Red covers the stock market after the holiday, foreign investors increase net selling

Many stock groups such as steel, technology, etc. have fallen sharply, so the Vietnamese stock indexes today (September 4) are all in red.

|

| FPT shares fell 1.34% and were one of the factors pulling the VN-Index down. |

After a 2.59% increase in August, although the market was somewhat quieter with a slight decrease in trading volume, entering the first trading session after the holiday, domestic investors received not so positive news from the world stock market.

The US stock market fell sharply in the trading session on Tuesday (September 3) as technology stocks continued to sell off and some gloomy economic data raised concerns about the health of the economy. At the closing time, the Dow Jones index lost 626.15 points, equivalent to a decrease of 1.51%, to 40,936.93 points. The S&P 500 index fell 2.12%, to 5,528.93 points. The Nasdaq index fell 3.26%, to 17,136.3 points. Nvidia stock attracted the most attention when it fell by 9.5%. Names in the same industry such as Micron, KLA, AMD also decreased in price. The effect spread, Asian markets such as Japan, Korea... were also immersed in red right at the opening of the session.

In the Vietnamese stock market, investor sentiment has become more pessimistic. Red covers most stock groups in the market. Recovery sometimes occurs but selling pressure is still too strong so the recovery is only moderate. Vietnamese stock indices in today's session all closed in red.

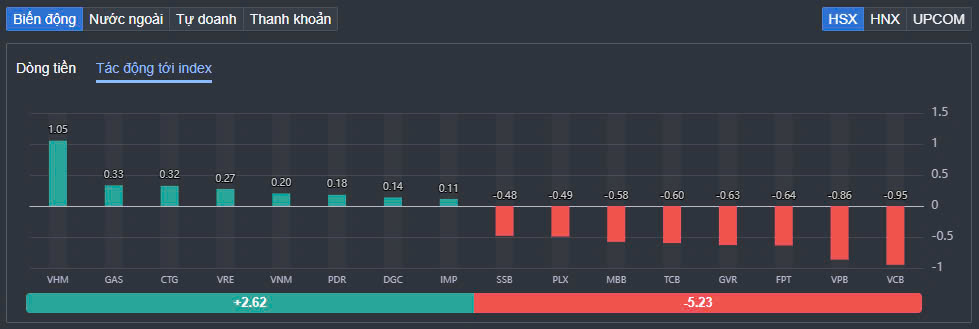

FPT was the most watched name in today's session when technology stocks in the US stock market fluctuated negatively. FPT at one point fell by more than 2.4%, but this code received support in the closing order matching session (ATC), so it closed the session down 1.34%. FPT was the third most negative stock on the VN-Index, taking away 0.64 points.

Meanwhile, stocks such as VCB, VPB, GVR, TCB, PLX… all decreased in price today and put strong pressure on the general market. VCB decreased by 0.76% and had the most negative impact on VN-Index with a loss of 0.95 points.

|

| VCB, VPB and FPT are three stocks that dragged the market down. |

Steel stocks had the most negative fluctuations in today's session, in which HSG decreased by 2.4%, NKG decreased by 2.06%, HPG decreased by 0.98%. Along with that, stocks in the textile group also traded quite badly when TNG decreased by 2.6%, MSH decreased by 2.44%, STK decreased by 2.1%... In the petroleum - oil and gas group, PLX suddenly decreased by 3.3%, codes such as PVC, PVD, OIL, BSR... also recorded a decrease of over 2%.

In the real estate group, NTL fell sharply by 4.89%, HPX fell by 3.45%. In addition, codes such as HAR, KBC, TIG, KHG... were all in red. However, the real estate group had a relatively strong differentiation when PDR reversed after a short period of price decline. At the end of the session, PDR increased by nearly 4%. In addition, CEO also increased by 3%, NLG increased by 2.44%... Notably, the stocks of the "Vin family" increased strongly with VRE increasing by 2.6%, VHM increasing by 2.4%... VHM was the stock that had the best impact on the VN-Index when contributing 1.05 points. VRE also contributed 0.27 points to this index.

In addition, pillar stocks such as GAS, CTG, VNM... also increased well in today's session and somewhat restrained the decline of the general market.

Meanwhile, the pharmaceutical group unexpectedly traded positively when IMP shares of Imexpharm Pharmaceuticals hit the ceiling price of VND93,900. The State Securities Commission announced that it had received the report on the issuance of shares to increase equity capital from owners' equity (bonus shares) according to the issuance report dated August 13, 2024 of IMP.

According to Imexpharm Pharmaceutical's previous report, the company's Board of Directors has approved the implementation of the plan to issue bonus shares at a rate of 100%, equivalent to the right exercise ratio of 1:1 (1 old share receives 1 right and 1 right receives 1 new share). The company plans to issue more than 77 million shares and the expected charter capital after issuance is more than 1,540 billion VND.

At the end of the trading session, VN-Index decreased by 8.07 points (-0.63%) to 1,275.8 points. The entire floor had 117 stocks increasing, 313 stocks decreasing and 49 stocks remaining unchanged. HNX-Index decreased by 1.42 points (-0.6%) to 236.14 points. The entire floor had 60 stocks increasing, 106 stocks decreasing and 53 stocks remaining unchanged. UPCoM-Index decreased by 0.42 points (-0.45%) to 93.75 points.

The total trading volume on HoSE alone reached 648.4 million shares (up 13% compared to the session at the end of last week), equivalent to a trading value of VND15,700 billion, of which negotiated transactions accounted for nearly VND2,000 billion. The trading value on HNX and UPCoM reached VND1,030 billion and VND523 billion, respectively.

Foreign investors increased their net selling with a value of up to 770 billion VND on the HoSE. The foreign investors' actions also put great pressure on investor sentiment.

|

| Foreign investors' moves also put great pressure on investor sentiment. |

Although DGC had a good increase in the first session, due to strong selling pressure from foreign investors, this stock could not maintain its excitement. In total, DGC was net sold by foreign investors for 142 billion VND. HPG and VPB were also net sold for over 100 billion VND. Codes such as FPT, MSN, HSG... were also strongly net sold by foreign investors. In the opposite direction, PDR was the strongest net bought with 50 billion VND. VNM and CTG were net bought for 47 billion VND and 38 billion VND respectively.

Source: https://baodautu.vn/sac-do-bao-trum-san-chung-khoan-sau-nghi-le-khoi-ngoai-day-manh-ban-rong-d224027.html

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

Comment (0)