Current law stipulates that employees are entitled to pension when they meet the conditions of 20 years of social insurance participation and reach retirement age according to the Labor Code.

Regarding the monthly pension rate, for male workers, if they have paid social insurance for 20 years, they will receive 45%. If they retire in 2023, they will receive 45%. After that, for each additional year of social insurance payment, an additional 2% will be calculated.

For women, if they pay for 15 years, they will receive 45%. After that, for every additional year of social insurance payment, an additional 2% will be calculated. The maximum monthly pension rate is 75%.

Streamlining payroll without deduction of pension rate

According to Decree 29/2023/ND-CP of the Government regulating the streamlining of payroll, effective from July 20, 2023, there are 5 cases of early retirement without deduction of pension rate.

Specifically, the subjects of staff reduction must be 2-5 years younger than the prescribed retirement age, and have paid 20 years or more of compulsory social insurance, including 15 years of working in arduous, toxic, dangerous or especially arduous, toxic, dangerous occupations or jobs, or 15 years or more working in areas with particularly difficult socio-economic conditions.

In addition to not having their pension rate deducted due to early retirement, they are also subsidized with 3 months of average salary for each year of early retirement; subsidized with 5 months of average salary for the first 20 years of work, with full payment of compulsory social insurance.

From the 21st year onwards, for each year of work with mandatory social insurance payment, a subsidy of half a month's salary will be provided.

The subjects of staff reduction must be 2-5 years younger than the retirement age, and have paid 20 years or more of compulsory social insurance.

In addition to pension, they are subsidized 3 months of average salary for each year of early retirement; subsidized 5 months of average salary for the first 20 years of work, with full payment of compulsory social insurance.

Workers subject to staff reduction will not have their pension benefits deducted (Illustration: To Linh).

From the 21st year onwards, for each year of work with mandatory social insurance payment, a subsidy of half a month's salary will be provided.

In addition, the subjects of staff reduction must be 2 years younger than the retirement age and have paid 20 years or more of compulsory social insurance, including 15 years of working in arduous, toxic, dangerous, or especially arduous, toxic, dangerous jobs, or 15 years of working in areas with especially difficult socio-economic conditions.

The subjects of staff reduction must be at least 2 years younger than the minimum retirement age and have paid 20 years or more of compulsory social insurance.

The subjects of staff reduction are female cadres and civil servants at the commune level who are 2-5 years younger than the retirement age, and have paid compulsory social insurance for 15 to under 20 years.

In this case, in addition to not having the rate deducted, the employee is also entitled to a subsidy of 5 months of average salary and 3 months of average salary for each year of early retirement.

Other cases

Cases where the pension rate is not deducted when an employee retires early, based on the provisions of the Law on Social Insurance 2014 and the Labor Code 2019, include: Employees who have worked for 15 years in areas with particularly difficult socio-economic conditions, including working time in areas with a regional allowance coefficient of 0.7 or higher before January 1, 2021.

This applies to workers who have worked in particularly difficult areas and received a regional allowance coefficient of 0.7 or higher. Workers only need to work for 15 years in these areas to be eligible for early retirement without having their pension rate deducted.

Workers working in areas with particularly difficult socio-economic conditions will not have their pension rate deducted when they retire early (Illustration: Pham Nguyen).

Employees whose age is up to 10 years lower than the prescribed retirement age. For employees in this case, the retirement age is calculated by subtracting the maximum prescribed age by a maximum of 10 years.

Workers who have worked in underground coal mining for at least 15 years, this regulation applies to workers who have worked in underground coal mining for at least 15 years. People infected with HIV due to occupational accidents while performing assigned tasks.

Source link

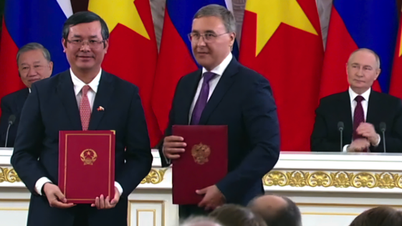

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)