The group has been dominating Asia and Europe for nearly 200 years, doing business in everything from opium, tea, cotton to cars, real estate... and continues to pour money into famous leading corporations in Vietnam.

Asia's No. 1 'Trader' Chooses Vietnam's Leading Enterprises

From trading opium, tea, spices, cotton,... for decades, the giant Jardine Matheson has expanded its investment to many other fields, including automobiles, real estate,... in Southeast Asian countries, including Vietnam.

Through its Singapore-based subsidiary Jardine Cycle & Carriage (JC&C), Jardine Matheson focuses on the automotive distribution sector. In Vietnam, Platinum Victory - a subsidiary of JC&C - has invested heavily in Thaco of billionaire Tran Ba Duong, REE Corp. (REE) of Ms. Nguyen Thi Mai Thanh and Vinamilk (VNM) of Ms. Mai Kieu Lien.

Accordingly, JC&C started participating in Thaco since 2008 with 20.5% and continued to buy more shares issued to strategic shareholders of this "giant" in the Vietnamese automobile industry. JC&C increased its holding ratio in the group to 26.6% from 2019.

At the end of 2023, JC&C will purchase about 350 million USD of Thaco's convertible bonds. These bonds mature in 2028, so JC&C's stake in Thaco will continue to increase.

In 2012, JC&C also invested in holding more than 10% in Refrigeration Electrical Engineering Corporation (REE) through the Platinum Victory investment fund. JC&C then increased its ownership ratio in REE and recently exceeded the 35% threshold.

On November 22, Ms. Nguyen Thi Mai Thanh resigned from the position of Chairwoman of REE Board of Directors and moved to the role of General Director after 31 years in the top leadership position of the leading enterprise in the field of electromechanical engineering in Vietnam. Replacing Ms. Mai Thanh is Mr. Alain Xavier Cany - representative of Platinum Victory Fund.

This fund has just registered to buy an additional 30 million REE shares with a total value of about VND1,900 billion from November 22 to December 20. If successful, it will increase its holding ratio to 42.1%, equivalent to 198.2 million shares. With a level of over 35%, the Singaporean giant has the right to veto important decisions. At the current market price, the REE shares that JC&C owns are worth more than VND11 trillion.

In addition, JC&C also spent a large amount of money to own more than 10% of Vinamilk (VNM) shares, worth about 14 trillion VND.

In addition to the above three businesses, Jardine Matheson also invests heavily in Asian real estate, including Vietnam, through Hong Kong Land.

Jardine Matheson’s formula for success is to invest in industry leaders, number one companies in their fields, and have a long history of operation. However, Jardine Matheson tends not to buy shares in large real estate corporations in the region, and has invested little in emerging corporations in the past 1-2 decades.

Profits fall

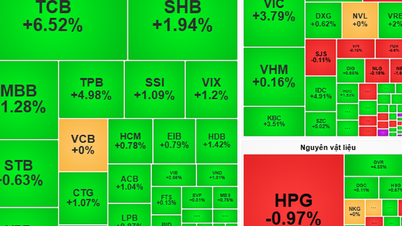

Jardine Matheson's 2024 semi-annual financial report shows that JC&C's profits in the first 6 months of the year decreased sharply compared to the same period last year. Particularly from Vietnam (Thaco, REE, VNM), profits decreased by 12% to only 30 million USD.

Of this, Thaco contributed 15 million USD despite increased sales and improved market share. Profit from Thaco's automobile business decreased due to lower profit margins due to strong competitive pressure.

Thaco is a multi-industry corporation, operating in the fields of automobiles, agriculture, mechanics and supporting industries, construction investment, trade - services and logistics. However, in recent years, Thaco has encountered difficulties with a large amount of investment in the agricultural sector from HAGL (HAG) of Mr. Doan Nguyen Duc (Bau Duc). The automobile sector is competing with the electric car manufacturer VinFast (VFS) of billionaire Pham Nhat Vuong and Chinese cars.

Meanwhile, REE contributed $7 million in profit to JC&C, down 39% year-on-year due to lower demand for hydropower. This is an electromechanical company with a history of more than half a century and has focused on investing heavily in the fields of hydropower, solar power, wind power, thermal power and clean water over the past many years.

Vinamilk is the leading dairy company in Vietnam. However, VNM has recorded a continuous slowdown in revenue and profit growth over the past several years. Its stock price has also declined.

In terms of real estate, Jardine Matheson is present through Hong Kong Land with many projects in prime locations such as Central Building in Hai Ba Trung (Hanoi), The Nassim (HCMC),... Jardine Matheson is also involved in many chain stores such as Pizza Hut, Starbucks, KFC Vietnam.

The British Jardine Matheson Group was once famous throughout Asia, especially in China. Jardine Matheson was founded in 1832 by two Scots (a country of the United Kingdom), William Jardine and James Matheson, in Canton (now Guangzhou). Jardine Matheson is famous for ending the monopoly of the East India Company in 1834. East India is the most famous private trading company in world history, an empire that held the power to "cover the sky with one hand", mainly operating in India and the Asian region in the 17th to 19th centuries. Later, Jardine Matheson became the largest British trading company in Asia. In 1844, Jardine Matheson established its headquarters in the new British colony of Hong Kong (China), then continued to expand along the coast from China. |

Source: https://vietnamnet.vn/ong-lon-do-von-vao-loat-dn-ten-tuoi-hang-dau-loi-khung-da-qua-dinh-hoang-kim-2346651.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)