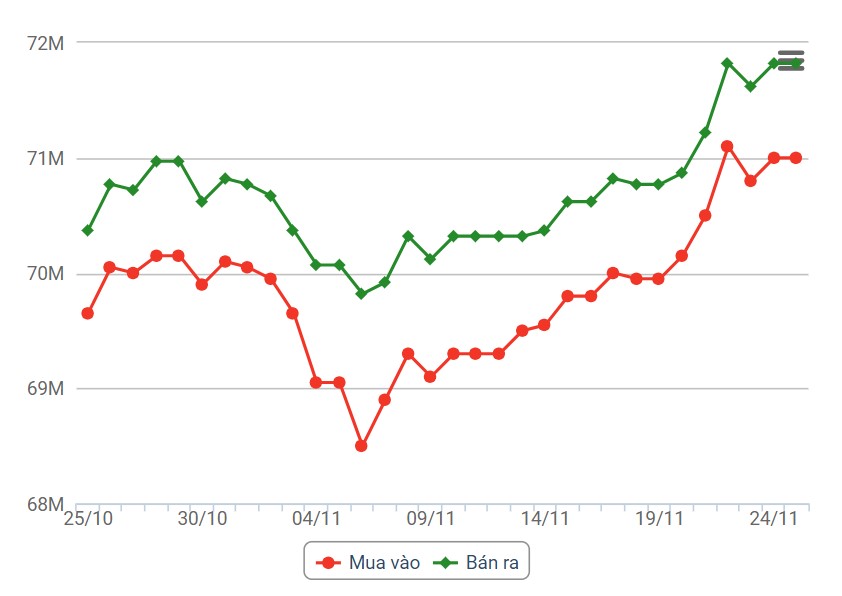

Domestic gold price

Domestic gold price fluctuations

World gold price developments

World gold prices surged amid a decline in the US dollar. At 5 p.m. on November 26, the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 103.285 points (down 0.52%).

Precious metals rose this week as many investors expect the US Federal Reserve (FED) to end its interest rate hikes at its December meeting. Meanwhile, the minutes of the Fed's November meeting just released showed that the central bank will adjust interest rate policy cautiously.

The biggest risk to gold would be rising bond yields, which would strengthen the US dollar, said Ole Hansen, head of commodity strategy at Saxo Bank.

“Gold looks well supported. Only a stronger US dollar could change that,” he told Kitco News.

Daniel Ghali, commodity strategist at TD Securities, said the Fed’s rate-cutting cycle starting earlier in 2024 is a key driver of gold’s rise. Lower oil prices could provide some short-term support for gold, Ghali said, explaining that lower energy prices would give the Fed some breathing room to ease its current tightening bias.

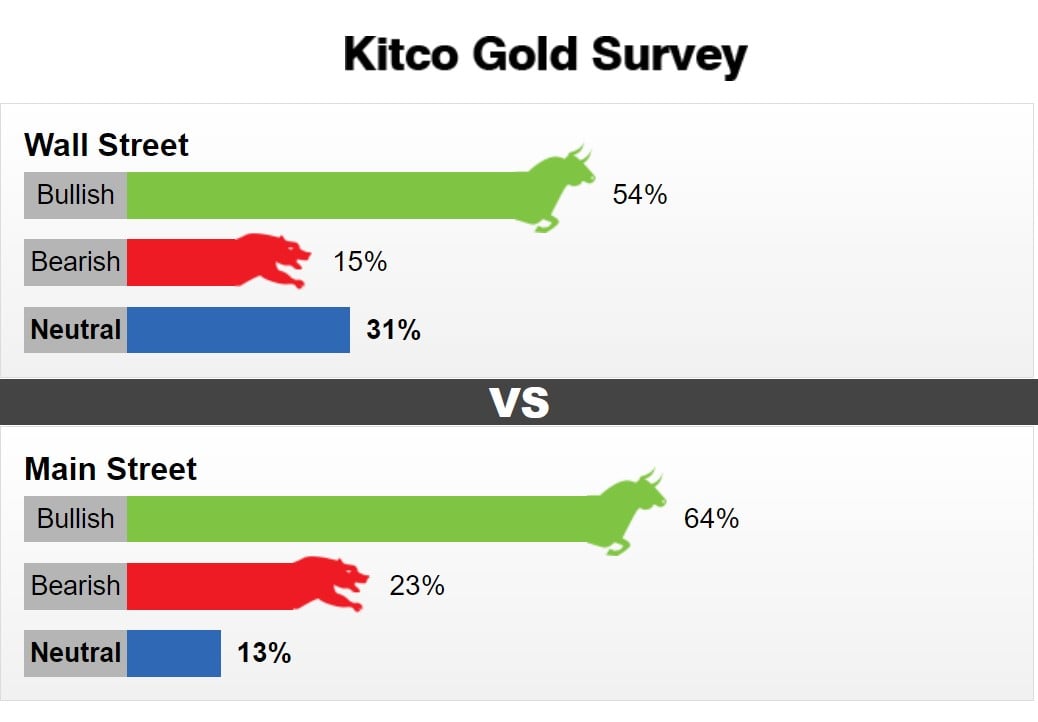

Thirteen Wall Street analysts participated in the Kitco News Gold Survey this week. Seven analysts, or 54%, see gold prices higher next week. Two analysts, or 15%, see gold prices falling. Four analysts, or 31%, are neutral on gold next week.

Meanwhile, 672 votes were cast in Kitco’s online poll. As usual, the majority of market participants remained bullish on gold. 431 investors, or 64 percent, expect gold to rise next week. Another 156, or 23 percent, predict lower prices. Meanwhile, 85 respondents, or 13 percent, are neutral on the precious metal’s near-term outlook.

Notably, while many people have an overly optimistic view on gold, there are still warnings about the risk of a sudden decline in the price of the precious metal. Frank McGhee - head of precious metals trading at Alliance Financial said that gold is overbought and the market is mispricing some important factors.

"I really don't expect this rally to last. I wouldn't be surprised if one day gold suddenly drops $50, $60 an ounce. Gold is overbought," said Mr. McGhee.

In addition, he also believes that the metals market, along with the stock market, is misjudging the Fed's easing scenario.

Source

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)