Market is strongly differentiated, VN-Index slightly decreased in the last session of the third quarter

Market transactions took place cautiously in the last trading session of the third quarter of 2024. Red dominated the closing day of the third quarter of 2024 - the time when many funds finalized their net asset value (NAV).

Last weekend, VN-Index briefly surpassed the 1,300 point mark, but then strong selling pressure caused the index to fall.

Entering the trading session on September 30, trading on the market was relatively tight. Investors were cautious because today's session was the end of the third quarter of 2024 - the time when many funds finalize their net asset value (NAV).

Demand in today's session was relatively weak when VN-Index was above 1,290 points. Meanwhile, supply pressure in this area was somewhat high. This caused most of the session, the indices traded in red.

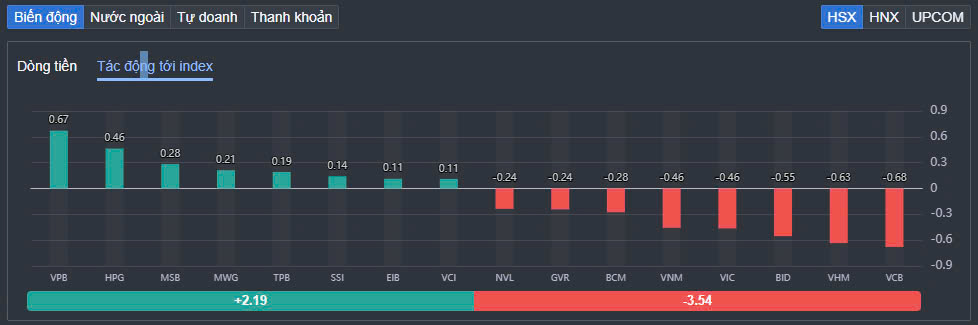

The market focus today was on three bank stocks: MSB, TPB and VPB, of which VPB increased by nearly 1.8% and was the main factor supporting the VN-Index. VPB was also the stock that contributed the most to the VN-Index with 0.67 points. In addition, MSB increased by 3.6% and TPB increased by 1.8%. These two bank stocks contributed 0.28 points and 0.19 points to the VN-Index, respectively.

Steel stocks also attracted investors' attention when they increased sharply in the early session. However, the general selling pressure of the market prevented many stocks in this group from maintaining their momentum. HPG increased by 1.15% and contributed 0.46 points to the VN-Index. VGS increased by 1.8%, HSG increased by 1.7%, NKG increased by 1.14%. On September 30, the domestic steel market kept its selling price unchanged; iron ore increased by nearly 100 USD/ton after China committed to additional stimulus measures.

In the securities group, transactions were also relatively positive, VGS increased by 2.5%, VCI increased by 2.23%, AGR increased by 1.6%, FTS increased by 1.1%...

The market was relatively differentiated, with real estate stocks moving in a relatively negative direction. NVL was the key factor causing this industry group to decline. NVL was sold off heavily from the beginning of the session and at one point hit the floor price. However, low-price demand was still quite good and helped this stock close down 4.33% with 30.2 million units matched.

NVL's strong selling in today's session came from the conversion of profit into loss of up to VND 7,300 billion after the 2024 semi-annual review. Explaining the reason, NVL said the main reason was due to the provision for land rent, land use fees and reduced profits as requested by the auditor.

|

| Top 10 stocks affecting VN-Index. |

Besides NVL, real estate stocks such as HPX, VRE, VHM, PDR, VIC, KHG, HDC… were all in red. VHM decreased by 1.4% and took away 0.63 points from the VN-Index.

In addition, large stocks such as VCB, BID, VNM, BCM or GVR all decreased in price and put great pressure on the general market. VCB decreased by 0.54% and was the stock with the worst impact on VN-Index with 0.68 points.

At the end of the trading session, VN-Index decreased by 2.98 points (-0.23%) to 1,287.94 points. The entire floor had 153 stocks increasing, 241 stocks decreasing and 70 stocks remaining unchanged. HNX-Index decreased by 0.8 points (-0.34%) to 234.91 points. The entire floor had 61 stocks increasing, 98 stocks decreasing and 64 stocks remaining unchanged. UPCoM-Index decreased by 0.34 points (-0.36%) to 93.56 points.

Total trading volume on HoSE today reached more than 748 million shares, worth VND16,289 billion, down 24% compared to the previous session, of which the negotiated transaction value accounted for VND1,173 billion. The transaction value on HNX and UPCoM was VND1,147 billion and VND654 billion, respectively.

No stock reached a liquidity level of over VND1,000 billion in today's session. HPG ranked first in terms of trading value with over VND989 billion. TPB and VPB traded VND648 billion and VND531 billion, respectively.

|

| Foreign investors return to net selling. |

Foreign investors returned to net selling over VND500 billion on HoSE. Of which, this capital flow sold the most net HPG code with VND291 billion. Despite facing strong selling pressure from foreign investors, support from domestic investors still helped Hoa Phat shares close in the green. Meanwhile, STB and GM shares, also sold heavily by foreign investors for VND110 billion and VND51 billion, respectively, both decreased in price.

On the other hand, FPT was the most net bought with 44 billion VND. SSI and VHM were net bought with 36 billion VND and 35 billion VND respectively.

Source: https://baodautu.vn/thi-truong-phan-hoa-manh-vn-index-giam-diem-nhe-trong-phien-cuoi-quy-iii-d226219.html

![[Photo] General Secretary To Lam receives Secretary General of the Mozambique Liberation Front Party](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/360d46b787c547bbaa5472c490ddeded)

![[Photo] Enjoying the experience of enjoying specialty coffee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/cb4f5818052e479392e8b3ad06cb1db0)

![[Photo] President Luong Cuong receives Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/44f0532bb01040b1a1fdb333e7eafb77)

![[Photo] Welcoming ceremony for Japanese Prime Minister Ishiba Shigeru and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/1c97f7123f4f47078488e8c412953289)

![[Photo] President Luong Cuong offers incense to commemorate Uncle Ho at House 67](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/162df748c87348e1821cc4c83745a888)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ee88e7119877496a9a73bb456f3414d3)

Comment (0)