According to DKRA Group's May 2024 report, the resort real estate market recorded the strongest supply in the villa category with 1 new project opening for sale and 2 projects opening for sale in the next phase. These projects provided the market with 90 products and sold 23 units, up 9 times and 22 times respectively compared to the same period last year.

Although it has increased compared to the same period, the supply of resort villas is still low compared to the period before 2022 and is mainly concentrated in the Northern and Southern regions. Although market demand has increased, it is not significant, transactions are mainly concentrated in the group of products with complete legal documents, clear construction progress and prices under 10 billion VND/unit.

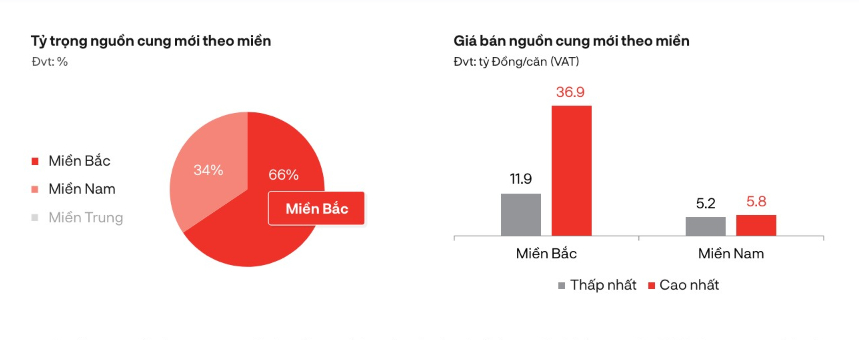

New supply is mainly concentrated in the North and there are no projects in the Central region.

Regarding selling prices, the primary selling price level has not changed much compared to the previous month and is still at a high level. Policies on profit/revenue sharing/commitment, interest rate support, principal grace period, etc. continue to be applied to increase liquidity. The highest selling price was recorded in the North at VND36.9 billion/unit and the lowest product price on the market was VND5.2 billion/unit.

In particular, legal problems have prevented many projects from being implemented, while high-value inventories have made liquidity difficult, and investor confidence has not yet recovered, which are also the main reasons why the market still faces many difficulties and challenges.

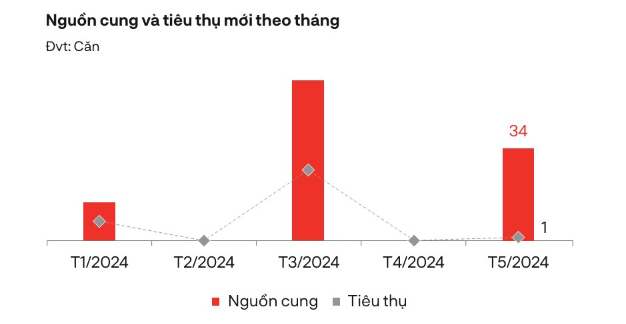

For the Condotel type, the market also recorded 1 new project opening for sale with 34 units joining the new supply and only 1 unit was sold, down 76% and 93% respectively compared to the same period last year. The supply is locally concentrated in the Northern region. In particular, the Central and Southern regions continue to lack new projects opening for sale.

Condotel supply and consumption are still dripping month by month.

Many Condotel projects are currently still stuck in legal issues that cannot be resolved, in addition, many investors are also constantly postponing the sales implementation time, causing the supply to the market to be limited. The general market demand is low, the consumption is only equivalent to 7% compared to the same period and is concentrated in products with complete legal documents with a selling price of less than 3 billion VND/unit.

Primary prices have not fluctuated much compared to last month. Preferential policies, interest rate support, quick payment discounts, etc. are still widely applied. Difficulties in terms of law, capital, investor confidence, etc. have affected both supply and consumption, causing the market to remain in a prolonged state of stagnation and showing no signs of recovery in the short term.

Notably, for the Shophouse and Townhouse types, this is the second month without supply in the resort real estate market. Many projects have continuously postponed their sales launch in the current difficult context, causing limited new supply.

Townhouses/Shophouses have been out of supply for 2 consecutive months

Overall market demand remains low, with modest transaction volume and mainly concentrated in primary products with complete legal documents and guaranteed construction progress. Primary prices have not fluctuated much, while the secondary market has recorded some products with prices decreasing by 30% - 40% but still facing liquidity difficulties.

The purchasing power of townhouses and shophouses has also decreased sharply, new supply is absent, legal problems, etc. have caused significant obstacles in the first months of 2024, causing the market to almost fall into a "prolonged hibernation" cycle.

Source: https://www.congluan.vn/nha-pho-va-shophouse-nghi-duong-tiep-tuc-vang-bong-nguon-cung-post298871.html

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

Comment (0)