Having dominated the textile industry since its early boom, nearly 30 years ago, Mr. Nguyen Cao Phuong, production manager of Viet An Garment Company (name has been changed upon request) in District 12, Ho Chi Minh City, has never felt the industry as difficult as it is now.

In 2020, when the pandemic broke out in China, the textile industry suffered the consequences of its inherent weakness: focusing too much on outsourcing, and leaving raw materials to foreign supply chains. At that time, Vietnam imported 89% of fabrics to produce for export, of which 55% came from its neighboring country of one billion people. The supply chain, which had been operating smoothly, suddenly broke down due to a "blockage" of raw materials when China "froze" trade to fight the pandemic.

Mr. Phuong recognized this "Achilles heel" many years ago, but had no choice.

Export partners refuse to accept processed goods if the raw materials do not come from the designated supplier, including glue, lining, buttons, etc. As a result, profits are reduced because the price is almost impossible to negotiate. Businesses that want to make a profit must "eat" into labor costs.

Viet An was established in 1994, seizing the opportunity when the economy welcomed the first wave of FDI into Vietnam. From the orders shared by FDI "guests", Mr. Phuong nurtured the ambition of building a large enterprise to dominate the home market, like the way Koreans and Chinese have succeeded.

One of Vietnam's goals in attracting FDI at that time was to create a stepping stone for domestic enterprises to take off with the “eagles”. But after three decades, despite the company's size reaching more than 1,000 employees, Viet An still has not found a way out of its last position in the textile value chain.

"Golden hoop" cutting - sewing

The three main production methods of the textile industry with increasing profits include: processing, input provided by the buyer (CMT); the factory actively purchases raw materials, produces, and then delivers (FOB); and the processing enterprise is involved in the design stage (ODM).

For the past 30 years, Mr. Phuong's company has followed the first method - always using raw materials specified by the ordering partner, including fabric, glue, buttons, otherwise the goods will be refused to be received. According to an in-depth study on the Vietnamese textile industry published by FPTS Securities Company, this method only brings an average profit margin of 1-3% in the processing unit price, the lowest in the entire value chain.

Mr. Phuong's company's situation is no exception. About 65% of Vietnam's textile exports are done using the CMT method. The number of FOB orders – the method that brings higher profits – accounts for 30%; the rest are ODM – the most profitable stage – which accounts for only 5%.

"There was a time when we thought it was unreasonable, why do we have to import lining fabric from China when Vietnam can also make it at a lower price, so we decided to buy domestically," said Viet An's manager about a time when he "disobeyed" his partner about 10 years ago. He said that they only specified the source of raw materials based on suggestions, so they could still be flexible with suppliers, as long as the product quality was not reduced.

This recklessness caused Viet An to suffer. The brand found fault with everything, and the goods were returned, although according to him, the lining fabric did not affect the quality of the product. After that, the company continued to depend on raw materials specified by the partner.

From the perspective of foreign partners, Ms. Hoang Linh, a factory manager who has worked for a Japanese fashion corporation for 5 years, explains that global brands almost never allow manufacturing enterprises to freely choose input suppliers.

In addition to the two mandatory criteria of quality and price, brands must ensure that raw material suppliers do not violate social and environmental responsibilities to avoid risks. For example, the US banned the import of garments using Xinjiang cotton in 2021, because it believed that the working conditions here did not meet standards.

"If the factory is given the right to purchase raw materials, the brand must also know who their partners are in order to hire an independent auditor to conduct a comprehensive assessment. That process takes at least a few months, while the production schedule is set a year in advance," Linh explained.

Raw materials for the Vietnamese textile industry are still dependent on foreign sources, especially China. Photo inside the fabric warehouse of Viet Thang Jeans factory, November 2023. Photo: Thanh Tung

Unable to escape the cut-and-sew rut, Mr. Phuong's company fell into even more difficult situations when the textile industry suffered a crisis of orders since the middle of last year. Factories were thirsty for work, brands were squeezing prices, and profits fell to rock bottom.

"The company needs orders to maintain jobs for thousands of workers, even if it means losing money, it has to do it," he said. There was no other way but to reduce the unit price of the product, meaning workers would work more for the same income.

With low profits, domestic companies that are only familiar with garment processing like Viet An cannot accumulate enough cash flow for market shocks, or reinvest for expansion.

Textile and garment export turnover has been growing steadily, but the contribution value from domestic enterprises has not improved significantly in the past 10 years. More than 60% of textile and garment export value belongs to FDI, although foreign enterprises only account for 24%. In the footwear industry, FDI also holds more than 80% of export turnover.

Contribution to export value of textiles, garments and footwear of domestic and FDI enterprises

Source: General Department of Customs.

30 years of defeat

"Vietnamese businesses are losing right at home," Ms. Nguyen Thi Xuan Thuy, an expert with nearly 20 years of research on supporting industries, concluded about the current situation of the textile and footwear industries.

