Nearly tripled in growth in the fourth quarter, NAF's after-tax profit reached VND100 billion for the first year

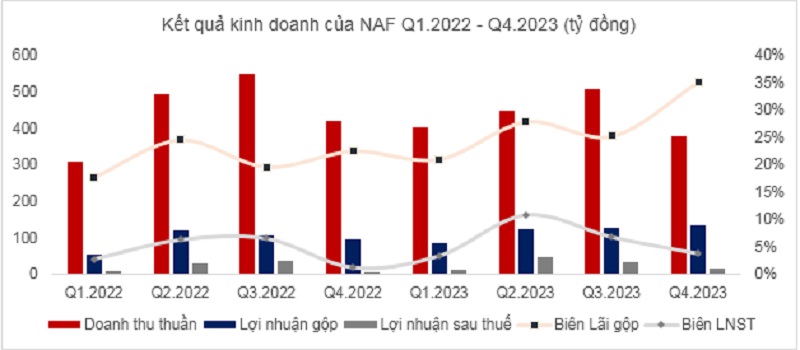

Nafoods Group JSC (HoSE: NAF) announced that its after-tax profit in the fourth quarter of 2023 reached VND14 billion, 2.8 times higher than the same period last year, thanks to continued improvement in gross profit margin. By the end of 2023, NAF exceeded its profit plan by 3.5%.

|

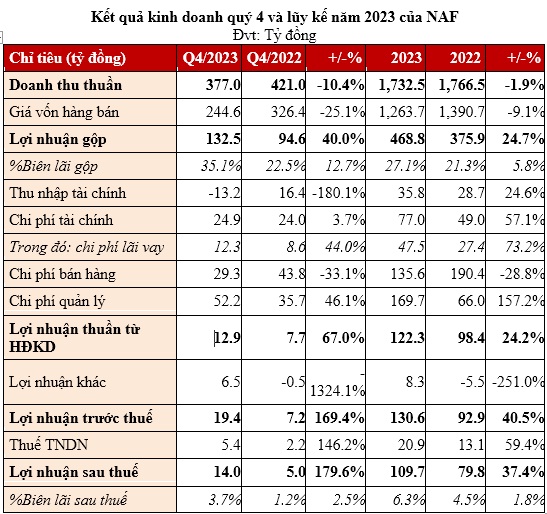

Specifically, NAF's net revenue in the fourth quarter of 2023 reached VND 377 billion, down 10.4% year-on-year. However, thanks to a strong improvement in Gross Profit Margin of 12.7 percentage points to 35.1%, gross profit reached VND 132.5 billion, up 40% year-on-year.

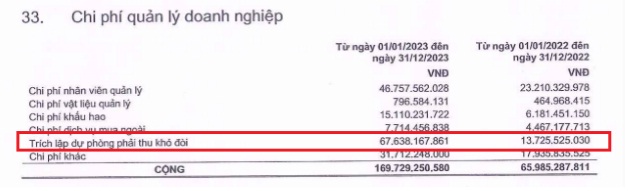

Selling and administrative expenses continued the same trend as in the first 9 months of the year when selling expenses decreased and administrative expenses increased, down 33.1% and up 46.1%, respectively, to VND29.3 billion and VND52.2 billion. Total SG&A expenses were VND81.5 billion, up 2.5% over the same period.

From the above fluctuations, net profit from business activities reached 12.9 billion VND, up 67% over the same period. Along with the recording of other profits of 6.5 billion VND while the same period lost 0.5 billion VND, NAF's after-tax profit reached 14 billion VND, up 2.8 times over the same period.

Accumulated for the whole year of 2023, NAF's net revenue reached VND 1,732.5 billion, down 1.9% compared to the previous year. Gross profit margin improved by 5.8 percentage points to 27.1%, helping gross profit reach VND 468.8 billion, up 24.7%. Profit after tax reached VND 109.7 billion, up 37.4%, surpassing VND 100 billion for the first time since listing (2015). Profit after tax margin reached 6.3%, up 1.8 percentage points compared to 2022.

In 2023, NAF targets net revenue of VND 2,125 billion and after-tax profit of VND 106 billion. Thus, the Company achieved 82% of the revenue plan and exceeded the profit plan by 3.5%.

|

| Source: Nafoods Group Financial Report. |

The company said that in 2023, despite difficulties in the Russian market, the company still maintained sales compared to the previous year, thanks to good growth in the business of frozen fruit and vegetable juices (IQF). Gross profit margin improved thanks to a better-managed supply chain, helping to reduce costs and take advantage of good opportunities from the market. Meanwhile, business management expenses in 2023 increased due to the company strengthening control activities, risk management, and increasing provisioning costs.

|

As of December 31, 2023, NAF's total assets reached VND 2,035 billion, up 17% compared to the beginning of the year. Of which, short-term assets reached VND 1,016 billion, down 13%; long-term assets reached VND 1,020 billion, up 77% compared to the beginning of the year. During the year, the Company also completed M&A transactions, increasing ownership at Nghe An Food JSC and Nafoods Tay Bac JSC, which was the main reason for the sharp increase in long-term assets.

The structure of short-term assets also shifted in a healthier direction when the total amount of cash and cash equivalents and short-term financial investments (bank deposits of 3-12 months) at the end of the year reached nearly 180 billion VND, a sharp increase compared to 66.5 billion VND at the beginning of the year. Meanwhile, short-term receivables decreased sharply from 908 billion VND at the beginning of the year to only 497 billion VND.

On the other side of the balance sheet, short-term loans and financial leases increased from VND578.5 billion at the beginning of the year to VND737.6 billion. Long-term loans and financial leases decreased slightly from VND74.9 billion to VND71.7 billion at the end of the year.

Source

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)