Semiconductor Manufacturing International Corporation (SMIC) has emerged as Beijing's secret weapon in breaking the US-led blockade aimed at curbing China's technological advancement, despite years of US sanctions.

The company's success in providing advanced 7nm chips to Huawei stunned the entire technology world.

SMIC's achievements are all the more surprising given more than a decade of US restrictions. SMIC was officially blacklisted in 2020.

The US Commerce Department is expected to impose broad controls on purchases of any equipment or software using US technology, but will continue to issue licenses to SMIC suppliers in certain cases.

US lawmakers and industry experts are now calling on the Biden administration to crack down further.

“If they don’t get tougher on SMIC, this policy doesn’t make any sense,” said Associate Professor Douglas Fuller from Copenhagen Business School.

The US government says its chip strategy is not aimed at China's smartphones but at the country's military capabilities.

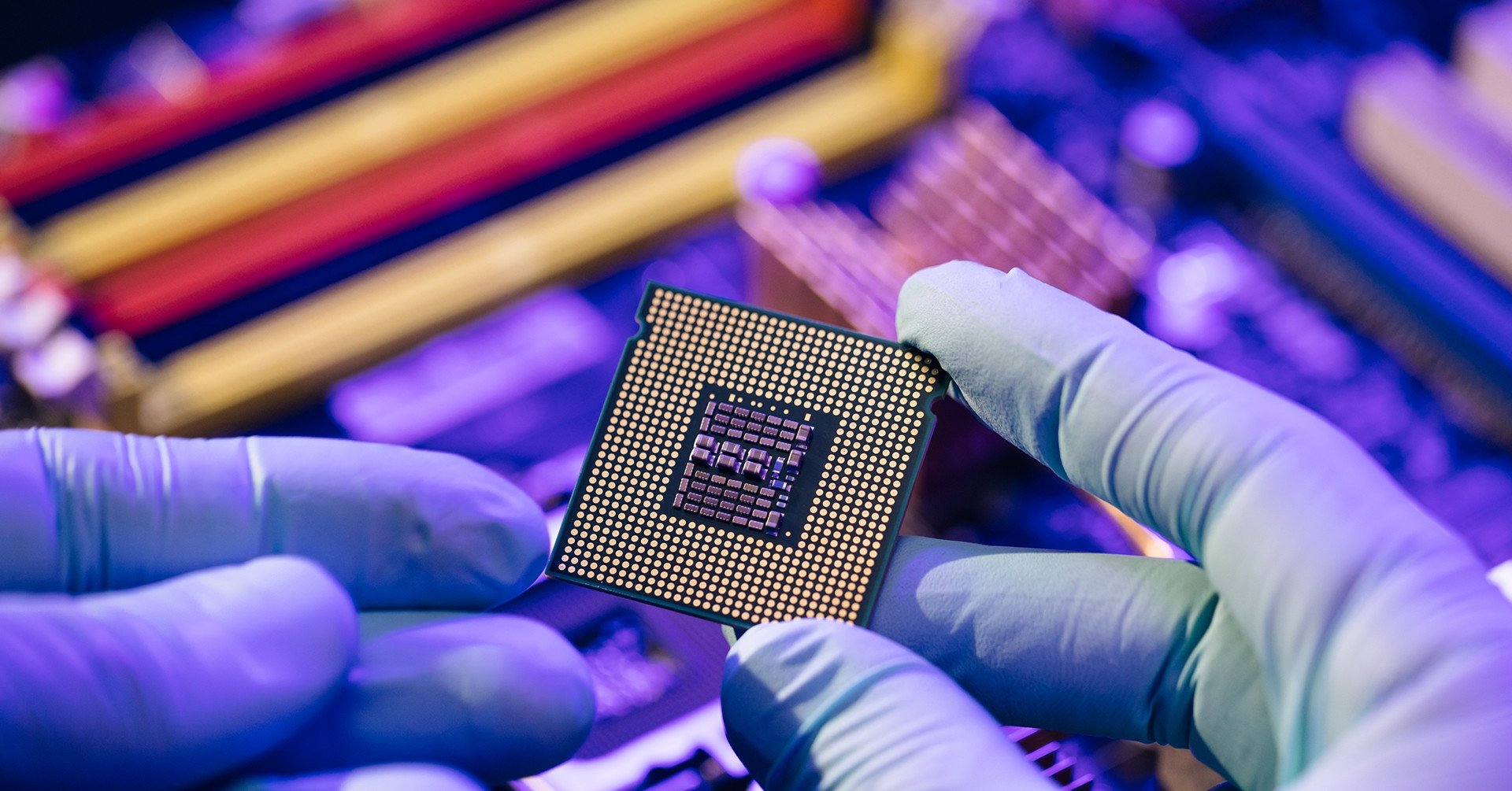

Semiconductors are the foundation of the technology industry, appearing in everything from artificial intelligence (AI) models and cloud computing to drones, tanks and missiles.

