Retirement age increased

Article 169 of the 2019 Labor Code stipulates that employees who ensure the conditions on social insurance payment period according to the provisions of the law on social insurance are entitled to pension when they reach retirement age.

The retirement age of employees in normal working conditions is adjusted according to the roadmap until reaching 62 years old for male employees in 2028 and 60 years old for female employees in 2035.

From 2021, the retirement age of employees in normal working conditions is 60 years and 3 months for male employees and 55 years and 4 months for female employees; after that, it increases by 3 months for male employees and 4 months for female employees each year.

Thus, in 2024, the retirement age of male workers under normal conditions is 61 years old; female workers under normal conditions is 56 years and 4 months old (currently, the retirement age under normal conditions for male workers is 60 years and 9 months old, and for women is 56 years old).

The increase in the retirement age of workers will also change the conditions for receiving pensions in 2024.

Employees participating in compulsory social insurance under normal working conditions are entitled to pension if they fall into the following cases:

When retiring, have at least 20 years of social insurance contributions and reach retirement age (male 61 years old, female 56 years and 4 months old).

Having paid social insurance for at least 20 years, having worked in a heavy, toxic, dangerous or especially heavy, toxic, dangerous job for 15 years... The retirement age for men is not lower than 56 years old and for women is not lower than 51 years and 4 months old, except in cases where the law provides otherwise.

Have paid social insurance for at least 20 years, have worked in underground coal mining for at least 15 years. The retirement age for men is not lower than 51 years and for women is not lower than 46 years and 4 months.

Have paid social insurance for 20 years or more, infected with HIV due to occupational accident while performing assigned duties.

Female workers who are commune-level officials, civil servants or part-time workers in communes, wards or towns who participate in social insurance when retiring have from 15 years to under 20 years of social insurance contributions and are 56 years and 4 months old.

For workers participating in voluntary social insurance, they are entitled to pension when the retirement age for men is 61 years old and for women is 56 years and 4 months old; and they have paid social insurance for 20 years or more.

Only recruit foreign workers when Vietnamese workers cannot be recruited.

The Government issued Decree No. 70 amending and supplementing a number of articles of Decree No. 152/2020 regulating foreign workers working in Vietnam and recruiting and managing Vietnamese workers working for foreign organizations and individuals in Vietnam.

The Decree clearly states that from January 1, 2024, after failing to recruit Vietnamese workers for positions recruiting foreign workers, employers are responsible for determining the need to use foreign workers.

The announcement of recruitment of Vietnamese workers for positions expected to recruit foreign workers is made on the Electronic Information Portal of the Ministry of Labor, Invalids and Social Affairs (Department of Employment) or the Electronic Information Portal of the Employment Service Center established by decision of the Chairman of the province or city.

According to the Ministry of Labor, Invalids and Social Affairs, as of August 2023, there were more than 130,500 foreign workers working nationwide. Of these, the number of workers not subject to work permits was more than 10,300 people, the number of workers subject to work permits was more than 120,200 people (about 92%).

2% VAT reduction and global minimum tax

In November 2023, at the 6th session, the 15th National Assembly passed a resolution to reduce 2% value added tax (VAT) for groups of goods and services currently applying 10% VAT from January 1, 2024 to June 30, 2024.

These goods are not subject to special consumption tax: Telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products, goods and services subject to special consumption tax.

Also at this session, the National Assembly passed a resolution to apply additional corporate income tax according to regulations against global tax base erosion (global minimum tax).

According to the resolution, Vietnam will apply a global minimum tax from January 1, 2024. The applicable tax rate is 15% for multinational enterprises with a total consolidated revenue of 750 million Euros (about 800 million USD) or more in two of the four most recent years. Taxable investors will be required to pay the global minimum tax in Vietnam.

Through a review by the General Department of Taxation, there are about 122 foreign corporations investing in Vietnam affected by global minimum tax.

You can still register for permanent or temporary residence while staying at home.

