Now, as it posts its first net profit in more than 10 years, CEO Datuk Captain Izham Ismail wants to write a new chapter – shaking off the airline’s troubled past and turning it into a well-run, consistently profitable airline, according to Bloomberg.

“The public has the impression that this is a sleepy airline,” Izham, CEO of Malaysia Aviation Group, the parent company of Malaysia Airlines, said in an interview. “But the new Malaysia Airlines is different, we are creating an aspirational organization.”

Malaysia makes first profit since 2014 double disaster

Izham said 2024 would be a "credible year" for the airline, as it wants to prove that consecutive years of operating profits were not a fluke due to soaring airfares and travel demand in the wake of the pandemic.

Malaysia Airlines has undergone five restructuring programs since the 1997 Asian financial crisis, and was delisted from the Malaysian stock exchange and privatized by sovereign wealth fund Khazanah Nasional Bhd after the twin disasters of MH370 and MH17 that killed 534 people.

The airline turned to two foreign bosses, Christoph Mueller, former CEO of Aer Lingus Group, and former Ryanair Holdings CEO Peter Bellew, to revive the business, but both lasted only about a year before Izham, who has been with the airline since 1979, took over in December 2017.

Former pilot Izham has led Malaysia Aviation Group - which derives most of its income from airlines - to post a net profit of RM766 million in 2023, its first since 2010.

Underscoring its resurgence, the airline last month signed a multi-year deal to become the commercial airline partner of English football club Manchester United. Izham said the deal was part of an existing marketing budget and was “dirt cheap” but did not disclose the price.

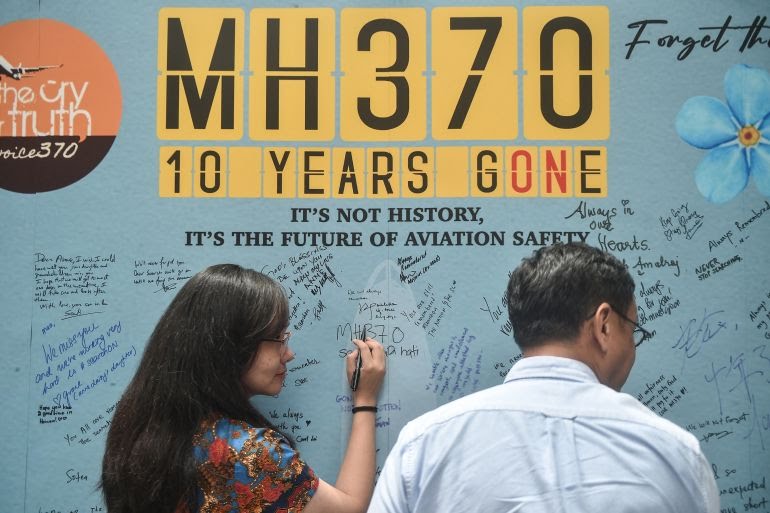

To this day, after 10 years, when talking about Malaysia Airlines, people always think of MH370.

Izham has drawn up plans aimed at taking Malaysia Airlines into the world's top 10 by the end of the decade, despite admitting its current products are "inferior" to premium segment leaders such as Singapore Airlines and Qatar Airways.

With RM5 billion (more than $1 billion) in cash reserves, Izham said the airline can start investing in its products – such as improving its fleet, catering and upgrading seats. There is also an additional RM2.3 billion unspent from Khazanah.

The company is also in the process of relisting but would need three consecutive years of net profits and a “stable appearance” before considering the move.

Source link

![[Photo] Ca Mau "struggling" to cope with the highest tide of the year, forecast to exceed alert level 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762235371445_ndo_br_trieu-cuong-2-6486-jpg.webp)

![[Photo] Government holds a special meeting on 8 decrees related to the International Financial Center in Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762229370189_dsc-9764-jpg.webp)

![[Photo] Comrade Nguyen Duy Ngoc holds the position of Secretary of the Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762234472658_a1-bnd-5518-8538-jpg.webp)

![[Photo] Ho Chi Minh City Youth Take Action for a Cleaner Environment](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762233574890_550816358-1108586934787014-6430522970717297480-n-1-jpg.webp)

Comment (0)