Holiday sentiment dominates the market in the session of August 29, Sacombank shares attract attention

Many large stocks such as STB, VHM, BCM… increased in price well and helped support the general market in the trading session on August 29.

After yesterday's increase, in the trading session on August 29, many large-cap stocks, especially banking stocks, increased sharply, helping the market trade more positively. However, when cash flow focused strongly on large stocks, especially banking stocks, many small- and medium-cap stocks adjusted.

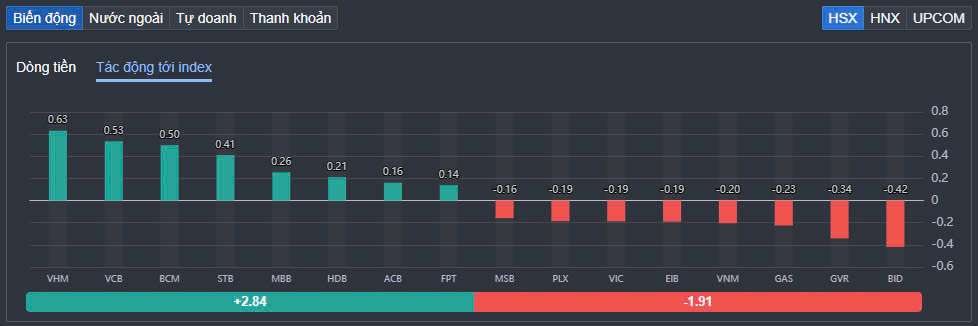

Trading was still gloomy and many large stocks fell in the afternoon session, causing the main index VN-Index to not maintain a good growth momentum. The focus of today's session was on banking stocks, of which STB was the most prominent when it increased by more than 3% to VND30,450/share and matched orders of more than 25 million units. STB was also in the top stocks with the most positive impact on VN-Index when it contributed 0.41 points to this index. Other banking stocks such as VCB, MBB, HDB, ACB... all increased in price and contributed to supporting the general market. VCB increased by 0.44%, ACB increased by 0.61%, MBB increased by 0.81%, HDB increased by 1.11%.

Besides, some large stocks such as VHM, BCM or FPT also kept green and contributed to keeping the market rhythm. VHM increased by 1.47% and was the code contributing the most to the VN-Index with 0.63 points.

The differentiation in large-cap stocks was quite clear when, on the contrary, red covered a series of codes such as PLX, VRE, GVR, BID, VNM... In which, BID decreased by 0.6% and took away 0.42 points from VN-Index. GVR decreased by 0.98% and also took away 0.34 points.

|

| The differentiation in large-cap stocks is quite clear. |

In the group of small and medium-cap stocks, many stocks are under pressure to adjust. VCI decreased by 2.9%, this stock is currently under pressure from the wife of General Director To Hai registering to sell 13 million shares. The transaction is expected to take place from September 4 to October 3 by order matching and/or negotiation. Recently, VCI announced that on September 13, it will finalize the shareholder list to issue shares to increase equity capital from equity (bonus shares). The ex-rights transaction date is September 12. The right exercise rate is 30% (shareholders owning 10 shares will receive 3 new shares).

SSI also decreased by 0.29% today despite receiving supporting information that it received a certificate of registration for offering shares from the State Securities Commission. According to the certificate, SSI is allowed to offer and issue to the public a total of more than 453.3 million shares. Of which, the number of shares issued to increase capital from equity is 302.2 million units and the number of shares offered to existing shareholders is more than 151 million units.

In the real estate group, red also covered stocks such as NVL, NTL, PDR, DXG... Of which, NTL decreased by 2.56%, NVL decreased by 2.26%, DXG decreased by 2.2%, PDR decreased by 2.05%.

At the end of the trading session, VN-Index increased by only 0.03 points to 1,281.47 points. The entire floor had 174 stocks increasing, 214 stocks decreasing and 92 stocks remaining unchanged. HNX-Index decreased by 0.35 points (-0.15%) to 237.88 points. The entire floor had 72 stocks increasing, 85 stocks decreasing and 65 stocks remaining unchanged. UPCoM-Index decreased by 0.28 points (-0.3%) to 93.85 points.

|

| Foreign investors extended their net selling streak to the 7th session. |

Total trading volume on HoSE reached more than 634 million shares (down 12% compared to the previous session), equivalent to a trading value of VND14,029 billion. Trading value on HNX and UPCoM reached VND702 billion and VND390 billion, respectively.

VIX topped the market's matched orders list with more than 54.5 million units. STB and VPB matched orders with 25 million units and 23.6 million units, respectively.

Foreign investors continued to net sell VND117 billion on HoSE alone today. This was the 7th session of net selling by this group of investors. Of which, this capital flow net sold the most HPG code with VND130 billion. VCI and VRE were net sold VND90 billion and VND84 billion respectively. On the other hand, foreign investors net bought the most FPT code with VND112 billion. STB and MWG were net bought VND112 billion and VND44 billion respectively.

Source: https://baodautu.vn/tam-ly-nghi-le-bao-trum-thi-truong-trong-phien-298-co-phieu-sacombank-gay-chu-y-d223684.html

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] Close-up of An Phu underpass, which will open to traffic in June](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/5adb08323ea7482fb64fa1bf55fed112)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

Comment (0)