Chuong Duong Beverage Company lost nearly VND20 billion in the first three months of the year and this is the 13th consecutive quarter of operating below cost price.

A recent financial report shows that Chuong Duong Beverage Joint Stock Company (SCD) had a revenue of about 56.8 billion VND, down 11% compared to the first quarter of 2022. Of which, revenue from investment real estate business doubled, reaching more than 6.2 billion VND but was not enough to offset the deficit in revenue from semi-finished products (down nearly 10 billion to 52.7 billion VND).

Financial revenue increased 10 times compared to the same period, reaching more than 1.1 billion VND. Most of it came from interest on deposits, loans, dividends and shared profits.

However, this part is not enough to cover fixed costs. Of which, financial costs increased 2.5 times to nearly 10 billion VND, all of which is interest. This enterprise has more than 609 billion VND in loans and financial leasing debt. In addition, selling costs also increased by 64%, mainly due to increased land rent.

In total, Chuong Duong Sarsaparilla lost nearly 20 billion VND after tax, 7 times higher than the same period last year. However, this level has decreased compared to the loss of the previous three quarters.

This is the 13th consecutive quarter that SCD has had a profit deficit. As of the end of the first quarter of 2024, the company's accumulated loss reached nearly VND218 billion, with negative equity of VND28.7 billion.

Earlier this month, the Ho Chi Minh City Stock Exchange (HoSE) announced the mandatory delisting of SCD shares from May 6. The reason is that the company has suffered losses for three consecutive years in the 2021-2023 period and its charter capital has fallen to a negative level.

Chuong Duong, formerly the Usine Belgique factory of BGI Group (France). This was the largest beverage factory in the South at the end of the last century. Chuong Duong's strength is carbonated soft drinks, of which the most stable consumption is the Sarsi product line. Thanks to this product line, business results in the period 2007-2016 were always stable with a profit of 20-30 billion VND per year.

However, while many beverage brands flooded the market, Sa Xi Chuong Duong was increasingly losing ground with old technology from the 2000s. After the parent company Sabeco was acquired by Thai people, SCD had a revival before the pandemic hit. The new management chose to save maximum operating costs and find solutions to improve sales by expanding distribution channels, investing heavily in packaging and promotions.

Last year, the company made efforts to cut and optimize costs. However, the business continued to be heavily affected by high input costs combined with difficult external economic conditions, with demand remaining lower than expected as unemployment increased.

Siddhartha

Source link

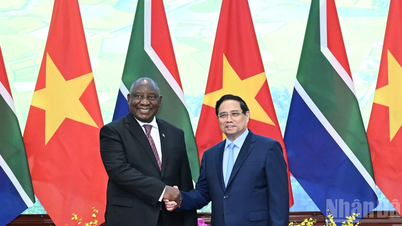

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)