Duc Giang Chemical Group Joint Stock Company (stock code: DGC) held its 2023 annual shareholders' meeting on March 29 in Ho Chi Minh City. This year's meeting was held at the Independence Palace. At the beginning of the meeting, Mr. Huyen started the song "Spring in Ho Chi Minh City".

The congress approved the plan for total consolidated revenue to reach VND 10,875 billion and after-tax profit to reach VND 3,000 billion, down 25% and 50% respectively compared to 2022.

According to Chairman of the Board of Directors Dao Huu Huyen, setting a low profit target is one of the preventive measures for the downward trend in yellow phosphorus prices in the market. With the above target, the businessman plans to pay dividends to shareholders in 2023 at a rate of 30%.

Chairman of the Board of Directors: Regarding buying stocks, I am currently also losing money.

Participating in the discussion at the general meeting, a shareholder said that he had bought DGC shares at the price of 140,000 VND/share, borrowed margin and is still holding. According to this shareholder's observation, there is a trend of foreigners selling DGC, causing the shares to not increase to their true value. The shareholder suggested that the management board invest and buy more DGC shares so that shareholders can feel secure in holding them.

Regarding this issue, Mr. Huyen said: "Our job is to ensure production and business and ensure the lives of our staff. We do not interfere with foreign investors and do not solve the sadness of shareholders. We all know that the stock market is volatile and no one thought that liquidity would decrease so sharply."

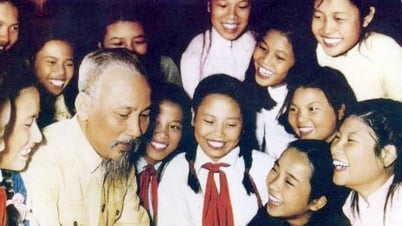

Mr. Dao Huu Huyen, Chairman of the Board of Directors of Duc Giang Chemicals (Photo: IT).

"We don't understand foreign investors. They once asked to buy 20% of DGC but we refused. As for buying shares, I am currently at a loss. I alone cannot fight the market," he added.

Sharing more at the congress meeting, Mr. Huyen said that he has no policy of buying shares because he does not want his family to control the shares and may sell them when appropriate. In many large corporations in the world, shareholders like Duc Giang holding 5-10% of the company's capital are considered large.

Still have 9,000 billion VND in cash

Another good sign, according to Mr. Huyen, is that despite having spent more than VND1,000 billion in dividends according to the Board of Directors' resolution, the group still has nearly VND9,000 billion in cash. It is rare for a company to accumulate such a large amount of cash, and this will be the basis for investing in projects such as the Nghi Son project and the Dak Nong NPK project.

According to the plan outlined for 2023, the enterprise plans to invest a total of 550 billion VND in basic construction, of which 50 billion VND will be used to complete the Dak Nong NPK factory and 500 billion VND to start the Duc Giang Nghi Son Chemical complex.

It is known that the Nghi Son project phase 1 is behind schedule. Explaining this, Mr. Dao Duy Anh, General Director, said that with the Nghi Son project, the delay is due to the fact that some residents in the area affected by 1,000 m to the project have not agreed, so far they have agreed to move out of the affected area. It is expected that by June this year, the residents will receive the money and relocate. According to the plan, it will be implemented in the second quarter of 2023. The project has made a big step forward in completing the environmental impact assessment, and it is expected that in April the Ministry of Natural Resources and Environment will approve the final version - a very important license for the chemical project to enter construction.

Another big project is the real estate project in Long Bien, which has been approved for 1/500 planning, but is currently stalled due to problems with the Housing Law, Land Law, and Environment. The company is working to resolve the problems.

In addition, this group also officially announced to become the parent company of Tia Sang Battery Joint Stock Company (stock code: TSB), with a 51% ownership ratio. The purchase of this company is not aimed at real estate because this group still has 6 hectares of land in Hanoi that has not been processed yet.

"Our goal is to expect to promote Tia Sang Battery to develop further. The ambition is to increase revenue to 1,000 billion VND, aiming to take advantage of Tia Sang Battery's platform to produce lithium batteries - a very important factor for today's electric vehicles," said Mr. Huyen.

The company also said it is starting to supply Coca-Cola globally, the world's largest consumer of food-grade phosphoric acid. In addition, the group is starting to tap the US market because of the huge demand there, and they are short of supply following trade tensions with China.

At the end of the meeting, shareholders approved the proposals. Regarding the dividend proposal, the general consensus was that the company would pay a cash dividend of 40% for 2022.

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] Close-up of An Phu underpass, which will open to traffic in June](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/5adb08323ea7482fb64fa1bf55fed112)

Comment (0)