| PMI May 2024: Vietnam's manufacturing sector improves slightly What to do to improve the manufacturing sector's ranking? |

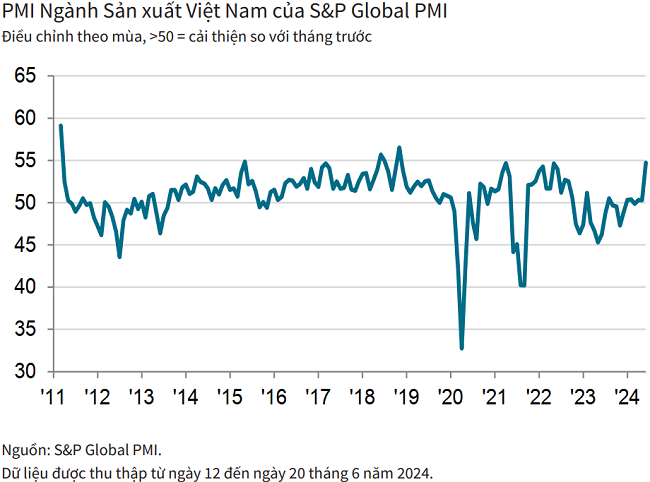

On July 1, 2024, S&P Global released the Vietnam Manufacturing Purchasing Managers' Index (PMI) report for June 2024, with three highlights: The number of orders increased the most since March 2011; employment grew again and output prices increased at the fastest rate in two years.

|

Growth in Vietnam’s manufacturing sector accelerated sharply at the end of the second quarter, with new orders rising at one of the fastest rates on record, allowing companies to increase output and purchasing activity, and increase staffing levels for the first time in three months.

Specifically, the S&P Global Vietnam Manufacturing PMI rose sharply to 54.7 points in June, compared to 50.3 points in May. The index results not only showed the health of the manufacturing sector improving for the third consecutive month, but also showed that business conditions had strengthened significantly. In fact, the improvement in operating conditions was one of the two strongest since November 2018, equivalent to the levels recorded in April 2021 and May 2022.

The sharper improvement in business conditions mainly reflected increases in both output and new orders at mid-year.

In particular, new orders rose to a level only slightly below that recorded in the first month of survey data collection in March 2011. Reports suggested that demand had improved as some customers returned to request additional orders during the month.

In some cases, competitive pricing helped firms secure new orders. Meanwhile, new export orders rose at the fastest pace since February 2022, although the rate of increase was much slower than that of total new orders.

New orders rose at a faster pace than manufacturing output, with June recording the strongest increase in output for more than five and a half years.

Firms also increased their purchasing activity, with input purchases rising for the third month in a row and at the fastest pace since June 2022. However, inventories of purchases continued to fall as inputs were used for production. Similarly, stocks of finished goods fell as stocks were moved to meet sales demand. Moreover, post-production inventories fell by the most in three years.

Input cost inflation accelerated for the third straight month in June and hit a two-year high, S&P Global said. There were reports of rising transportation costs, along with rising oil and import costs. To compensate, manufacturers raised their selling prices by the largest amount since June 2022. The increase in selling prices was recorded for two consecutive months.

