Asia Commercial Joint Stock Bank ( ACB ; HoSE: ACB) ended the first half of 2023 with its main source of revenue increasing by 13% over the same period, bringing in VND 12,461 billion in net interest income.

Regarding non-interest income, only service income decreased by 17% to VND 1,432 billion, while other incomes all increased.

Of which, net profit from trading investment securities increased from 25 billion VND in the same period to nearly 407 billion VND in this period, net profit from trading business securities was at 115 billion VND, while in the same period, there was a loss of 237.8 billion VND, profit from foreign exchange trading increased by 71% to 765 billion VND.

During the period, the bank set aside nearly VND962 billion for credit risk provisions, while in the same period it reversed more than VND270 billion. After deducting expenses, ACB reported pre-tax profit of VND79 billion, a slight increase of 2% over the same period last year.

After deducting operating expenses, the bank earned a pre-tax profit of VND9,990 billion, up 11% over the same period last year. Compared to the plan of VND20,058 billion in pre-tax profit, ACB has achieved 50% after the first half of the year.

In the second quarter alone, ACB's net interest income reached nearly VND6,245.7 billion, up 11% over the same period. Non-interest income all grew positively, notably net interest income from trading investment securities increased from VND18 billion in the second quarter of 2022 to VND407.8 billion in the second quarter of 2023.

During the period, the bank set aside VND706 billion for provisioning expenses, while in the same period it was refunded VND267 billion. As a result, ACB's pre-tax profit was VND4,832 billion, down 2% over the same period.

As of June 30, 2023, ACB's total assets stood at VND630,893 billion, up 4% compared to the beginning of the year. Of which, deposits and loans at other credit institutions increased by 4% to VND89,763 billion, mainly from term deposits. Customer loans increased by 5% to VND434,031 billion.

Customer deposits increased by 4% compared to the beginning of the year to VND432,410 billion. Most of which were savings deposits of nearly VND262,998 billion, demand deposits of VND87,977 billion, term deposits of over VND79,234 billion and margin deposits of VND1,399 billion.

Regarding debt quality, ACB's bad debt increased by 11% compared to the beginning of the year to VND441 billion. The ratio of bad debt to outstanding loans increased from 2.12% to 2.3%.

ACB's bond portfolio only includes government bonds and bonds from other credit institutions, with no corporate bonds. ACB ends the first half of 2023 with an LDR ratio of 79%, and the ratio of short-term capital to medium- and long-term loans at 19%.

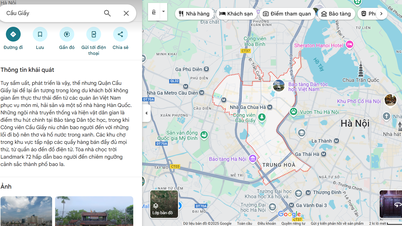

ACB stock price movements (Source: FireAnt).

In early June, ACB reported the results of its share issued to pay dividends for 2022. evident, the bank distributed more than 506.61 million shares, of which nearly 506.59 million shares were distributed to shareholders and 21,356 shares were processed in the form of odd shares. After this issuance, ACB's charter capital increased from VND33,774 billion to VND38,840 billion.

In addition to the above dividend shares, the bank also distributed a total of more than VND 3,777 billion in cash dividends to shareholders .

Source

Comment (0)