The latest draft of the revised Social Insurance Law adjusts many regulations on retirement, one-time insurance withdrawal, and raises the floor and ceiling salary for insurance contributions.

After more than two months of collecting comments, the draft revised Law on Social Insurance received nearly 160 written comments from ministries, localities, enterprises, workers, and experts. The Ministry of Labor, War Invalids and Social Affairs then completed and submitted it to the Ministry of Justice for appraisal with a number of adjustments to retirement benefits, one-time social insurance (SI), and expansion of compulsory contribution coverage...

Report to the National Assembly both options for withdrawing social insurance at one time

There are three opinions on the plan to withdraw social insurance at one time. The first group agrees to keep the current regulation allowing employees who have paid social insurance for less than 20 years to withdraw at one time if they do not participate in the system after one year. The withdrawal is to ensure the rights of employees according to the principle of contribution - benefit.

The second group supports the option of withdrawing 50% of the total contribution period and keeping the remaining amount in the Social Insurance Fund for future benefits. This group considers the remaining amount as the workers' "savings", also leaving open the opportunity for them to return to the social security system.

The Ministry of Justice is in the third group, believing that the one-time social insurance policy is a fundamental change to the bill. If it is resolved by 50%, it could lead to a lower one-time social insurance benefit than the current one. To avoid negative reactions from workers, the Ministry suggested that the drafting agency carefully assess the impact of each option to supplement before submitting it to the Government .

In response to comments, the Ministry of Labor, War Invalids and Social Affairs said it will supplement the assessment of the options to synthesize and submit to the Government, and at the same time report to the National Assembly for comments on both options.

Withdraw the condition of paying 20 years of social insurance

The initial draft tightened the conditions for pension entitlement. Accordingly, workers who have paid social insurance for 20 years and reached the retirement age according to regulations will be entitled to pension. However, many agencies have proposed to remove this regulation to ensure fairness between the contribution groups, ensuring that those who have paid social insurance for 15 years and are of age will be entitled to pension.

Taking into account comments, the Ministry of Labor, War Invalids and Social Affairs has removed the above condition in the latest draft. Accordingly, the pension regime applies to employees who have paid social insurance for 15 years and reached the prescribed retirement age (increasing according to the roadmap to 62 years old for men in 2028 and 60 years old for women in 2035).

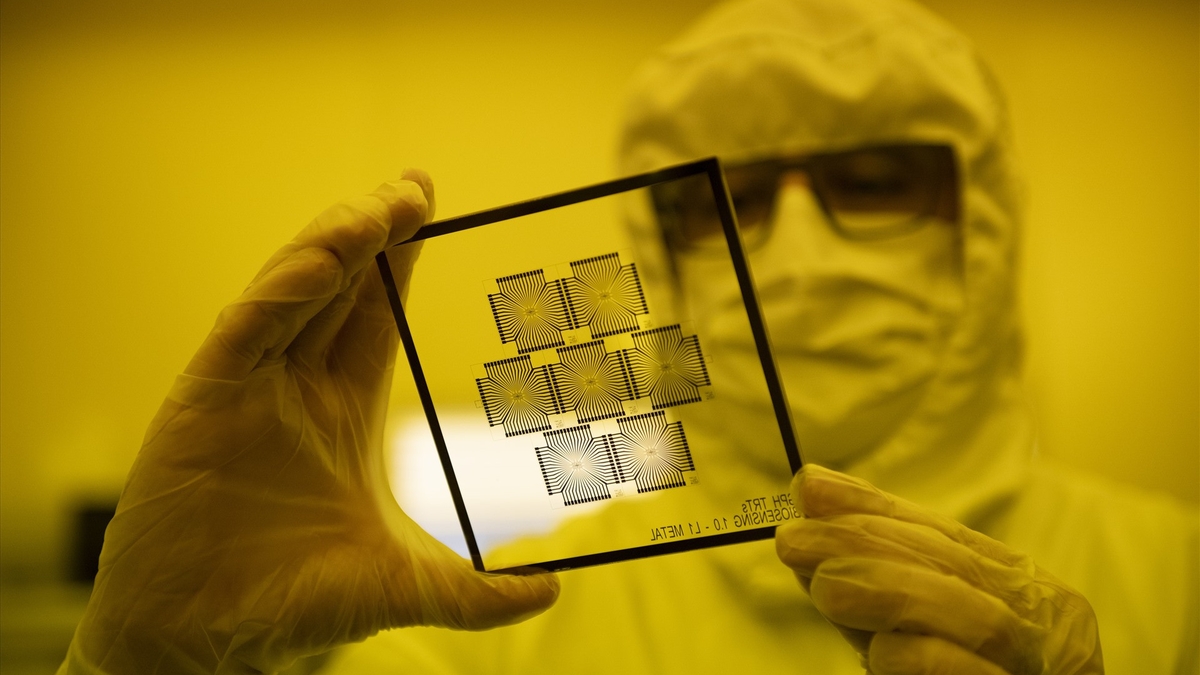

Workers wait to complete documents to withdraw one-time social insurance at the Social Insurance Agency of Thu Duc City (HCMC) at the end of 2022. Photo: Thanh Tung

