Nam A Bank achieved positive profits in the first half of this year - Photo: NAB

In 6 months, Nam A Bank achieved a profit of more than 2,200 billion VND

In the first 6 months of 2024, the world economy continued to face many difficulties, with inflation and interest rates remaining high. In this context, the Government and the State Bank of Vietnam (SBV) have implemented a series of solutions to stabilize the macro-economy and control inflation.

Under the flexible and timely management of the State Bank, commercial banks, including Nam A Bank, continue to operate stably and maintain sustainable development momentum.

As the only bank in the banking system to have its shares listed on HoSE in the past 6 months, Nam A Bank continues to affirm its sustainable development with positive operating results.

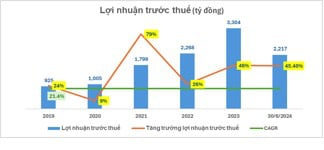

NAB's first-half profit increased by more than 45.4% compared to the same period in 2023 - source: Nam A Bank Financial Statement

In particular, pre-tax profit in the first 6 months of 2024 broke through, reaching more than 2,200 billion VND, completing more than 55% of the 2024 plan. Total assets of Nam A Bank reached more than 228,000 billion VND, completing 98.7% of the 2024 plan. Safety indicators on operations exceeded the regulations of the State Bank...

Specifically, Nam A Bank's pre-tax profit in the first 6 months of 2024 reached VND 2,217 billion, an increase of 45.4% over the same period in 2023, completing 55.4% of the 2024 plan.

As of June 30, Nam A Bank's total assets reached more than VND 228,000 billion, an increase of 14.3% over the same period in 2023, completing 98.7% of the 2024 plan.

Capital mobilized from residents and economic organizations grew well, reaching nearly 173,000 billion VND, an increase of more than 9.4% over the same period in 2023, completing 97.1% of the 2024 plan.

Outstanding customer loans grew in line with the credit growth limit licensed by the State Bank of Vietnam, reaching nearly VND 157,000 trillion, up 21.2% over the same period in 2023...

Powerful digital transformation and continuous expansion of operations

Notably, this is the second consecutive quarter that Nam A Bank has recorded a profit of more than VND 1,000 billion/quarter. Of which, net interest income increased by VND 834 billion, equivalent to an increase of 27% compared to the same period in 2023.

(Source: Nam A Bank Financial Statements)

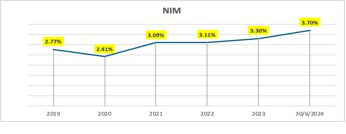

The positive point is that Nam A Bank's NIM grew well at 3.7% in the context of narrowing interest rate margins for customer deposits and loans, thanks to optimal solutions for profit-generating asset structure and mobilization structure.

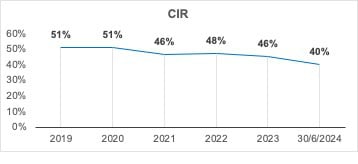

NAB's cost/total operating income ratio (CIR) in Q2-2024 has improved effectively, with Q2 CIR approaching 40% - the lowest level in the past 5 years.

For many years, Nam A Bank has been strongly transforming digitally as well as expanding its operations across provinces and cities nationwide. Although operating costs have increased, CIR has gradually improved over the years.

(Source: Nam A Bank Financial Statements)

Furthermore, the operational safety indicators far exceed the regulations of the State Bank. Nam A Bank has also complied with liquidity indicators and completed the implementation of risk management standards according to Basel III standards.

Capital safety ratio CAR reached over 11.38% (minimum according to SBV regulations is 8%). Loan balance ratio to mobilized capital LDR reached 76.06% (maximum according to SBV regulations is 85%).

LCR liquidity reserve ratio 17.35% (minimum as regulated by SBV is 10%). 30-day VND solvency ratio reaches over 73.41% (minimum as regulated by SBV is 50%).

Ratio of short-term capital for medium and long-term loans is 14.13% (maximum according to State Bank regulations is below 30%).

Bad debt is well controlled

Nam A Bank's business results in the first 6 months of 2024 grew positively - Photo: Nam A Bank

Nam A Bank still maintains a stable and safe liquidity strategy. Bad debt is well controlled according to the regulations of the State Bank (down 0.15 percentage points compared to the same period in 2023).

In the first and second quarters, Nam A Bank has made many important marks in the market such as: Moody's upgraded Nam A Bank's credit rating in two categories: asset quality from B3 to B2.

The profit and profitability indexes were upgraded from B2 to B1, while the issuer's outlook was upgraded to "stable".

Developing green credit is one of the key activities that Nam A Bank actively implements and completes the handover of the ESMS environmental and social risk management system with Pacific Risk Advisors LTD (PRA).

This marks an important stepping stone in implementing and perfecting the pillars to reach Level 5 Green Bank…

Nam A Bank representative said that in the challenging market context, Nam A Bank has implemented the right strategy with high adaptability to create sustainable growth momentum in the first 6 months of 2024.

This is also an important premise for Nam A Bank to complete its goals for the year, soon realizing its strategy of entering the top 15 strongest banks in Vietnam.

Source: https://tuoitre.vn/quy-2-2024-nhieu-chi-tieu-kinh-doanh-cua-nam-a-bank-sap-ve-dich-20240731160448404.htm

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)