Ms. Thuy said that it is sad that Vietnam used to have a complete textile supply chain system but today it is at a disadvantage. Previously, the textile industry exported both domestically produced clothes and fabrics. But economic integration has brought this industry to a new turning point: rushing into outsourcing, based on the biggest comparative advantage of labor costs.

Ms. Thuy analyzed that it was the right choice at the time of opening up to attract FDI, because at that time Vietnam was behind in technology so of course it could not compete in the quality of fibers and fabrics compared to Japan and Korea. But the problem is the state of being disadvantaged in terms of raw materials that has lasted for the past 30 years.

"At first, we accepted using foreign fabrics, but we should have continued to nurture the domestic textile and fiber industry, learning technology with the goal of catching up with them," said Ms. Thuy, adding that the textile industry itself had cut off links in its own supply chain.

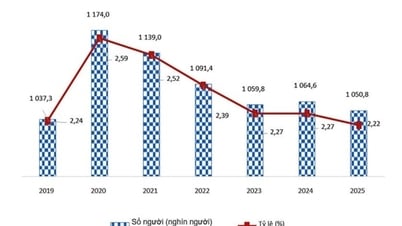

The increase in textile and footwear exports, along with the trend of importing fabrics and accessories, shows the dependence of this industry on raw materials.

According to expert Thuy, the loopholes in the supply chain of enterprises will only really be exposed when Vietnam joins new generation free trade agreements such as EVFTA and CPTPP. To enjoy tax incentives when exporting, "made in Vietnam" garments must ensure that the raw materials are also of domestic origin. Enterprises that only process garments now "lose" because they are completely dependent on foreign fabrics.

"The ultimate beneficiaries of the agreements are FDI enterprises because they have large resources and synchronous investment to complete the fiber - textile - garment chain," Ms. Thuy analyzed. In the period 2015-2018, right before EVFTA and CPTPP took effect, Vietnam was the country that received the most FDI from textile investors from Korea, Taiwan, and China.

According to experts, this fault is not only the state's but also the business's.

The world's advanced industrial countries all started with the textile industry, then sought to move up the value chain. For example, Germany still maintains research activities on new materials and textile technologies applied in textiles. The US has been the world's largest supplier of cotton and cotton yarn for decades, and the government maintains subsidies for cotton farmers. Japan has for many years mastered fabric technologies such as heat retention, cooling, anti-wrinkle... applied in high-end fashion.

"Everything that brings the highest, core value, they keep for their country," expert Thuy concluded.

Vietnamese textile and garment workers are still focused on processing and have not been able to move up the value chain. Photo: Thanh Tung

Meanwhile, Vietnam has wasted its golden time in attracting FDI for 35 years. In 1995, when the US and Vietnam normalized relations, the textile and garment industry boomed. However, over the past three decades, the industry has only done well in garment processing, without investing in research and development, fabric production, etc.

"Policy has not looked far ahead and businesses are too focused on short-term benefits," the expert said.

Initially, Vietnamese textile and garment enterprises still followed the chain trend, meaning that enterprises all had textile, yarn and sewing factories. However, when export orders were too large and customers only wanted to order sewing, Vietnamese enterprises abandoned other stages. Only a few state-owned corporations with synchronous investment from decades ago such as Thanh Cong and member companies of the Vietnam Textile and Garment Group (Vinatex) still control the supply chain.

This situation leads to the current imbalance: the total number of spinning, weaving, fabric dyeing, and related supporting industries combined is only equal to more than half of the number of garment companies, according to data from the Vietnam Textile and Apparel Association (VITAS).

"Fish Head" of Industry

"If Ho Chi Minh City's industries are seen as a fish, then the textile industry is seen as the head, which can be cut off at any time," Mr. Pham Van Viet, General Director of Viet Thang Jean Company Limited (Thu Duc City), lamented.

Labor-intensive industries such as textiles and footwear are facing pressure to shift or innovate, according to the Project on developing industrial and export processing zones for the period 2023-2030 and vision to 2050 that Ho Chi Minh City is finalizing. The city's future orientation is to focus on developing towards ecology and high-tech industrial zones.

"Nowadays, wherever we go, we only hear about high technology. We feel very self-conscious and overlooked because we are labeled as labor-intensive and polluting," he said.

To transform gradually, Viet Thang Jean has automated machinery and applied technology in laser washing, bleaching, spraying, etc. to help reduce water and chemicals by up to 85%. However, the business is almost "swimming on its own" in this process.

According to Mr. Viet, to borrow investment capital, the company must mortgage assets. Usually, banks value 70-80% of the real value, then lend 50-60%, while investing in technology and machinery is very expensive.

"Only bosses who are dedicated to the industry dare to invest," said Mr. Write.