|

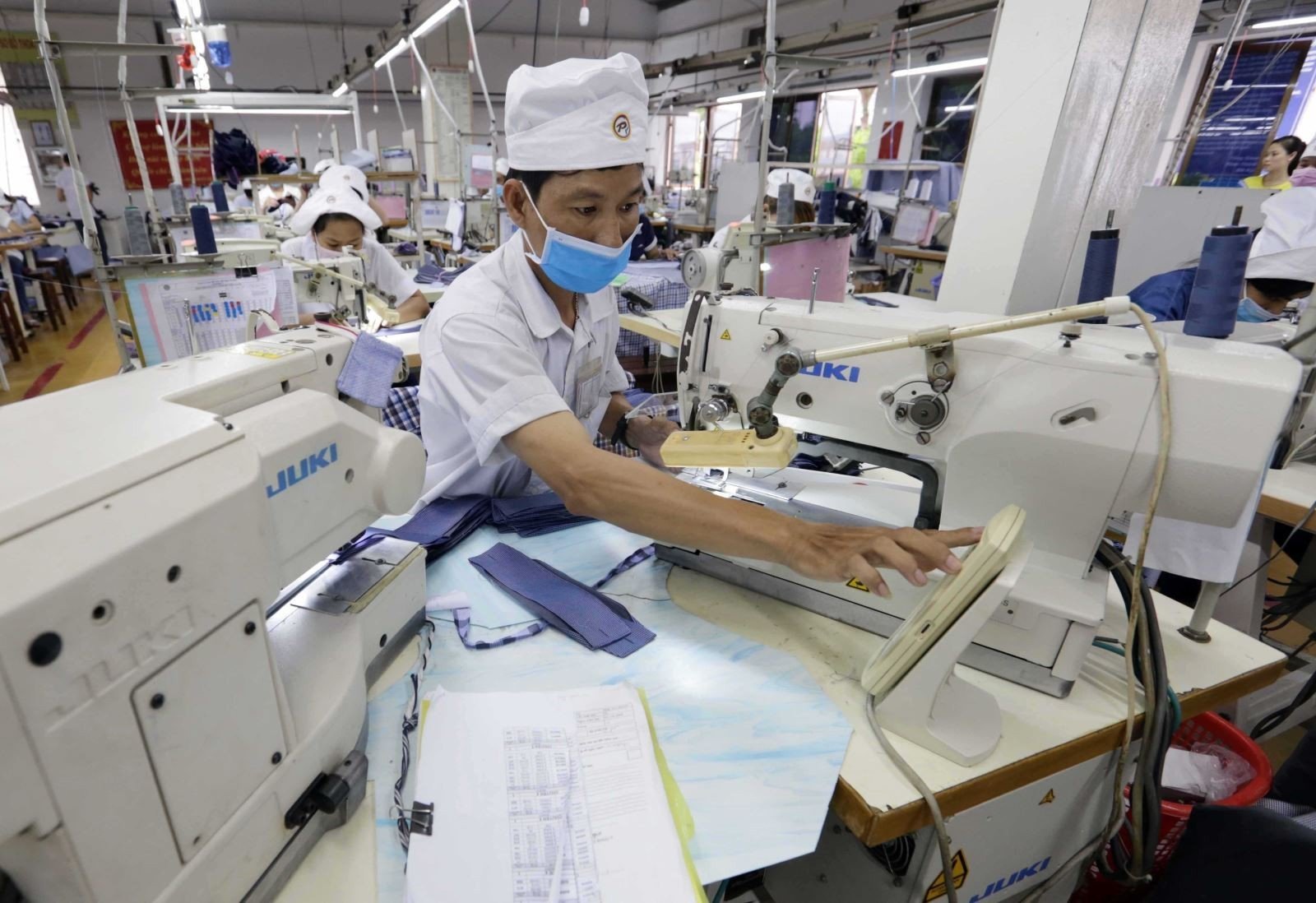

| Vietnam's manufacturing sector grew strongly by the end of the second quarter of 2024. |

Increased availability of raw materials helped suppliers speed up deliveries in June. Lead times shortened for the first time in 2024 so far. However, the improvement in sellers’ performance was only marginal as international shipping difficulties persisted.

The outlook for favourable business conditions continued to support business confidence about the outlook for manufacturing output over the coming year. Business sentiment hit a three-month high with around half of survey respondents forecasting growth.

Commenting on the survey results, Andrew Harker, Chief Economist at S&P Global Market Intelligence, said: “Vietnam’s manufacturing sector returned to activity mid-year, overcoming the relatively modest growth seen in recent months, driven by a rapid increase in new orders. The sharp increase in new orders has exposed staff shortages in some companies and led to increased workloads. In response, companies have been hiring more staff.

The strong growth was accompanied by rising costs, particularly as higher transport costs pushed input prices to a two-year high. Rising inflation could dampen demand in the future, but for now firms will enjoy a rise in new orders in June.

Source: https://congthuong.vn/pmi-tang-len-547-diem-nganh-san-xuat-viet-nam-cai-thien-manh-me-329453.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)