Raising the floor - ceiling salary for calculating compulsory social insurance contributions

The latest draft proposes that the salary used as the basis for compulsory social insurance contributions is at least half and the contribution ceiling is 8 times the highest regional minimum monthly salary (the current highest level of region I is 4.68 million VND/month) announced by the Government.

Thus, the floor and ceiling have both been raised compared to the draft in March. Because the current minimum wage of region I is 4.68 million VND/month. If applied according to the draft, the floor and ceiling at this time will fluctuate between 2.34 and 37.44 million VND, but the regional minimum wage will be adjusted depending on the socio-economic situation.

Previously, the drafting committee proposed a minimum compulsory social insurance contribution level of VND2 million and a maximum of VND36 million. The government adjusted this level based on the increase in the consumer price index and economic growth.

According to the drafting committee, Resolution 27 of 2018 of the Central Committee on salary reform for cadres, civil servants, public employees, armed forces and workers in enterprises will no longer have a "basic salary". Therefore, it is necessary to change the monthly salary for social insurance contributions in the direction of not being linked to the basic salary but using the regional minimum wage as the basis for determining the highest and lowest levels.

Current law stipulates that the monthly compulsory social insurance contribution salary for employees in the enterprise sector must not be lower than the regional minimum wage at the time of contribution, plus 5% for employees in hazardous occupations, and 7% for trained workers; the highest contribution level is 20 times the base salary.

Narrowing down the mandatory payment scope for business owners

The previous draft law proposed to include business owners, business managers, unpaid cooperative managers and part-time workers in the compulsory social insurance scheme. These groups will enjoy full benefits of retirement, death, maternity, sickness, occupational diseases and unemployment benefits.

After synthesizing and absorbing opinions, the latest draft has narrowed the scope of compulsory contributions to the group of household heads with business registration and does not apply to people of retirement age. It is expected that the number of household heads participating in compulsory social insurance may decrease from 5 million households as originally planned to nearly 2 million households.

The salary used as the basis for calculating contributions for this group is also adjusted, based on the floor and ceiling levels according to the minimum wage in region I, not fluctuating between 2-36 million VND as in the original draft.

A neighborhood official in front of the "green zone" alley on Cua Nam Street (Hanoi) during the peak of Covid-19 in 2021. Photo: Pham Chieu

Expanding the coverage to non-professionals at village and residential group levels

The new draft adds a group of people who are required to pay compulsory social insurance, including non-professional workers in villages and residential groups, similar to those at the commune level. Statistics show that there are about 300,000 people in this group working nationwide. Meanwhile, the current law only stipulates compulsory social insurance payments for full-time workers at the commune level.

The drafting agency explained that because the beneficiary regimes and policies of the two groups are similar and are both regulated by the Government, it is necessary to include the groups in villages and residential groups in the compulsory category. The proposal is also consistent with Resolution 28 of the Central Committee, striving to bring 60% of the working-age workforce into the social security system by 2030.

The salary used as the basis for social insurance contributions for this group is regulated by the Government, ensuring that it is not lower than the minimum floor, which is half the minimum monthly salary of the highest region (region I).

Raise funeral allowance from 14.9 million to 18 million VND

The initial draft stipulated that workers who pay social insurance and receive pensions and die will receive a funeral allowance of 14.9 million VND - 10 times the current base salary (1.49 million VND/month). However, from July 1, the base salary will be adjusted to 1.8 million VND/month, so the drafting committee raised the funeral allowance to 18 million VND in the latest submission. This amount will increase each time the Government adjusts pensions.

However, to be eligible for funeral benefits, the social insurance contribution period must be at least 60 months or more. Many opinions suggested removing this provision, but the drafting committee kept it to ensure the contribution-benefit principle, balance the fund and avoid policy exploitation, especially in the voluntary sector.

The draft revised Law on Social Insurance is expected to be submitted to the Government in June, submitted to the National Assembly for discussion at the National Assembly session in October 2023, approved at the session in May 2024 and take effect from January 1, 2025.

Hong Chieu

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)