Vietnam Stock Exchange (VNX) - the parent company of Ho Chi Minh City Stock Exchange (HOSE) and Hanoi Stock Exchange (HNX) - has just announced its audited consolidated financial report for 2023 with profits continuing to record thousands of billions of VND.

Vietnam Stock Exchange to be established at the end of 2021

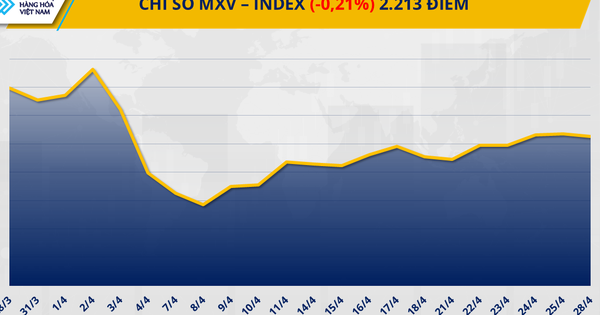

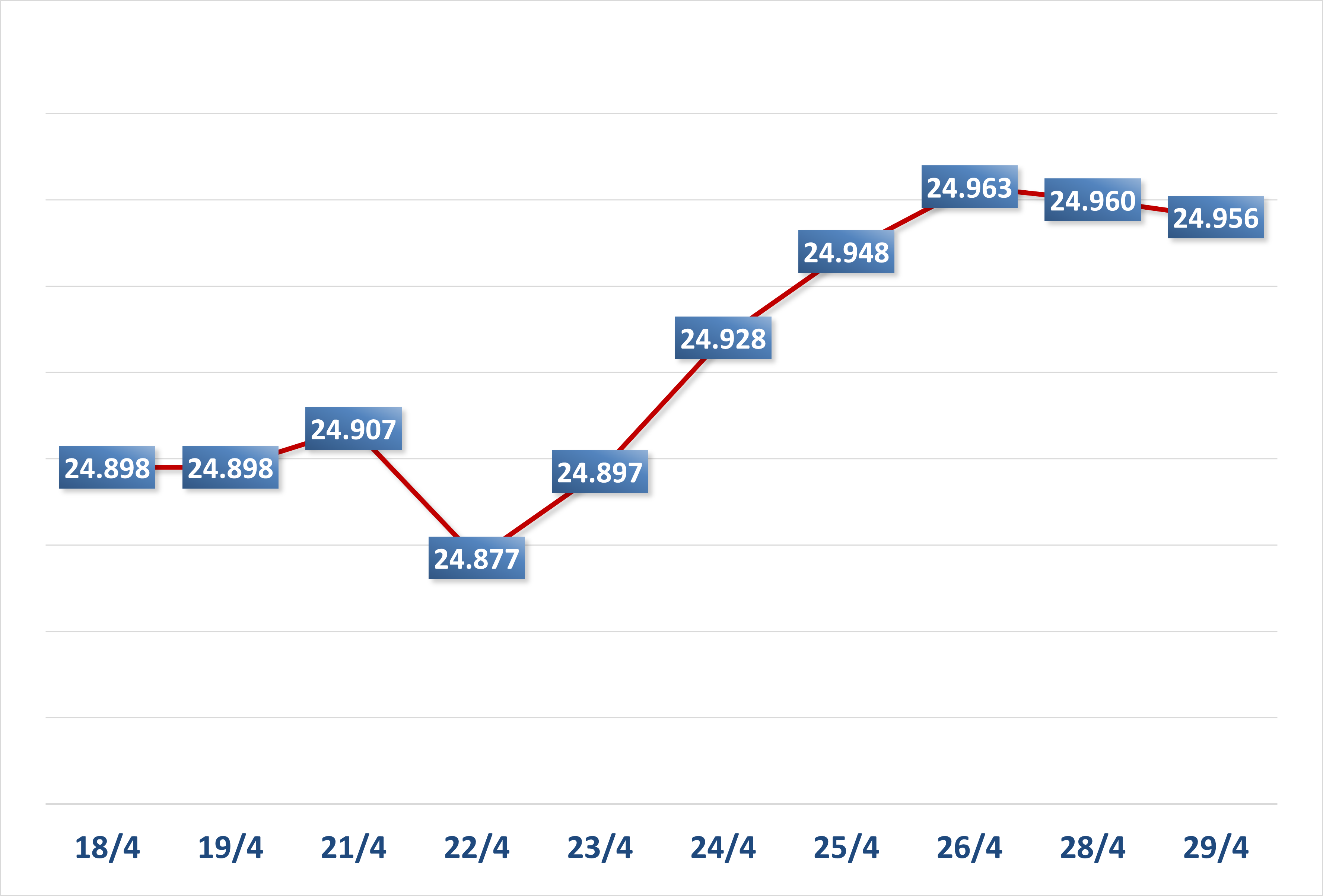

At the end of last year, VNX achieved revenue of more than 3,000 billion VND, down 10% compared to 2022. Of which, revenue from securities trading services reached 2,800 billion VND, equivalent to 92% of total revenue. In addition, revenue from financial activities reached 166 billion VND, up 47%, mostly interest on deposits and loans.

In terms of expenses, VNX does not record interest expenses or sales expenses. The most significant expense of the Vietnam Stock Exchange is business management expenses of VND 671 billion. At the end of 2023, VNX reported pre-tax profit of more than VND 2,400 billion and after-tax profit of more than VND 1,920 billion, down 8% compared to 2022. The total assets of the exchange reached nearly VND 4,000 billion, down slightly by 1% compared to the beginning of the year. VNX currently has nearly VND 2,000 billion in deposits and nearly VND 600 billion in cash and cash equivalents.

Vietnam Stock Exchange has a charter capital of VND3,000 billion, holding 100% of the charter capital of HOSE and HNX. In 2024, VNX plans to have a total revenue of nearly VND2,797 billion and a profit after tax of more than VND1,423 billion. In the first quarter of 2024, the exchange will achieve a total revenue of nearly VND585 billion and a profit after tax of nearly VND575 billion. Thus, after only the first quarter of the year, VNX has achieved 21% of the revenue target and 41% of the profit after tax target for the whole year.

Source: https://thanhnien.vn/so-giao-dich-chung-khoan-viet-nam-dat-gan-2000-ti-dong-loi-nhuan-185240531182539896.htm

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

Comment (0)