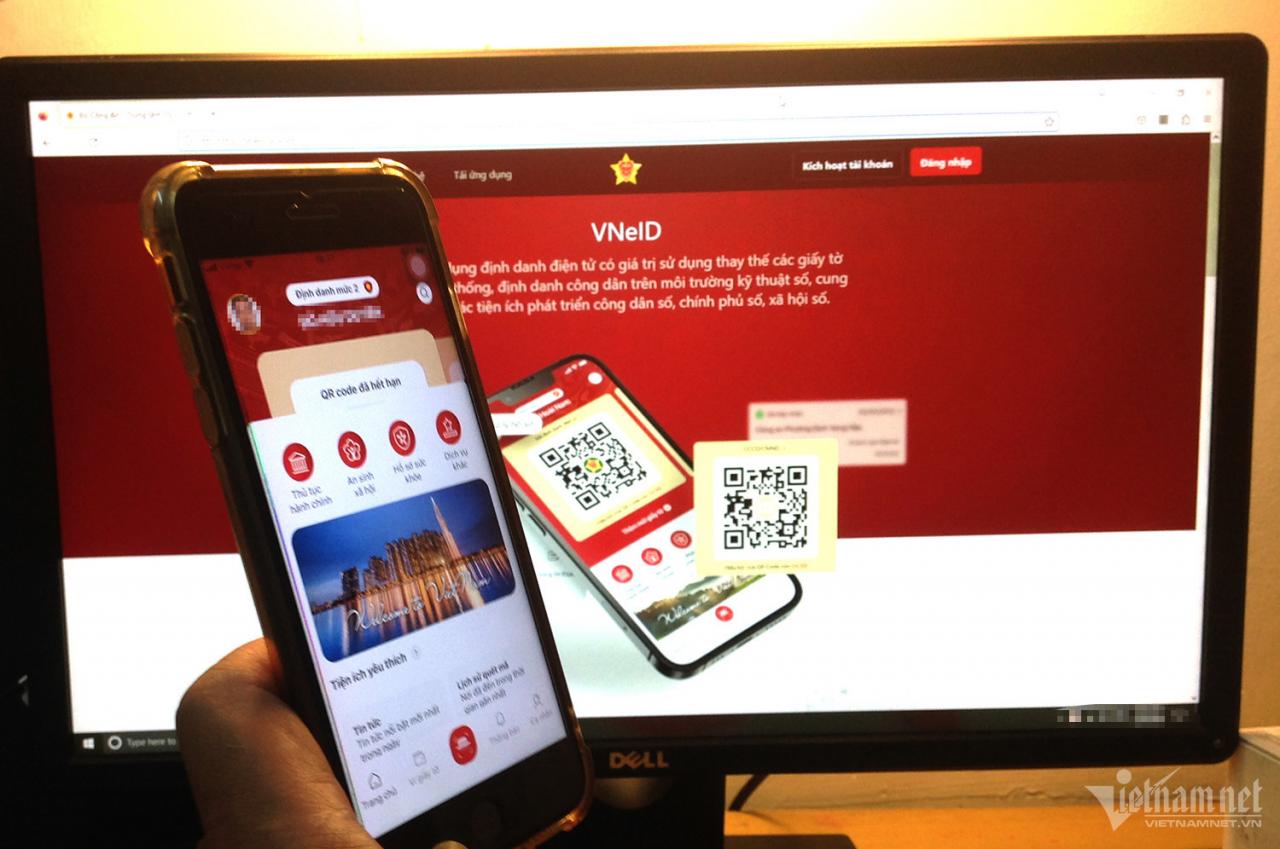

According to Circular 66 of the Ministry of Public Security on the process of residence registration, the forms of receiving residence registration applications from January 1, 2024 include: Directly at the residence registration agency; online via the public service portal or other online public services or via the VNeID application.

Meanwhile, the old regulation only stipulates the forms of receiving residence registration applications, including directly at the residence registration agency or online through the national public service portal, the Ministry of Public Security or residence management.

In addition, people can also reflect information about the residence of citizens and households and confirm information about residence through the VNeID application.

Millions of civil servants, public employees and workers get salary increases in the new year.

Source

![[Photo] 60th Anniversary of the Founding of the Vietnam Association of Photographic Artists](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764935864512_a1-bnd-0841-9740-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man attends the VinFuture 2025 Award Ceremony](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764951162416_2628509768338816493-6995-jpg.webp&w=3840&q=75)

Comment (0)