With more than three decades of experience in the profession, CEO Viet Thang Jean believes that if this industry wants to move up the value chain, the responsibility does not only belong to businesses, but also to policies. For example, the city needs to invest in a fashion center to train people, research fabrics, master material sources, introduce products, etc. Associations and businesses participating will together.

When they can't change, businesses have to choose to leave the city or downsize. Either way, workers are the ones who suffer the most.

Workers cutting and sewing at Viet Thang Jeans factory, November 2023. Photo: Thanh Tung

The policy in writing does not ignore businesses in traditional industries. The Politburo's Resolution on the orientation of building a national industrial policy until 2030, with a vision to 2045, requires continued development of the textile, garment and footwear industries, but prioritizes the creation of high added value, associated with smart and automated production processes.

However, in reality, domestic enterprises invest to invest in fabric production still willing face barriers, according to Vice President of the Vietnam Textile and Apparel Association (VITAS) Tran Nhu Tung.

"Many localities think that dyeing and weaving is polluting so they do not grant licenses, even though in reality advanced technologies can handle it safely," said Mr. Tung.

The Vice President of VITAS emphasizes that green production is now a mandatory requirement in the world, so if businesses want to sell their products, they themselves must be aware of sustainable development. However, if many localities still have prejudices, Vietnam's textile and garment supply chain will continue to be flawed.

While not yet able to master input materials, Vietnam's biggest advantage over the past years has been the increasingly low labor cost compared to later-developing countries such as Bangladesh and Cambodia.

Comparing Vietnam's textile industry with some countries

The economy cannot just "catch the trend"

Vietnam in general and Ho Chi Minh City in particular are placing high expectations on "new generation" industries such as semiconductors, green economy, and circular economy, according to Associate Professor Dr. Nguyen Duc Loc, Director of the Institute for Social Life Research.

"There is nothing wrong with this because it is a global trend, but with current conditions, it needs to be carefully considered. It can be a double-edged sword. The economy cannot just follow trends," he said.

For example, the semiconductor industry is expected to need 50,000 workers, but domestic demand is forecast to only meet 20%. There will be two scenarios: investors come but Vietnam does not have a labor source, so they are forced to bring in workers from abroad; or they will give up and not invest.

"Either way, we lose. If they invest and bring people over, Vietnam will only serve others. If the business abandons it, our plan will be ruined," said Mr. Loc.

In this context, he believes that we should not only focus on "catching the trend" of the semiconductor or high-tech industries, but forget about traditional industries that bring export value to Vietnam. For example, textiles and garments bring in billions of USD each year. With three decades of development, businesses at least have experience, the task now is to help them move up the value chain.

"Let's keep the train running according to the 30-30-30-10 principle," Mr. Loc suggested. Of which, keep 30% traditional industries, 30% are industries that need to shift, 30% invest in "trending" industries, and 10% for breakthrough industries.

Experts compare this method to a flock of birds protecting each other. The new generation of industries will fly first, while the old and weak traditional industries will fly last, forming an arrow shape moving forward. This method not only helps the flock fly faster, but also protects the group of workers working in traditional industries, avoiding creating another unproductive generation, becoming a burden on the social security "net".

The garment industry currently employs more than 2.6 million workers - the most of any industry. Photo of workers at a garment factory in Binh Tan district at the end of the day. Photo: Quynh Tran

Along with supporting traditional industries, the state must also take responsibility for guiding and supporting the generation of workers left behind by this transition. Associate ProfessorDr. Nguyen Duc Loc suggested that Vietnam learn from Korea's approach of establishing a Labor Fund to support vocational training, health care, financial advice, etc. for workers.

Expert Nguyen Thi Xuan Thuy believes that it is necessary to frankly admit that Vietnam's ability to compete on labor costs will soon disappear. Policymakers therefore need to prepare for two tasks in the near future: supporting the simple labor group to transition to other industries, and repositioning their position in the value chain.

In the first part, she cited Singapore's approach, where the government established career counseling and guidance centers in industrial zones to help workers think about changing careers. The centers recorded workers' thoughts and desires, then provided advice and options for workers to choose from. Depending on demand, the government will open training courses or support costs for workers to study new careers on their own.

As for the second task, experts believe that Vietnam still has many opportunities when FDI capital is pouring in thanks to three advantages: large market size - 100 million people, favorable geopolitics; shifting supply chains from China; and the greening trend of the European Union (EU) forcing businesses to restructure their supply chains.

"We have lost a lot of time. But if we have the right direction, Vietnamese enterprises can still catch up with FDI corporations," said Ms. Thuy.

Content: Le Tuyet - Viet Duc

Data: Viet Duc

Graphics: Hoang Khanh - Thanh Ha

Lesson 4: "Eagle" stays at the hostel

Source link

Comment (0)