|

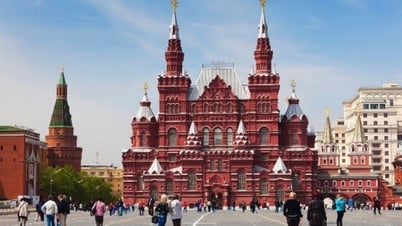

| Some politicians claim that the worst of Europe's energy crisis is over. (Source: Reuters) |

In an article on The Conversation , Professor Michael Bradshaw, who specializes in global energy at Warwick Business School (UK), said that the unexpected energy shock after Russia's special military campaign in Ukraine last year raised concerns that Europe's energy infrastructure would not be able to cope with the cold winter and could potentially cause economies to collapse.

However, a mild winter, coupled with swift measures by the European Union (EU) to reduce energy consumption and wean itself off dependence on Russian fuel, "has left the region shaken but not broken".

The International Energy Agency (IEA) has warned that at the moment, a combination of factors could “easily exacerbate tensions in the gas market.” Prices have fallen and the EU is working to fill its gas storage capacity, but major uncertainties remain over the coming winter, according to its latest annual gas market report.

It's too early to be confident.

Gas prices in the 27-member bloc have been falling since June 2022. Last year, countries dependent on Russian gas, such as Germany and Italy, quickly “turned the corner” away from Moscow, said Professor Michael Bradshaw. Since then, there has been more good news for the EU.

Energy prices will fall “steadily” into 2023 and Europe’s gas reserves are on track to reach the 100% capacity target by November.

Some politicians claim that “the worst of the energy crisis is over”, but, Mr Bradshaw finds, “it is a bit early to be so confident”.

The IEA report pointed out that the cold winter combined with a complete shutdown of Russian gas supplies could bring new disruptions to the European market. The agency asserted: “Adequate storage facilities are no guarantee against winter market volatility.”

The “very volatile” situation could lead to a sharp rise in energy prices later this year, analysts told CNBC.

The market has been “relentlessly volatile” in recent months due to factors such as extreme temperatures and maintenance at gas plants, the news site said. Industrial activity at major liquefied natural gas (LNG) facilities in Australia has also had a knock-on effect on the European gas market.

While most of Australia's gas is exported to Japan, China and South Korea, the disruption "could lead to Asia and Europe competing" for gas from other suppliers.

Lower gas consumption and filling of storage facilities have “helped prevent gas prices from spiking to an extraordinary peak last summer of 340 euros per megawatt hour,” CNBC added.

Ana Maria Jaller-Makarewicz, energy analyst at the Institute for Energy Economics and Financial Analysis, said in a research note that because of the uncertainty in Australia, Europe should brace for more volatility in energy markets.

To avoid a spike in gas prices, Europe must hope for a mild winter in the next two or three years and no major disruptions to existing supplies, says Professor Michael Bradshaw.

He pointed out that gas prices in Europe remain about 50% higher than the average level before the special military operation in Russia broke out.

|

| Energy crisis: 'Gold mine' discovered in forgotten places, Europe |

Actively exploit new flows

Europe's energy crisis last winter "got worse" when "major electricity exporter" France was forced to shut down more than a dozen nuclear reactors, Bloomberg News reported.

But Electricite de France SA, the French multinational power company, said it had “overcome problems that caused energy production to be cut by nearly a quarter in 2022,” raising hopes that European households and businesses will not have to worry too much about power shortages this year.

In the UK, Ofgem chief executive Jonathan Brearley also called on ministers to implement a "more stringent framework" to protect consumers from rising energy prices.

Mr Brearley told The Guardian that the energy price cap was a “broad and crude” mechanism that was “no longer fit for purpose”, with record numbers of consumers already in debt to their energy suppliers.

The Wall Street Journal reports that new, neglected energy markets, such as offshore Congo and Azerbaijan, are experiencing a boom in gas exploration.

In Bir Rebaa, deep in the Sahara, Italy's Eni and Algeria's state-owned energy company are drilling dozens of wells. In recent months, they have been searching for and focusing on gas production from previously untapped deposits.

Three pipelines under the Mediterranean Sea connect Algeria’s vast gas reserves to Europe. Over the past decade, Russian gas giant Gazprom has kept energy prices low, squeezing suppliers like Algeria out of the European market.

Algerian officials are currently negotiating new gas contracts with buyers in Germany, the Netherlands and other EU countries.

Meanwhile, Eni is investing heavily in production in Algeria. The government is also in talks with American giants Chevron and Exxon Mobil about agreements for gas production there.

In addition, a BP-led consortium is boosting gas production in Azerbaijan. A series of pipelines spanning more than 3,000 km from Azerbaijan to Italy promises to double gas supplies to Europe by 2027.

The EU hopes the new flow will provide a major boost to the energy sector over the next three years – a period when officials and analysts fear the supply crunch will be at its most intense.

At the same time, many people also predict that the new gas supply will help cool down energy prices, thereby helping Europe once again "avoid" an energy crisis this winter.

Source

![[Photo] 60th Anniversary of the Founding of the Vietnam Association of Photographic Artists](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764935864512_a1-bnd-0841-9740-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man attends the VinFuture 2025 Award Ceremony](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764951162416_2628509768338816493-6995-jpg.webp&w=3840&q=75)

Comment (0)