Viet A Commercial Joint Stock Bank (VietABank - code VAB) has announced its financial report for the third quarter of 2023 with the main source of revenue being net interest income reaching nearly 142 billion VND, down 56% compared to the same period last year.

Non-interest income also decreased sharply compared to the same period last year. Specifically, service income decreased by 45% compared to the third quarter of 2022 to more than VND 14 billion, and foreign exchange income also decreased by 89% compared to the same period to only VND 1.5 billion. In contrast, investment securities trading activities earned nearly VND 131 billion in profit, while in the same period, they only earned more than VND 2 billion.

During the period, operating expenses increased by 21% compared to the same period last year, to nearly VND 226 billion. In addition, the bank also set aside nearly VND 43 billion for credit risk provisions, 2.3 times higher than in the third quarter of 2022. As a result, VietABank's pre-tax profit was more than VND 63 billion, down 67% compared to the same period last year.

In the first 9 months of the year, this bank recorded a pre-tax profit of more than VND592 billion, down 27% compared to the same period last year. With the achieved results, VietABank has only achieved 46% of the year's profit target (VND1,275 billion) even though it has completed 3/4 of the way.

By the end of the third quarter, VietABank's total assets had decreased slightly by 1% compared to the beginning of the year, down to VND104,023 billion. Of which, cash decreased by 16% compared to the beginning of the year, down to VND376 billion, and deposits at other credit institutions decreased sharply by 46% to VND11,834 billion.

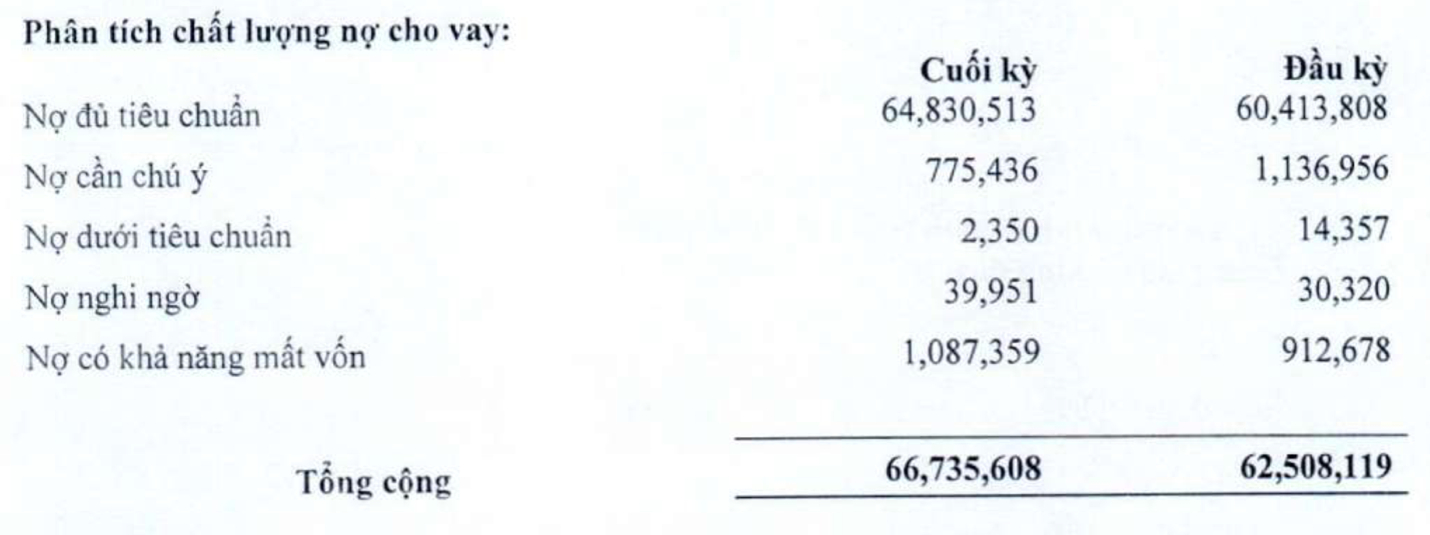

In contrast, customer loans increased by 7% compared to the beginning of the year to VND66,735 billion at the end of the third quarter. However, credit quality has clearly declined as total bad debt as of September 30 increased by 18% compared to the beginning of the year to VND1,130 billion. The ratio of bad debt to outstanding customer loans also increased from 1.53% at the beginning of the year to 1.69%.

In the bad debt structure at the end of the third quarter, substandard debt (group 3) decreased by nearly 84% compared to the beginning of the year to VND2.3 billion. Doubtful debt increased by nearly 32% compared to the beginning of the year to nearly VND40 billion. Notably, the bank's debt with the possibility of losing capital (group 5) increased by 19% to VND1,087 billion, accounting for 96% of total bad debt.

As of September 30, customer deposits had increased by 25% compared to the beginning of the year, reaching VND87,658 billion. In contrast, deposits from other credit institutions had decreased sharply by 77% compared to the beginning of the year, down to VND4,923 billion.

Source

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)