On July 7, statistics from the Vietnam Securities Depository (VSD) showed that in June alone, domestic investors opened nearly 146,000 new securities accounts. This is the second consecutive month that the number of newly opened securities accounts by domestic investors has increased sharply, after hitting bottom in April (only about 23,000 newly opened accounts).

Stock market recovers both in points and new account openings

By the end of June, the total number of domestic individual investor accounts had exceeded 7.25 million, equivalent to more than 7.2% of the population. Meanwhile, the number of securities accounts opened by organizations stopped at only 8.

Previously, in May, VSD recorded nearly 114,000 newly opened securities accounts. Thus, in June, the number of newly opened securities accounts increased by tens of thousands.

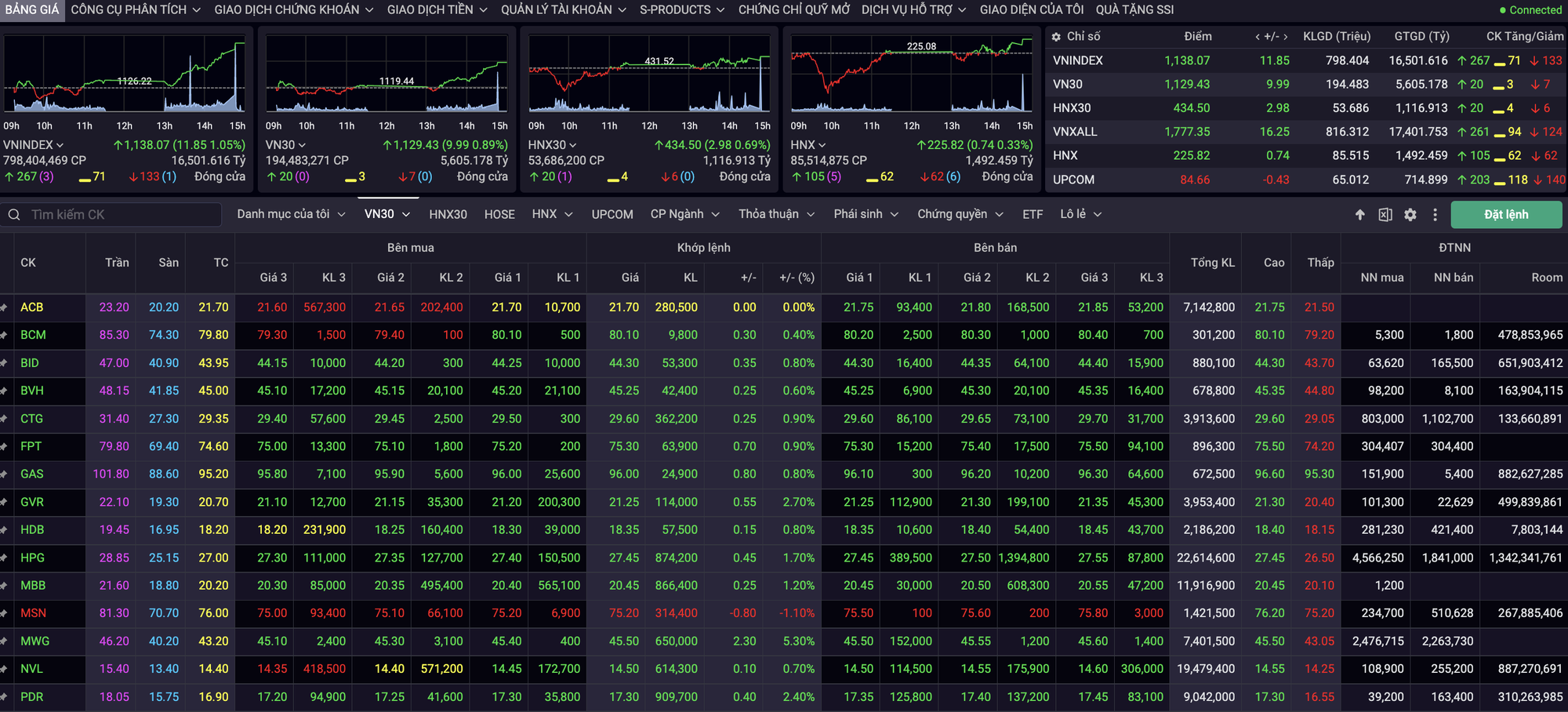

Along with the increase in the number of newly opened securities accounts, the VN-Index also recovered strongly, increasing by more than 4% in June with active trading, market liquidity reaching billions of USD in some sessions. On the Ho Chi Minh City Stock Exchange (HOSE) alone, the average matched trading value per session reached over VND 15,000 billion, an increase of more than 40% compared to May and the highest level in more than 1 year since April 2022.

