From a helicopter purchased for 1.5 million USD for personal use, Ibrahim became involved in the helicopter rental industry and took the number 2 market share in Asia.

“Ten years from now, we want to be the largest helicopter operator in the world ,” declared Syed Azman Syed Ibrahim, 63, Chairman of Weststar Aviation Services.

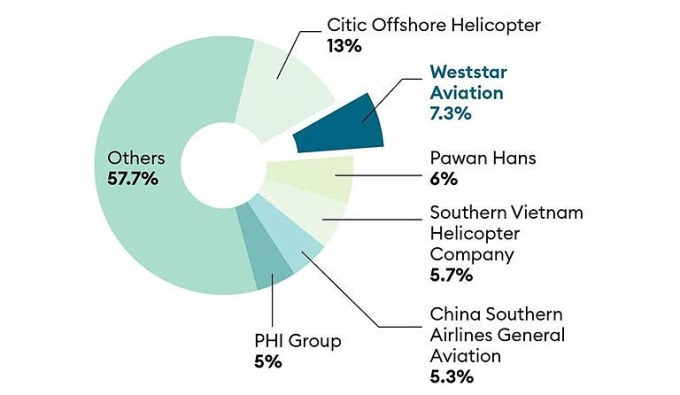

Part of Weststar Group, of which Ibrahim is the CEO, Weststar Aviation Services is the second-largest offshore helicopter operator in the Asia- Pacific , according to Indian market research firm Imarc. The company has 34 helicopters and ordered five more in May.

Weststar helicopters are used to transport executives and personnel for the oil and gas industry, for survey operations, and for medical evacuations in locations that are difficult or inaccessible by other forms of transport. The company has operations in Southeast Asia, the Middle East, and Africa.

They have major clients such as Malaysia's state oil company Petronas and Western oil giants such as Shell and ExxonMobil. Weststar Aviation Services also has a separate division, Weststar General Aviation, which owns two planes and a helicopter for VIP services.

Syed Azman Syed Ibrahim, Chairman of Weststar Aviation Services. Photo: Forbes

Before setting big ambitions in the helicopter service industry, Ibrahim came from the Malaysian military and his Weststar Group was also doing business in other areas such as car dealerships and F&B.

Syed Azman Syed Ibrahim entered the business world in 1994 after serving 13 years as an officer in the Royal Intelligence Corps of the Malaysian Armed Forces. He started his business by investing 200,000 ringgit to import used luxury cars from Europe to sell in Malaysia. In 2002, he became a Honda distributor. In 2011, he imported Maxus cars from China for distribution.

Ibrahim got into aviation in 2002, when he bought a helicopter for $1.5 million, primarily for personal use. But he quickly became interested in learning about the costs and legal requirements of operating helicopters commercially.

He decided to expand after seeing the huge potential for helicopter services in the oil and gas sector. Malaysia is the second-largest oil and gas producer by volume in Southeast Asia, according to the U.S. Energy Information Administration. By 2011, he had 11 helicopters and received funding from KKR two years later.

By March 2023, Ibrahim had acquired 21% of Weststar Aviation Services from KKR to own 100% of the company. In this deal, the company was valued at 4 billion ringgit ($890 million). Mr. Ibrahim ranked 24th in the list of 50 richest people in Malaysia with an estimated net worth of $825 million.

According to a report from German research firm Research & Markets, the global offshore helicopter services market size is expected to increase from 2.5 billion USD in 2022 to 3.1 billion USD in 2028.

Ibrahim plans to invest $250 million to increase the number of helicopters it owns and leases by nearly 30% over the next two years. His fleet will consist mainly of medium-sized aircraft made by Airbus and Italy's Leonardo.

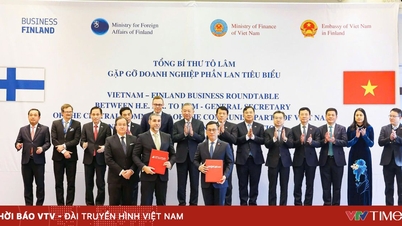

At the same time, to reduce dependence on Malaysia, he is actively looking for new markets. "We are looking for strategic investors who can help us grow overseas," he said. He has recently had discussions with a few investors in the Middle East.

In March, the company entered into a partnership with Helicopter & Cooperation SAS, a joint venture between Avico Group (France) and Westair Aviation (Namibia). The agreement allows the company to expand its presence in the oil and gas industry in Europe and Africa. Ibrahim is particularly interested in Namibia, Equatorial Guinea and Mauritania in Africa; as well as Guyana on the northern coast of South America and Suriname in Indonesia.

The company is also expanding its government leasing business. This year, it leased four helicopters to the Royal Malaysian Air Force. Four more will be delivered in early 2024, while three others will be contracted to the Malaysian government. Under the agreements, the air force and government operate the aircraft, but they are owned and maintained by Weststar Aviation Services.

Market share of offshore helicopter charter services in Asia-Pacific. Source: Imarc

Matthieu Guisolphe, Southeast Asia business director of Hong Kong-based aviation consultancy Asian Sky Group, said Weststar Aviation Services is a long-standing and experienced company. "They are a reputable helicopter operator with a modern fleet," he said.

There are, however, some challenges to Ibrahim’s ambitions. Dennis Lau, director of consulting services at Asian Sky Group, said many companies in the industry are also racing to expand their reach. “The helicopter services market is very fragmented and competitive, especially when bidding for oil and gas contracts,” he said. Finding the right partners is also not easy.

Apart from helicopter services, Ibrahim’s automotive business had consolidated revenue of 315 million ringgit last year. He is the exclusive distributor of Chinese Maxus vehicles in Malaysia through Weststar Maxus. Ibrahim plans to open more dealerships to boost distribution of Maxus electric and hybrid vehicles, which he expects to account for 20% of Maxus sales this year. Weststar Auto is also a Honda dealer.

In the F&B sector, Ibrahim’s eldest son, Syed Muhammad Arif, manages nine Wolf & Turtle coffee shops in Malaysia and plans to triple the number of outlets by 2025. In total, three of Ibrahim’s seven children and a son-in-law are involved in the sector. Ibrahim also has the Absolute Thai chain located in shopping malls in Thailand.

Commenting on reports that Weststar Aviation Services is considering an IPO, Ibrahim said the company is in no rush. "We will only do it when the time is right."

With his goal of becoming the world’s largest helicopter operator, he may face stiff competition. Some of the industry’s top players operate more than 200 aircraft. But Ibrahim is unfazed, saying the key isn’t who has the most helicopters. “It’s also about who has the best pilots, the best engineers, the best safety record and a reasonable profit,” he said.

Phien An ( according to Forbes )

Source link

![[Photo] Lam Dong: Images of damage after a suspected lake burst in Tuy Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/02/1762078736805_8e7f5424f473782d2162-5118-jpg.webp)

![[Photo] President Luong Cuong receives US Secretary of War Pete Hegseth](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/02/1762089839868_ndo_br_1-jpg.webp)

Comment (0)