Since the Mate 60 Pro was launched, SMIC shares have increased by 22%, equivalent to $5 billion in capitalization.

The question for SMIC in the long term is whether it can produce sophisticated chips in large quantities. US Commerce Secretary Gina Raimondo said China lacks the capacity to produce such components “at scale”.

Still, industry experts like Burn J. Lin, former vice chairman of TSMC, argue the U.S. is underestimating its rivals' capabilities.

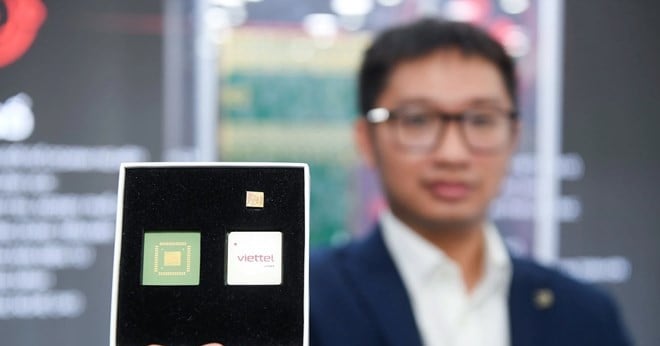

SMIC has stockpiled chipmaking machinery for years, including models of deep ultraviolet (DUV) lithography equipment from ASML of the Netherlands.

Bloomberg reported that SMIC has been manufacturing chips for Huawei on ASML’s DUV machines. Lin said SMIC could move toward 5nm chips using ASML equipment. Associate Professor Fuller shared the same view.

SMIC was founded more than two decades ago by Richard Chang, who was born in China, grew up in Taiwan (China) and then spent two decades at Texas Instruments (USA).

He built the chip company on barren land east of Shanghai. From the start, it was clear that the company was well positioned in China, with land incentives and tax breaks to support its ambitions.

SMIC surpassed rivals such as Hua Hong Semiconductor to become the country's top semiconductor maker.

As one of China's largest chipmakers, SMIC became a target of the US shortly after its establishment.

In 2005, Washington blocked SMIC's plan to buy $1 billion worth of chipmaking equipment from Applied Materials, fearing it would compete with Micron Technology.

That same year, Taipei fined its founder for violating investment laws when establishing SMIC. In 2009, a California court ruled that SMIC had illegally used TSMC's trade secrets.

SMIC has been working with Shanghai, Beijing and other cities such as Shenzhen to develop local manufacturing bases.

They quickly set up foundries across the country and competed with TSMC for contracts. The company began hiring Taiwanese executives and engineers to oversee the expansion.

SMIC's local relationships have helped cultivate a roster of big-name customers — including US giants from Qualcomm to Broadcom.

They also won backing from big funds, from the Big Fund – China's main semiconductor investment fund – to Singapore's sovereign wealth fund.

Then, in December 2020, the Trump administration blacklisted SMIC for allegedly aiding the Chinese military, meaning US companies would need a license from the Commerce Department to sell to SMIC.

Restrictions on SMIC were quickly tightened. In October 2022, the US announced landmark export controls, including limits on the sale of advanced chipmaking equipment to Chinese foundries that produce chips at 14nm or below.

Still, there are reasons why, while the US rules applied to domestic chipmakers immediately, the Biden administration took months to get the Netherlands and Japan on its side.

As a result, companies in these two countries, such as ASML and Tokyo Electron, can continue to sell advanced machinery to Chinese customers to stockpile equipment.

ASML is allowed to sell advanced DUV machines until the end of this year under government regulations.

In addition, the Commerce Department’s own regulations are complicated. Most foundry machines, like ASML’s DUV, can be used to make both embargoed chips and less advanced chips that are not.

According to Reuters , the Justice Department is looking into whether Applied Materials sold hundreds of millions of dollars of equipment to SMIC without proper licenses by shipping the equipment from the United States to South Korea and then to China.

SMIC may continue to be sanctioned by Washington, but its achievements have given hope to Beijing's strategy of building a more self-reliant tech industry.

“This marks a significant milestone in China’s semiconductor progress,” Bloomberg Intelligence analysts Charles Shum and Sean Chen wrote in a note. “The chip shows that China’s tech giant is moving forward, making progress in circumventing U.S. sanctions while quietly pursuing technological self-sufficiency.”

(According to Bloomberg)

Source

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)