Domestic money flows back into the stock market as interest rates continue to fall

According to some financial experts, the strong recovery of the stock market in recent times has attracted investors' money to return to the market after a period of leaving. At the same time, along with the continuous adjustment of bank interest rates, more money is transferred to the stock market, pushing up the average transaction value of each session. In addition, margin is also activated, "pumped" into the stock market more strongly when interest rates decrease.

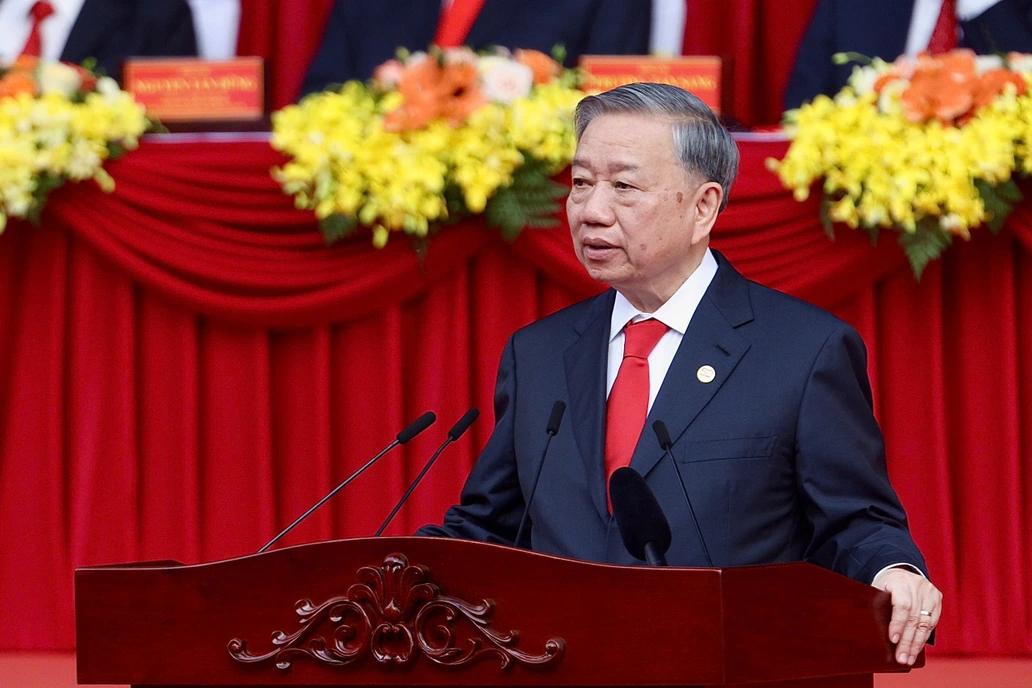

Notably, on July 6, when working with the Association of Small and Medium Enterprises, Prime Minister Pham Minh Chinh continued to direct further interest rate reduction to provide more timely support to small and medium enterprises. Many stock investors assessed that this is also good news for the stock market because when interest rates are reduced, cash flow will likely continue to shift more into stocks.

According to VSD, in June, while domestic cash flow showed signs of increasing into the stock market, foreign investors continued their net selling trend, but the selling intensity decreased significantly compared to before. Specifically, in June, foreign investors net sold VND400 billion on HOSE. This was the lowest net selling value in the second quarter after foreign investors net sold VND2,800 billion in April and more than VND3,000 billion in May.

VSD also reported that in June, foreign investors opened nearly 200 new securities accounts on the VN-Index. By the end of June, foreign investors had a total of nearly 44,000 accounts.

Source link

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

Comment (0)