sought after for its safety, but caution is needed when prices are at high levels.

In summary, the price of gold today, April 22, 2025, is forecast to continue to increase, although there may be slight adjustments at times. With the weak USD and the increasing demand for safe haven assets, gold remains an attractive choice. If you are considering investing, keep a close eye on it but also be cautious, as the market is always subject to unexpected changes.

Source: https://baodaknong.vn/gia-vang-hom-nay-22-4-2025-gia-vang-trong-nuoc-va-gia-vang-the-gioi-co-ky-luc-moi-250223.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)