Bright Spots Amid Market Turmoil

In 2023, the Vietnamese real estate market has experienced global economic pressure and global and domestic challenges. High interest rates have depressed the world economy, sowing uncertainty for investors.

In addition, rising inflation also put pressure on household spending; the manufacturing sector recorded high inventory levels and reduced production orders, directly affecting Vietnam's key growth sectors.

In addition, delays in approving housing projects have delayed investment implementation, affecting market sentiment. However, the demand for home ownership remains strong thanks to the country’s urbanization process, large population and urgent housing needs in major cities. The Government’s efforts over the past two years have made progress in managing and addressing this issue, building confidence in a better future.

Despite the market challenges, many positive signs point to a bright future.

Despite global challenges, the office market in Ho Chi Minh City has maintained high occupancy rates and stable rental growth. The office market in Ho Chi Minh City is also one of the bright spots in the Asia-Pacific region. High-end office buildings with green certification also help ensure high occupancy rates and rental prices.

According to Savills Vietnam ESG Report 2023, there are 20 office buildings with LEED or Green Mark certification in Vietnam. Seventeen of them are in Ho Chi Minh City, accounting for about 25% of the current office supply and expected to increase to 31% by 2026.

After a slow recovery, the tourism industry in 2023 recorded strong operating capacity with hotel performance in Hanoi and Ho Chi Minh City returning to pre-Covid-19 pandemic levels.

Opportunities from M&A deals

In the region, real estate transaction volumes have fallen sharply, leaving a significant amount of available investment capital. Despite high interest rates, Vietnam’s growth prospects and relatively high yields continue to attract foreign investment. In particular, in 2023, Savills Vietnam continues to receive strong interest from investors looking to participate in this potential market.

In the context of scarce housing supply, any investor with the capacity to launch a project can exploit the high demand of the market at this time, especially the growing middle-class customer segment.

In the office segment, in Ho Chi Minh City, although the supply of new Grade A projects is quite abundant, the positive rental performance shows that there are still opportunities for investors and office developers in the future. Those who provide or reposition office buildings with green certification will attract high rental rates.

Class A office space has been a bright spot in the market recently.

The major challenge for real estate investors in Vietnam at the moment is the administrative obstacles, especially in resolving land use fees. Along with that, investors are now very careful about the legal ownership of the project, ensuring a clear roadmap to obtain the necessary approvals from the Government. Resolving land use fees and approving 1/500 planning are the most important factors for housing development projects.

Currently, there are few projects with clear legal ownership and all the necessary approvals for development, which has made it difficult for investors to enter the market. This has also caused a credit crunch, as banks have difficulty obtaining the necessary collateral to lend to real estate projects. Variations in the completion schedule of major infrastructure projects have added complexity to determining the optimal timing for real estate project development.

While the changes in the legal framework have not been fully implemented, local authorities are still hesitant to implement them. Until there are clear changes and progress in resolving land use fees and granting land use rights certificates, the completion of M&A activities will continue to be difficult. For example, with condotel products, where local authorities are still hesitant to grant certificates to projects despite clear explanations in the legal framework.

The country’s robust economy is fueled by a large population, infrastructure development, urbanization, abundant foreign direct investment (FDI) and a rapidly growing middle class. If the legal framework allows, real estate M&A activity is expected to boom in the next two to three years.

Most of the investment comes from Asian countries such as Singapore, South Korea, Thailand, Malaysia and Japan. These countries have been active investors in Vietnam and are expected to increase their investment in the next two to three years, in addition to the potential from Middle Eastern investors. In particular, Vietnam’s industrial sector will benefit from the many free trade agreements (FTAs), creating a diversified investment base and increasing investment in manufacturing and industrial real estate.

Foreign investors also appreciate the extensive experience and knowledge of the Vietnamese market that domestic companies bring to their partnerships. At the same time, domestic companies have provided greater investment opportunities for foreign investors, such as a large base or supporting industries. This allows foreign investors to expand quickly after entering the market, while also leveraging the experience and network that local partners provide.

Source

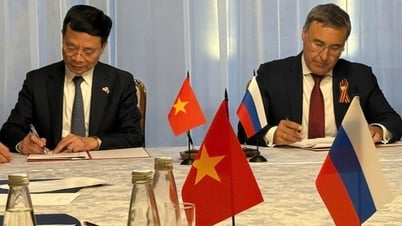

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)