Sam Holdings JSC has just been reminded of the delay in disclosing information.

Ho Chi Minh City Stock Exchange (HoSE) recently issued a document reminding Sam Holdings JSC (HoSE code: SAM) about the delay in announcing information about personnel changes.

Accordingly, on August 9, 2023, HoSE received information about the dismissal of Mr. Nguyen Minh Tung from the position of member of the Board of Directors of Sam Holdings and the replacement of Mr. Pham Hong Diep. Effective from April 21, 2023.

According to the provisions of Clause 2, Article 10 and Clause 2, Article 11 of the Information Disclosure Regulations, the disclosure of unusual information must be made within 24 hours from the occurrence of one of the information disclosure events regarding changes, new appointments, reappointments, dismissals of insiders, etc. Thus, Sam Holdings has delayed the disclosure of information by nearly 4 months compared to the regulations. HoSE has reminded the company to comply with the regulations on information disclosure to ensure the rights of investors.

Second Quarter Profit Drops 87.7%, Financial Revenue Decreases While Interest Expenses Increase

Not only was HoSE repeatedly reminded about the delay in information disclosure, SAM's recent Q2 business results also showed a decline.

In the second quarter of 2023, SAM recorded net revenue of VND 492.5 billion, down 10.2% year-on-year. Cost of goods sold decreased by 10% to VND 454.4 billion. Gross profit reached VND 38 billion, gross profit margin reached 7.7%.

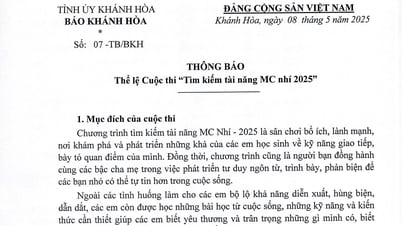

Sam Holdings (SAM) Q2 profit decreased by 87%, had to sell almost all securities portfolio in the first half of the year (Photo TL)

In the second quarter, SAM's financial revenue dropped sharply from 150.1 billion to only 35.4 billion VND, a decrease of 76.4%. According to the financial statement explanation, the decrease mainly came from other financial activities, down from 132.1 billion to only 17.1 billion VND.

Financial operating expenses also decreased by 73.6% to only VND26.9 billion. However, it is worth noting that the unit's loan interest increased from VND21.7 billion to VND23.3 billion. This shows that the company is temporarily cutting financial expenses but is increasing debt, causing interest expenses to not decrease but increase.

After deducting all expenses and taxes, SAM's profit after corporate income tax was only 6.3 billion VND, down 87.7% compared to the same period last year.

SAM sold almost all of its securities portfolio in the first half of 2023

At the end of the second quarter of 2023, SAM's total assets decreased slightly by 7.5% to VND 6,688.8 billion. Of which, cash and cash equivalents increased sharply to VND 423.5 billion.

Notably, SAM has sharply reduced its short-term financial investments, mostly trading securities. In the first half of 2023 alone, SAM sold nearly VND180 billion of its investment securities portfolio, reducing its assets to only VND29.4 billion.

In its investment securities portfolio, SAM has sold all Dong Nai Plastics (DNP) shares, Hoa Phat (HPG) shares, Military Joint Stock Bank (MBB), Song Da Urban Development Investment, and SSI Securities. Currently, SAM only retains 2 securities codes: Alphanam (ALP) with 7.2 billion and Song Da Urban Development and Industrial Park Investment (SJS) with 22.2 billion VND.

Regarding the capital structure of SAM Holdings, in the second quarter, this unit recorded a debt of VND 2,086.3 billion. Of which, short-term debt decreased from VND 1,156.8 billion to only VND 898 billion. Long-term debt decreased from VND 238.3 billion to VND 154.9 billion.

SAM's equity reached VND4,602.5 billion, not much fluctuation compared to the beginning of the year. Of which, undistributed profit after tax only accounted for VND73.5 billion.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)