The biggest shake-up ever

+ The Ministry of Finance has just announced the results of the 2022 thematic inspection of 4 life insurance companies. How will the inspection results impact the general market, in your opinion?

- Every year, the Insurance Supervision and Management Department will organize inspection teams to inspect insurance enterprises (IIEs) according to the state management function.

The above inspection is a thematic inspection of insurance business activities through banks, under the inspection plan of the Ministry of Finance. The inspection focuses on the activities of enterprises in the 2021 fiscal year, with consideration of related periods.

The impact of inspection and examination activities on the market is always very clear, a "filter" to help the market become healthier. The discovered problems are aimed at helping businesses improve and perfect their management and business activities, while helping to improve the quality of customer service, in line with changes in the law from 2022 when the new Law on Insurance Business and guiding documents come into effect.

The recently announced inspection results have pointed out some disadvantages in the operations of the four companies and proposed specific solutions. This is not the result of just the four companies, but the entire insurance industry can examine. The discovered loopholes are the key points that insurance companies have been proactively focusing on improving. Even insurance companies that have done well are trying to do better.

Mr. Ngo Trung Dung - Vice President of Vietnam Insurance Association

+ So first of all, the insurance company will adjust and review its operations according to the "indications" of the inspection conclusion?

- Insurance companies have taken immediate action based on market developments, instead of just “sitting there” and waiting for conclusions from management. According to the quick reports of 4 companies, all insurance agents violating the inspection conclusions were handled immediately upon discovery, without waiting for the conclusion to be announced. Some companies have proactively worked with their banking partners to correct errors from the banks, including establishing an agency to manage customer conduct standards with members of both sides.

The recent period also witnessed the first time 100% of life insurance companies taking action together, reviewing, adjusting, improving business processes, and correcting existing problems...

The review and adjustment process will take place continuously as a strategy at insurance companies to promote a healthy market, improve quality at all stages, and ensure the highest benefits for customers.

It can be seen that the most extensive reform of the insurance companies has been implemented so far. There is no room or time for slow businesses…

The key is in operation and execution.

+ Is there any solution to bring about a breakthrough change for the insurance industry, especially in the face of the fact that buyers are "panic" over long and confusing contracts?

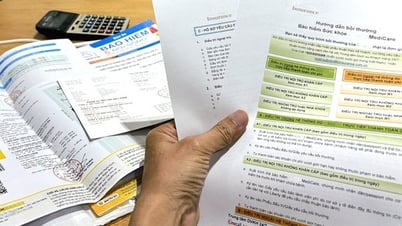

- This is a problem for global life warranties. In the world , life insurance contracts are always thick and have difficult-to-understand terms. In the US, contracts can be up to 100-200 pages; Singapore is more than 80 pages; Japan and Taiwan are nearly 100 pages. Vietnam and Thailand are about 80 pages and 75 pages respectively.

It is very encouraging that this problem is being focused on by insurance companies in Vietnam. Some companies have researched and launched a shortened contract of only a dozen pages with important information for customers to easily grasp. Electronic contracts with "digital insurance certificates" that do not need to be printed on paper are also being deployed.

When these adjustments are completed and applied, they will create a breakthrough for the insurance industry. The major controversial barriers that prevent customers from owning life insurance products that meet their needs will be removed. At the same time, it will be in line with the trend of digitalizing insurance businesses.

+ And right now, when the market needs immediate solutions, have there been any significant actions put into practice, sir?

- A series of immediate actions have been implemented, creating positive signals for the life insurance market since the "hottest" period, around March - April.

Within 24 hours of the controversy breaking out, the insurance companies reviewed the contracts of all customers with complaints, quickly came up with appropriate solutions and took steps to "re-consult and further explain" in detail the information that customers questioned.

Complaint hotlines are widely publicized.

Enterprises also strive to eliminate "blind spots" in the quality of insurance agents' consulting by reviewing insurance agency contracts signed with organizations and individuals; controlling the activities of insurance agency organizations, ensuring compliance with the provisions of Clause 2, Article 125 of the Law on Insurance Business.

Continuous training and knowledge updating activities for direct employees at insurance agencies have taken place. Enterprises have also promoted mystery shopping activities to evaluate the quality of advice.

On the side of the Vietnam Life Insurance Association (IAV), we and insurance companies identified 5 quick solutions to improve the quality of the life insurance market.

A series of immediate and long-term actions are being implemented.

+ Many actions have been taken, so in your opinion, what is the key point for the life insurance market to restore customer trust?

- The Law on Consumer Protection, recently passed by the National Assembly on June 20, 2023, requires financial, banking, and insurance service providers to clearly explain terms to customers. These requirements are stipulated in the Law on Insurance Business.

Looking deeper, before the Consumer Protection Law was passed by the National Assembly on June 20, in essence, consumers in Vietnam, like in any other country, when buying life insurance, were guaranteed their rights with transparency in the contract, in the terms, in all the data provided as well as regulations on rights, financial obligations, profits received or cases of risk that must terminate the contract.

To put it simply, the key is in the operation and supervision. The good news is that recently, many customers, after being thoroughly explained, have understood, stopped complaining, and brought up the idea of terminating the contract.

+ Thank you!

| Regarding the insurance hotspot at SCB bank, after a press conference to announce the situation and results of police work in the first 6 months of 2023, Major General Nguyen Van Thanh, Deputy Director of the Department of Investigation Police on Corruption, Economic Crimes, and Smuggling - C03, Ministry of Public Security said: Upon receiving the denunciation and through research, Department C03 found that the contracts for transferring from savings books to Manulife insurance packages were very transparent. The contracts all had the signatures of investors. Therefore, Department C03 raised many issues that needed to be verified, such as: Was it true that SCB leaders directed bank employees to propagate to customers to transfer from savings deposits to insurance packages? Was it true that bank employees use "professional skills" to make people transfer contracts?... |

PV

Source

Comment (0)