US President-elect Donald Trump's import tariff policy has raised concerns about domestic production costs and inflation.

|

| Tariffs are a top concern for corporations after Donald Trump was elected the 47th President of the United States. (Source: South China Morning Post) |

Top concern

Tariffs have been a top concern for corporations at recent investor events and conferences following the election of Donald Trump as the 47th President of the United States. Reports from the November 19 meeting showed that prices would rise as tariffs increased. “We are concerned that increased tariffs will result in higher prices for our customers, while consumers will still feel the residual effects of inflation,” Walmart, the largest retailer in the United States, said in a statement.

President-elect Donald Trump has pledged to make tariffs a centerpiece of his economic agenda. Corporate executives say the solution is to continue efforts to diversify away from China, a top Trump goal.

Since early September 2024, representatives from nearly 200 companies in the S&P 1500 Composite Index have discussed tariffs in earnings reports or at investor conferences.

Lowe’s CFO Brandon Sink said nearly 40% of the company’s cost of goods comes from overseas, including direct imports and national brands supplied by partners. “When you look at the potential impact of tariffs, it’s pretty clear that manufacturing costs will increase,” he added.

Mr. Trump proposed a 60% tax on imported goods from China - the world's largest exporter - and a 10% or more tax on the remaining countries. The president-elect asserted that this was necessary for the US to reduce the trade deficit.

Oxford Economics estimates that a 60% tariff on Chinese goods could raise U.S. inflation by 0.7 percentage points, while tariffs in general would only raise inflation by 0.3 percentage points. Experts say the government will implement the tariffs slowly, but some analysts worry about the shock effects on the economy.

“The 47th Trump is not the 45th Trump,” said Brian Jacobsen, chief economist at Annex Wealth Management, adding that the president-elect’s proposal this time is “much more docile.”

|

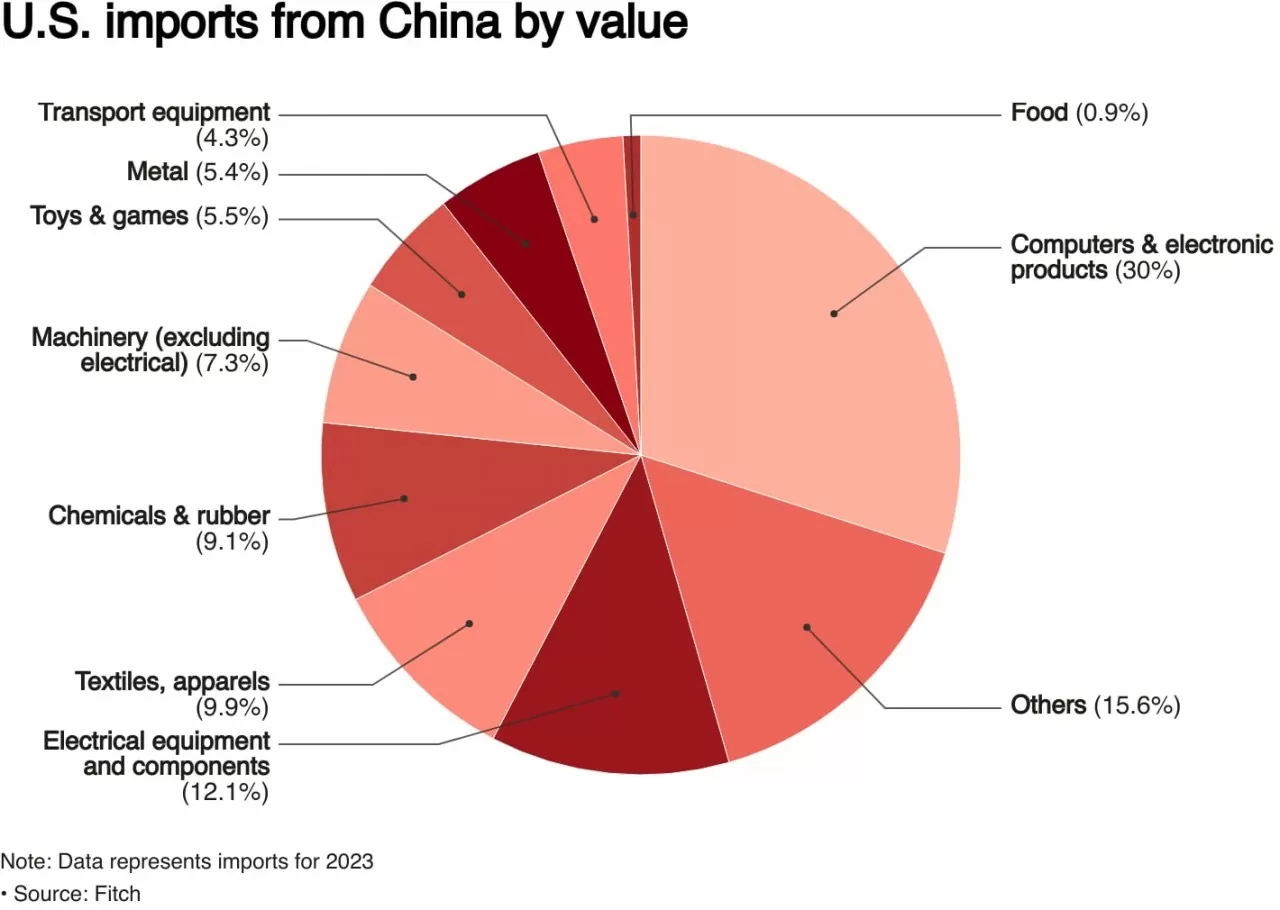

Computer products, electronics, electrical equipment and components account for nearly 50% of the total US imports from China. (Source: Fitch) |

Learn to adapt

According to the U.S. International Trade Commission, the top U.S. import sectors are electronics, transportation equipment, chemicals and minerals. According to the National Retail Federation, tariffs could increase the prices of clothing, toys, furniture, home appliances, footwear and travel goods, especially goods largely supplied by China.

“This is certainly one of the quickest things that can happen, with just one signature,” Stanley Black & Decker CFO Patrick Hallinan said at the Robert W. Baird investor conference last week. He said the tariffs currently cost the company $100 million a year, a figure that could double with the president-elect’s proposed tariffs.

To be sure, companies began shifting production out of China during both Trump’s first term and President Joe Biden’s tenure to boost America’s manufacturing capabilities.

U.S. Census Bureau data show that imports from China peaked at $538.5 billion in 2018 and will reach $433.3 billion in the 12 months ending in September 2024. Executives say businesses will be ready to respond by adapting to changes from the Covid-19 pandemic, a series of strikes and disruptions at key waterways such as the Panama and Suez Canals.

“We’ve had to go through a lot of disruption and challenges, and we’ve had to adapt, so we’re pretty good at managing those situations,” said Scott Roe, Tapestry’s chief financial officer.

Thus, President-elect Donald Trump's tariff policy is causing certain concerns for American businesses. However, companies are gradually adapting to be ready to deal with possible risks.

Source: https://baoquocte.vn/tam-diem-nong-bo-ng-trong-chien-luoc-kinh-te-cu-a-to-ng-thong-dac-cu-my-294556.html

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

Comment (0)